The latest House Price Index from Zoopla reveals that 2024 is set to be a bumper year for house sales.

Rising incomes combined with average mortgage rates at their lowest for two years have resulted in the highest level of new sales since late 2020.

Comparatively, house prices are rising slowly, up by just 1% over the last 12 months compared to -0.9% a year ago.

Price inflation is being held back by a large choice of homes for sale and affordability pressures which are keeping buying power in check.

AFFORDABLE AREAS

In more affordable areas, house prices are rising at an above-average rate for example the North-East (2%), Yorkshire & Humberside (2%), North-West (2.3%), Scotland (2.4%) and Northern Ireland (5.6%).

Conversely, house prices are down slightly in Eastern England (-0.3%) and the South-East (-0.1%). UK house prices remain on track to be 2% higher over 2024 as price falls from this time last year drop out of the annual rate of price inflation.

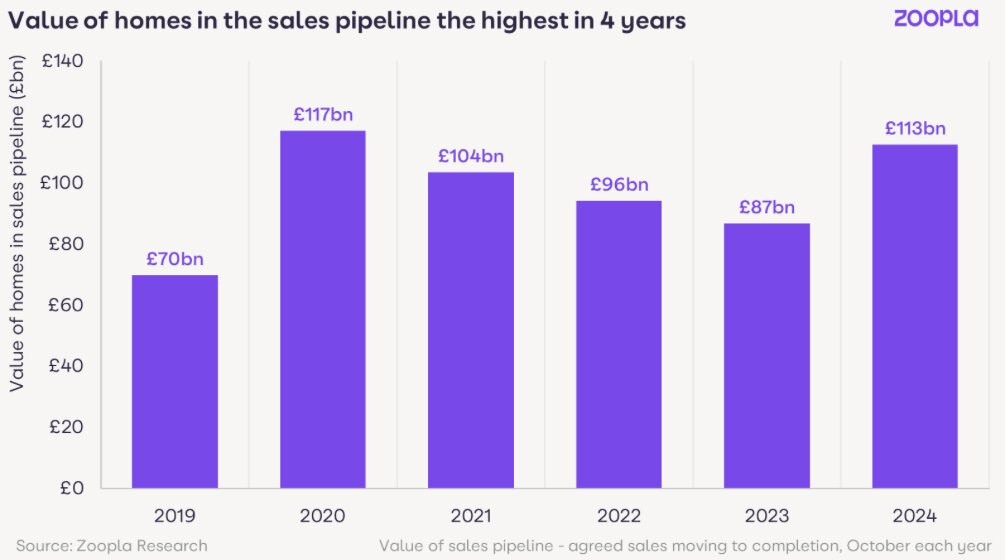

SALES PIPELINE

Sustained growth in new sales over 2024 has led to the largest sales pipeline the market has seen for four years.

Zoopla’s analysis reveals that there are currently 306,000 homes working their way through the buying process to completion, 62,250 (26%) more than 12 months ago.

The total value of these sales has hit £113bn, 30% higher than this time last year when a spike in mortgage rates hit buyer demand and reduced the number of sales agreed over 2023 H2.

Momentum in new sales remains strong and looks set to continue into December, supported by a high supply of homes for sale. Many of the most recent sales will complete in the first half of 2025.

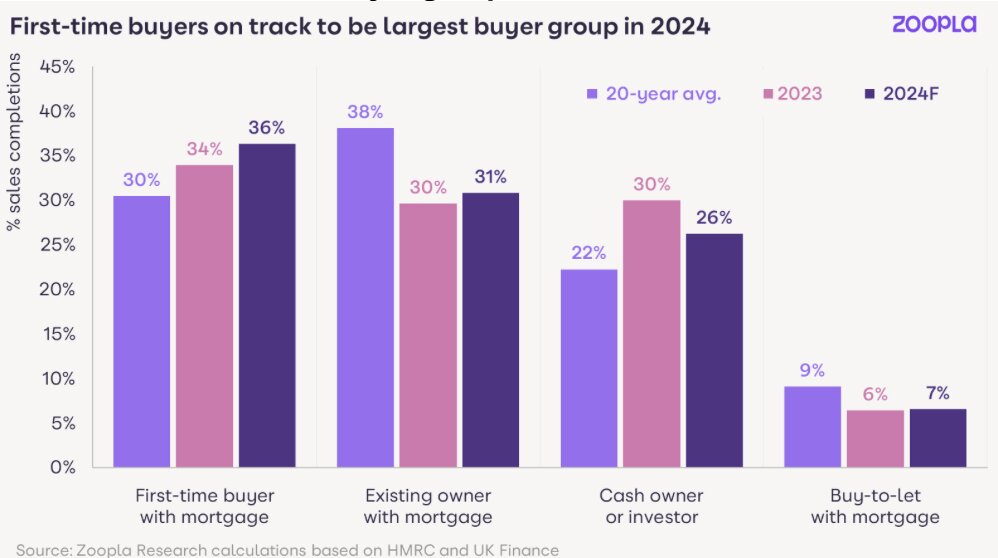

FIRST-TIME BUYERS

The growth in sales is being driven by a combination of first-time buyers (FTBs) and existing homeowners who have delayed moving decisions until borrowing costs fell and the outlook improved.

