The nostalgic dream of returning to one’s childhood town has, for many, become an unattainable reality, as new analysis from Zoopla reveals significant property price increases in certain areas of the UK over the last 20 years have placed this dream firmly out of reach.

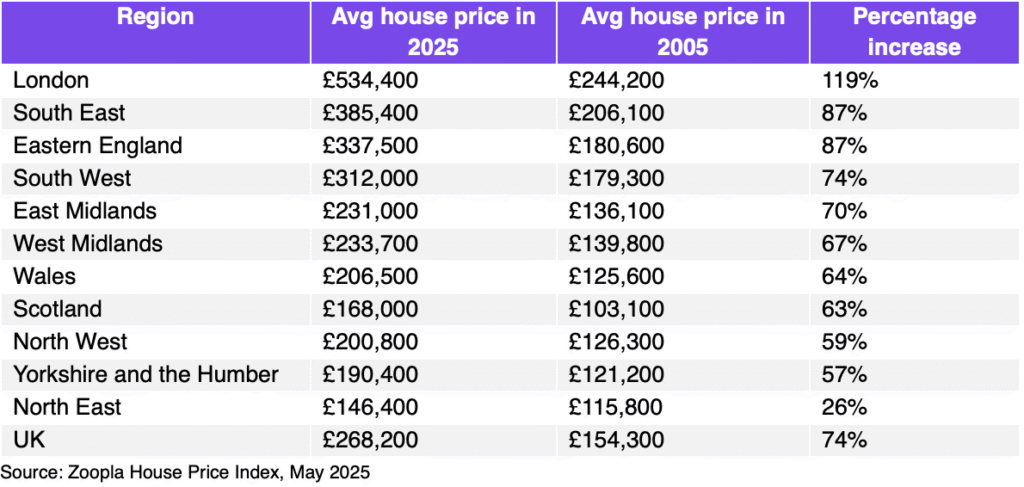

House prices across the UK have increased by an average of 74%, over the last 20 years, from £113,900 to £268,200, with house price to earnings ratios staying broadly in line at 6.42.

However, house price increases vary significantly across some regions, making some areas unaffordable for the 52% of Brits who say that they would consider a move back to their hometown.

Whilst London has seen significant house price increases (119%) over the last twenty years, house prices in the South East and Eastern England have also registered a significant jump, increasing by 87% in both regions. House price to earnings ratios have also increased in both regions, from 7.8 to 8.6 in the South East and 7.1 to 7.7 in Eastern England.

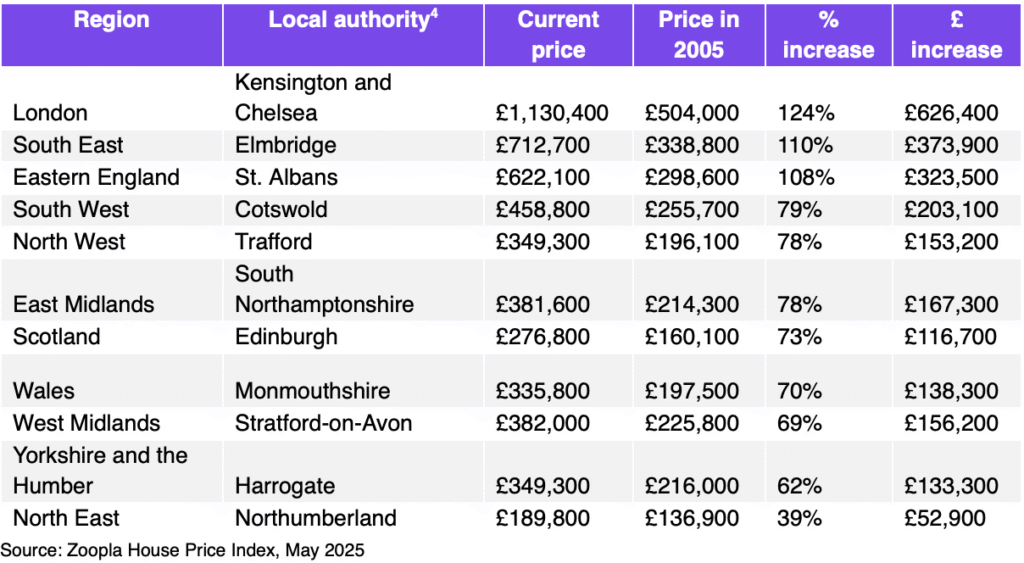

Within the South East, the town of Elmbridge in Surrey has seen the biggest average increase in house prices over the last two decades, up from £338,800 to £712,700 (a 110%). Despite its high property prices, the area’s excellent transport links to London and picturesque countryside lifestyle make it a highly attractive location for families in the region.

