The dream of homeownership remains out of reach for many renters across the UK but a subtle shift in mortgage rules could change that.

Property portal Zoopla is calling for a reassessment of mortgage stress testing rates, suggesting a move closer to 6-7% – a step that could unlock homeownership for middle- to higher-income renters without triggering a house price boom.

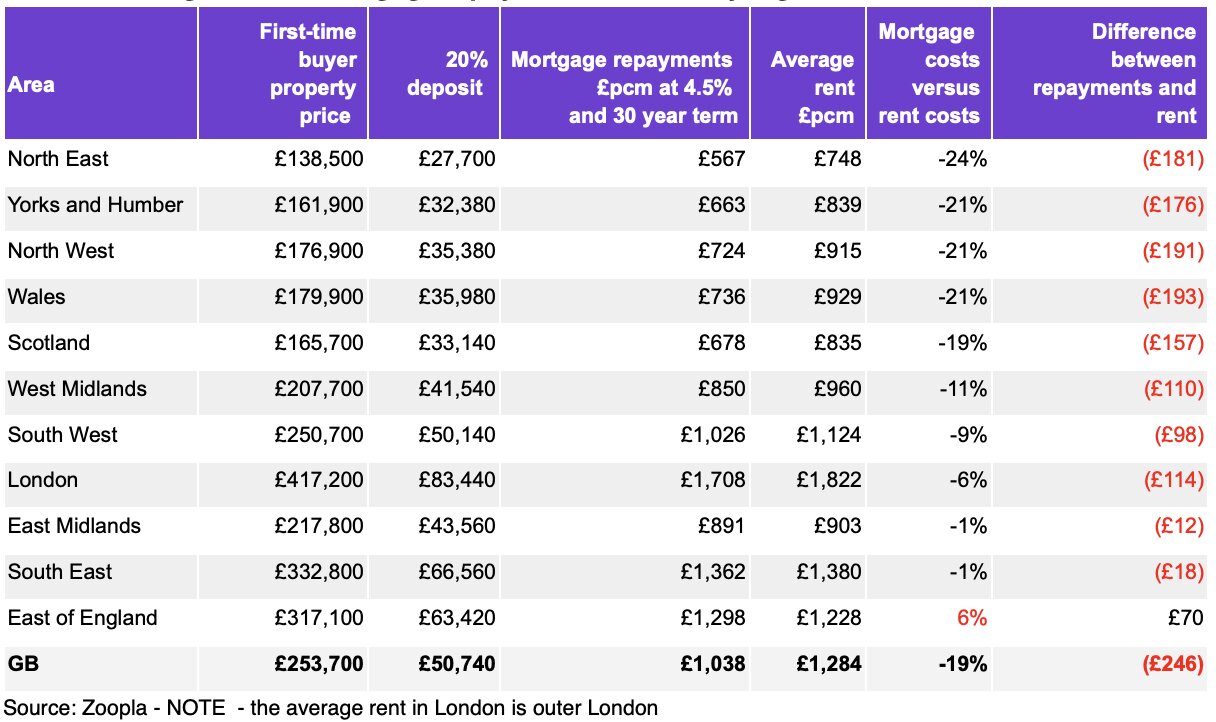

According to Zoopla’s latest research, the cost of buying a home is now more affordable than renting across most of Great Britain. The average monthly mortgage payment for a first-time buyer sits at £1,038, a notable 20% lower than the typical rent of £1,248.

In regions like the North East, mortgage payments are 24% lower than rents, while in cities such as Glasgow (-46%) and Edinburgh (-32%), the gap is even wider. However buying remains more expensive than renting in just 10% of postal areas, with hotspots like Harrogate (+15%) and Watford (+7%) bucking the trend.

AFFORDABILITY CHALLENGE

Despite these figures, the path to homeownership is still fraught with obstacles – most notably, saving for a deposit.

The average 20% deposit required for a first-time buyer home ranges from £27,700 in the North East to a staggering £83,400 in London. Unsurprisingly, 63% of first-time buyers rely on family support to bridge this gap.

But it’s not just deposits that are blocking the road. Mortgage rules introduced in 2015 – designed to prevent another housing market crash – require borrowers to prove they could afford higher mortgage rates should interest rates rise.

Many lenders are currently stress testing at an 8% mortgage rate, pushing mortgage affordability above rental costs in every UK region.

CASE FOR CHANGE

Richard Donnell, Executive Director at Zoopla, argues that while these regulations have curbed reckless lending, they now present an unfair hurdle for those on middle incomes.

He says: “These rules have created a higher barrier to homeownership for renters who can comfortably afford monthly rent payments but are unable to prove they could manage a mortgage at artificially high stress rates.”

And he points out that this dynamic fuels demand for rental homes, driving rents even higher, and adds: “The more first-time buyers priced out of homeownership, the greater the pressure on the private rental market.”

BALANCED APPROACH

Zoopla is advocating for a modest adjustment to mortgage stress tests – suggesting a move towards rates of 6-7%. Donnell clarifies that this wouldn’t mean a return to the risky lending practices of the past but would give more renters a fair chance at stepping onto the property ladder.

For estate agents, this potential shift could be a game-changer. If more renters gain access to mortgages, demand for first-time buyer properties will likely rise, creating fresh opportunities for agents to support a new wave of homebuyers.

With the rental market under immense strain and many renters paying more each month than they would for a mortgage, the case for revisiting stress tests is gaining momentum.

*Zoopla’s analysis is based on an average 20% deposit of £50,740 for a typical first-time buyer property priced at £253,700. In London, first-time buyer deposits average 30% due to higher property prices.