FTBs are set to be the biggest buyer cohort in 2024, accounting for 36% of all sales followed by existing homeowners (31%), cash buyers (27%) and landlords buying with a mortgage (7%).

The rapid growth in rents and the decline in mortgage rates have shifted renting versus buying dynamics, supporting more FTB purchases.

The average mortgage repayment for a typical UK FTB home is 17% cheaper than renting, compared to a much smaller 2% difference a year ago when mortgage rates were higher.

BUDGET IMPACT

Today, FTBs do not have to pay any stamp duty on properties that cost up to £425,000 and pay partial stamp duty on homes up to £625,000 (England and Northern Ireland only). Zoopla reckons that 80% of FTBs pay no stamp duty, with just 14% paying partial duty.

This support for FTBs is set to end in April 2025, unless reversed in the Budget next week.

A return to previous thresholds would result in an additional 20% of FTBs being liable to pay stamp duty and a further 14% would be required to pay a partial amount.

THRESHOLDS

The impact of a return to previous thresholds would be more keenly felt in southern England where the average FTB in London and the South East would pay £5,600 and £1,390 respectively, compared to £0 today.

In parts of London such as Camden, Hammersmith and Fulham and Islington with average house values over £600,000, FTB could pay an additional £15,000 in stamp duty. Faced with higher buying costs, FTBs will want to pay less for homes in these areas which will keep price rises in check.

SUSTAINED INCREASE

Richard Donnell, Executive Director at Zoopla, says: “It is positive to see the sustained increase in sales activity over 2024 which reflects growing confidence amongst buyers and sellers supported by lower borrowing costs and rising incomes.

“Overall, the market remains on track for a modest 2% price increase in 2024 and 1.1m sales.

“First-time buyer numbers have recovered as mortgage rates have fallen but a sizeable deposit is still required to buy. Possible changes to stamp duty relief will only create further barriers to ownership for this group who already face significant affordability constraints.”

“The housing market doesn’t need short term policy tweaks from the Budget.”

“The health of the housing market and people’s ability to afford housing is linked to the health of the economy.

“It’s vital the Budget is focused on economic growth and expansion in jobs and rising incomes. The primary focus should be on providing the financial support and investment needed to help build the homes the nation needs for buyers and renters.”

FIRST-TIME BUYER RESURGENCE

Chris McLaughlin, Director at Bristol-based Ocean Estate Agents, says: “The housing market is experiencing significant variation across districts and price bands.

“In some areas volume has grown by over 50% but on average year-on-year growth has reached approximately 30%, largely driven by lower interest rates, which have spurred a resurgence of first-time buyers.

“Furthermore, many sellers, who had transitioned to rental accommodation during the period of higher interest rates, are now re-entering the market, often mortgage-free or with substantial deposits.

“Buy-to-let activity has notably declined as smaller or accidental landlords exit the market.”

“Buy-to-let activity has notably declined as smaller or accidental landlords exit the market, influenced by less favourable financial conditions and increasing regulation.

“Consequently, much of the new housing stock now comprises former rental properties. Additionally, transaction completions have risen in the last couple of months, particularly within the investment property sector, as sellers seek to conclude deals ahead of potential changes anticipated in the upcoming budget.”

PENT-UP DEMAND

Matt Thompson, head of sales at Chestertons, says: “The property market has been extremely active this year and we currently have 17% more properties under offer than in 2020.

“Pent-up demand, improved mortgage deals and people’s desire to find a property ahead of the Autumn Budget have been key motivators for house hunters to finalise their search.”

HOUSE PRICE GROWTH

Nathan Emerson, Chief Executive of Propertymark, adds: “We have seen an encouraging transformation across the year in terms of a resilient trend of house price growth.

“Affordability and overall confidence in the sector have also seen a boost throughout the year so far.

“Considering the UK Government has an ambitious aim to deliver growth following what has been a turbulent few years, we hope that this week’s Autumn Budget will be used as a springboard to improve housing supply.

“Propertymark has long argued that Stamp Duty reform is one way to do that, especially for those wishing to downsize.

“When the Bank of England’s Monetary Policy Committee meet on Thursday next week, we hope to see further progression on potentially cutting interest rates as this will continue to improve the overall health of the economy.”