Zoopla has delivered a 30% year-on-year increase in quality home buyer leads for its homebuilder customers after rolling out a series of product upgrades over the last 12 months.

The strong growth in quality leads from Zoopla comes at a time when buyer demand for new homes has been weaker across the wider market, although there are signs that buyer demand for new homes is now improving.

The key improvements include increasing the visibility of new-build homes on the Zoopla website, particularly on its most viewed pages. This has helped to encourage more consumers to consider a new build property.

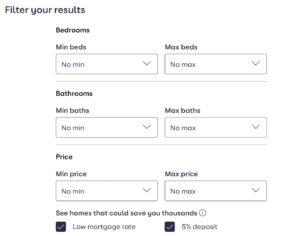

Specific buying scheme filters and call-outs have also been added to the search experience, resulting in a 40% increase in new home leads from this specific buyer journey on the Zoopla website.

SELLING SCHEMES

New homes specific selling schemes to support home buyers purchasing new homes has been a consistent feature of the market in recent years.

Help to Buy was the main Government backed scheme which has now ended while current schemes available include Own New – Rate Reducer and The Deposit Unlock Scheme which enables buying a new home with just a 5% deposit.

Zoopla is the only property portal in the country that enables consumers to search specifically for new-build homes which are part of these schemes, helping build awareness amongst consumers of the different ways they can buy a new home.

AFFORDABILITY TOOL

Zoopla has developed and launched a new affordability tool which is currently being tested by four major housebuilders.

The tool helps serious buyers assess their budget and matches them to new home developments that meet their budget and property requirements within an end-to-end journey.

Zoopla research has revealed that 70% of buyers are open to new builds, but only 7% explicitly look for them and this exciting new tool is designed to encourage more would-be buyers to consider new build properties.

QUALITY LEADS

Stephen Parker, Head of Digital at Taylor Wimpey, says: “Zoopla is a valued partner of Taylor Wimpey and we’re consistently impressed by the quality of leads they deliver, with a sector-leading percentage of leads delivered by the portal in 2024 converting into reservations.

“This has been enhanced by improvements they have made to their site to make new homes more visible to consumers.”

Alex Rose, Commercial Director at Zoopla, adds: “Zoopla empowers consumers to make more confident moving decisions. This includes encouraging potential buyers to consider all types of properties, including new builds.

“Our dedicated new homes product team has made some big strides over the last 12 months and these innovations we have implemented are driving direct benefits for our homebuilder customers..

“This is just the beginning for Zoopla and we are focused on introducing further improvements to maximise the visibility of new homes on Zoopla’s website and app in the months to come as we look to drive a stronger ROI for our housebuilder customers and boost the pool of potential demand for new-build properties.”

BUILDER AND BUYER BOOST

PropertySoup revealed yesterday how Nationwide Building Society will raise its maximum loan-to-value (LTV) ratio for new build houses to 95% from today (26 June), a move expected to provide a timely boost to both first-time buyers and the UK’s struggling housebuilding sector.

And in a further sign of its growing commitment to housing delivery, the mutual will also allow borrowers to access its flagship Helping Hand proposition at the full 95% LTV, making Nationwide the largest lender in the UK to offer up to six times income at this level of borrowing.