As economic shocks from Donald Trump’s latest trade tariffs intensify, the volatility shaking the global markets may be a net positive for the UK residential property sector.

While many see only risk, our data suggests that the UK is uniquely positioned to benefit from the current wave of uncertainty as capital seeks safe havens.

The UK, with its stable legal system, transparent property market, and with London’s global city status, is a natural beneficiary of global economic turmoil especially when the culprit is the US Market and the Dollar.

Evidence is already mounting: the FTSE 350 Real Estate index is up year-to-date, even as global equities remain volatile, and the US markets are down over 10% for the same period. Overseas buyers, particularly from the Middle East and Asia, are increasing allocations to UK prime residential, student accommodation, and build-to-rent (BTR) assets. At REalyse, we are seeing a surge in client interest in these sectors, as investors look for resilient, income-generating opportunities.

CURRENCY SHIFTS AND A WINDOW OF OPPORTUNITY

The US dollar’s recent meltdown, down over 10% against the Swiss franc as well as against the Japanese yen, has had a profound impact on global capital flows.

For the UK, a weaker dollar means cheaper imports (over 35% of UK imports are dollar-priced), which is helping to drive down inflation in the UK. Annual inflation slowed to 2.6% in March, and the Bank of England now has room to cut rates, supporting lower mortgage costs and improved affordability for buyers.

This too is evidenced by the swaps market where the five-year SONIA swaps hit 3.742% last week – a significant enough drop from the 3.925% seen just before Trump’s tariff announcements earlier this month.

Sterling’s strength, now at 1.32 against the dollar, is another sign of international confidence in the UK.

As the US faces policy uncertainty and recession risk, the UK’s relative stability is attracting both institutional and private capital helping the sterling catch a bid. This is not just theory: transaction data shows increased activity from overseas buyers, particularly in prime London, Manchester, and the BTR and PBSA sectors.

In fact, Purpose-Built Student Accommodation (PBSA) planning applications have ramped up significantly since late 2023, with clear momentum building into 2024 and early 2025.

Peaks in Dec 2023 and Nov 2024, both surpassing 5,000 units, highlight a renewed investor focus on student housing, likely driven by growing domestic and international student populations and a structural undersupply in key university cities.

The data suggests a strategic pivot toward PBSA as an increasingly popular asset class with investors moving quickly to capitalise on long-term demographic trends despite broader economic headwinds.

DOMESTIC FUNDAMENTALS REMAIN STRONG FOR ASSET PRICES

Despite global headwinds, the UK’s property price fundamentals are robust in large part due to the structural imbalance between supply and demand.

While new build activity has slowed as developers wait for price certainty, this only tightens supply further, supporting asset prices and rental yields for the medium and long term.

Obviously, builders will only build when they know they can sell their assets at profitable prices. So the construction sector will continue to struggle in the short term until rates decline more aggressively, which we expect very shortly.

In addition, Buy-to-let (BTL) owners selling up are adding to rental demand, while first-time buyers benefit from lower mortgage rates and a more competitive lending environment.

DATA-DRIVEN DECISIONS

In times of global uncertainty, the winners are those who can see beyond the headlines and act on tangible evidence.

Since we are in the time of declining interest rates and inflation in the UK, we expect cheaper borrowing costs, which should increase demand for real estate and lead to higher property prices along with an uptick in transaction figures.

In addition, the hunt for stable income will come back as bond yields stabilise. While Gold has done exceptionally well post 2008 recession, the UK property priced in gold is at historical lows (measured in gold, house prices are about the same today as in 1952). This is another way to look at UK property in Real Terms.