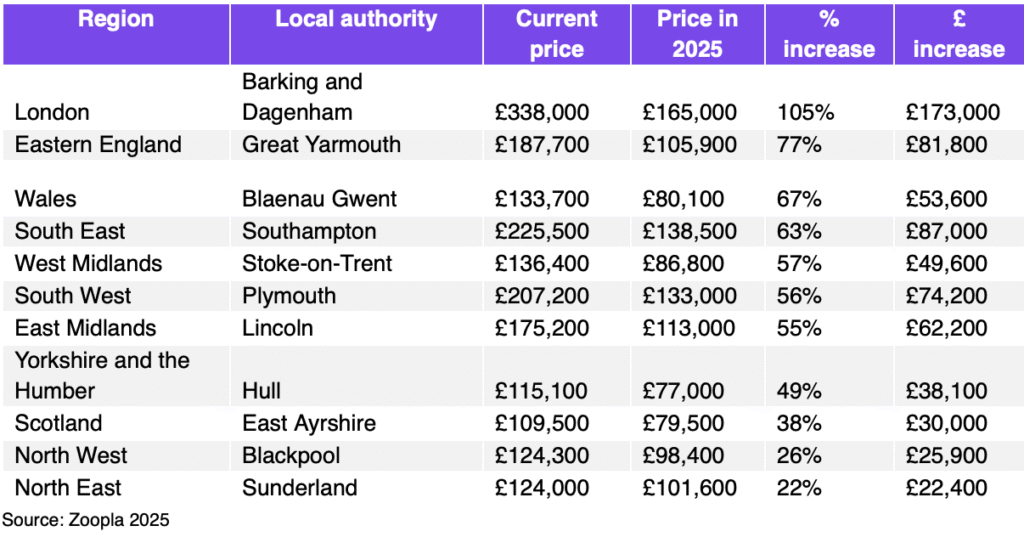

However, there are also more affordable areas in the South East, with Southampton in Hampshire registering the lowest average price increases in the region over the last 20 years, up 63% from £138,500 to £225,500.

In Eastern England, average house prices in St Albans have seen the most significant increase in the region since 2005, up from £298,600 to £622,100 (108%).

Just 25 miles away from London, the city is popular with commuters as well as history enthusiasts due to its spectacular cathedral and Roman architecture.

However, like the South East, there are more affordable pockets in Eastern England, with the popular coastal town Great Yarmouth seeing the lowest growth in average house price increases in the region over the last 20 years, up 77% from £105.900 to £187,700 (77%).

Those born and raised in the North East who have since moved away but would like to return, might find this dream more attainable than those in other parts of the UK.

Average house prices have increased by 39%, the smallest increase across all regions, while the house price to earnings ratios have improved the most in the region compared to the rest of the UK, falling from 5.7 to 4 over the last twenty years.

Sunderland, a vibrant city on the North East coast, has registered the lowest average house price increases in the region from £101,600 to £124,000 (22%).

Elsewhere, affordability has also improved in the North West and Yorkshire, with house price to earnings ratios falling from 6 to 5.1 in the North West and 5.7 to 5 in Yorkshire.

In Blackpool, a popular seaside resort on the North West coast, average house prices have increased by just 26%, with homes costing £124.300, up from £98,400 in 2005.

In Hull, the fourth largest city in Yorkshire, average house prices have increased by 49%, or £38,100 over the last 20 years.

Daniel Copley, consumer expert at Zoopla, says: “Our latest analysis certainly brings to light the profound impact that two decades of house price growth has had on the dream of ‘returning home’.

“UK house prices have soared by 74 per cent since 2005, making that nostalgic return financially unattainable for many, especially in hotspots in the South East and Eastern England.

“However, the picture is far from uniform across the UK. Our data shows that while some areas have seen dramatic increases, house prices have risen slowly, in line with incomes in northern regions.

“This means that for some, the dream of returning to their roots might be much more attainable than they think.”

LONDON SQUEEZE

Tom Bill, head of UK residential research at Knight Frank, says: “If you grew up in north-east England, bought in London and are now returning to your roots, you’re in luck.

“You will get significantly more bang for your buck and the equity accumulated means your mortgage could be wiped out altogether.

“The gap between the capital and the rest of the country has narrowed in recent years as more affordable parts of the UK have seen stronger house price growth. The squeeze in London means more buyers are looking beyond the M25 and that often includes locations where they have roots, a trend that was accelerated by the pandemic and shifting work patterns.”

COMPETITIVENESS HAS BALLOONED

Nigel Bishop, who founded buying agency Recoco Property Search 25 years ago, says: “I have been a buying agent for over 25 years and personally witnessed how certain areas in the UK have seen a drastic growth in property values.

“As time goes by, inflation tends to make everything more expensive, however, property prices have also been pushed by an ongoing imbalance between supply and demand.

“Nowadays, we are seeing multiple buyers putting in offers for one and the same property, often outbidding each other.

“Whilst this happened 20 years ago to some extent, the volume of house hunters and competitiveness has undoubtedly ballooned.

“Sadly, this has made it less possible for some to buy a property in the area that they grew up in.”

FIRST-TIME BUYER SUPPORT

Toby Leek, President of NAEA Propertymark, adds: “Rural and picturesque areas across the county are popular destinations that many people choose to move to, especially those that are looking for a quiet escape, such as certain coastal locations. However, this sometimes comes with a bigger price tag.

“As places increase in popularity, this raises house prices to levels that mean many current or ex-locals who may wish to move back to their hometowns where they grew up could find it hard to afford to purchase a home.

“It also has the potential to be extremely challenging for people to migrate around the locality as well, due to higher prices.

“Not only are these areas highlighted becoming harder for many aspiring homeowners move to, but across the country, homeownership in general is becoming increasingly difficult to achieve. Ultimately, we need additional support for first-time buyers, a review of stamp duty, and more homes to be built to keep pace with growing demand. T