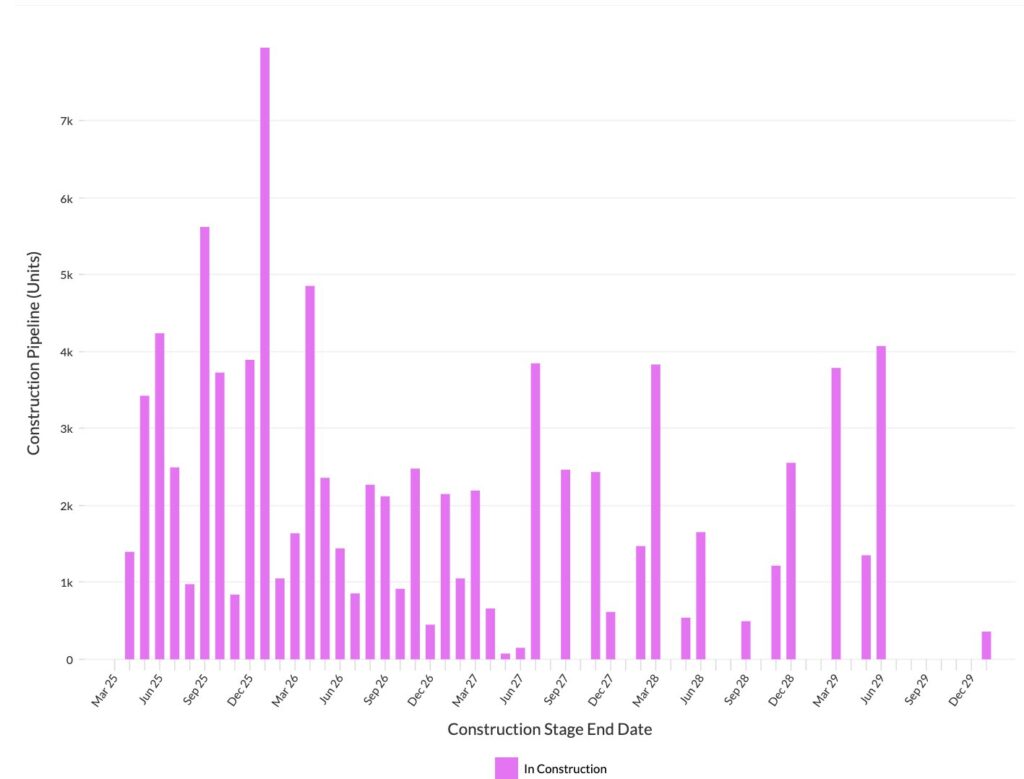

For example, if we look at the next five years, Build to Rent (BTR) planning applications that are in construction across the UK have shown a sharp upward trend, peaking around late 2025 to mid-2026 (see the graph above), despite global market volatility and tariff-driven uncertainty.

This surge signals strong investor confidence in BTR as a stable, income-generating asset class amid economic disruption. While activity moderates slightly post-2026, the pipeline remains consistently active, with another uptick projected in late 2029. The data clearly shows BTR evolving from niche to necessity, offering resilience and long-term value in an unstable financial landscape.

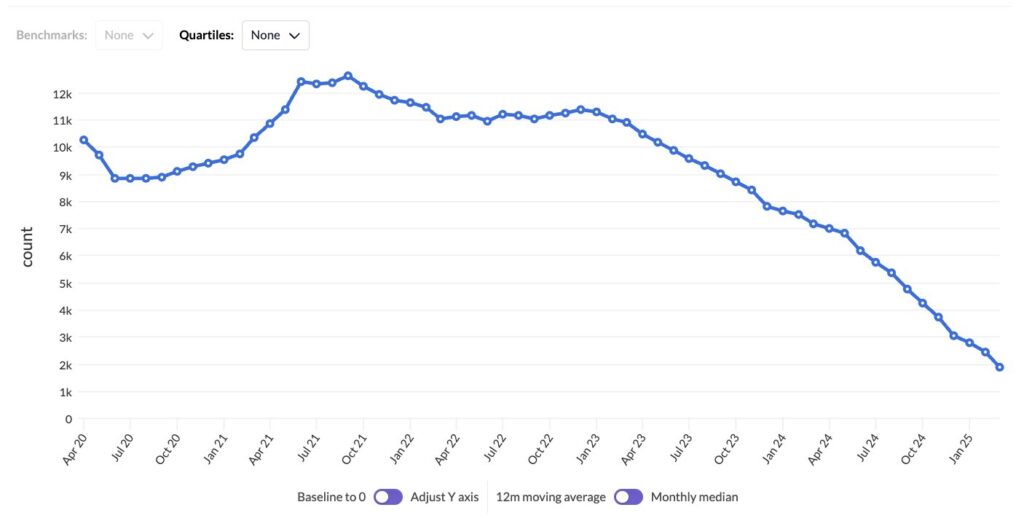

In addition, over the past five years, BTR planning application submissions have surged dramatically, especially from mid-2023 through 2024, hitting multiple peaks of over 3,000 units per month.

This sharp rise highlights growing institutional appetite for rental housing, even amid inflation fears and global financial uncertainty.

Compared to the patchy volumes of 2020–2022, the recent uptick reflects a shift from caution to conviction, as investors double down on BTR’s long-term potential. The pipeline shows no signs of slowing, reinforcing BTR as a key pillar in the UK’s evolving housing strategy.

A CONTRARIAN OPPORTUNITY

While many see US tariff-driven volatility as a threat, the reality is that it is driving capital, confidence, and opportunity toward the UK real estate market. With relatively sound fundamentals, a stabilising currency, and a reputation as a global safe haven, the UK is poised to benefit from the very uncertainty that is unsettling others.

For those ready to act on data, not fear, now is the time to seize the advantage and find out who is doing what and where.

Irakli Menabde is CO-CEO at REalyse