‘Labour isn’t working’ was the famous advert strapline that won the Conservatives the 1978 Election. It is still relevant today, as the Party goes on an economic wrecking spree, leaving a trail of fiscal ineptitude behind them.

It is becoming clearer by the minute that our Chancellor knows as much about finance as my pet does about nuclear fusion and her naivety is causing much distress across many demographic groups.

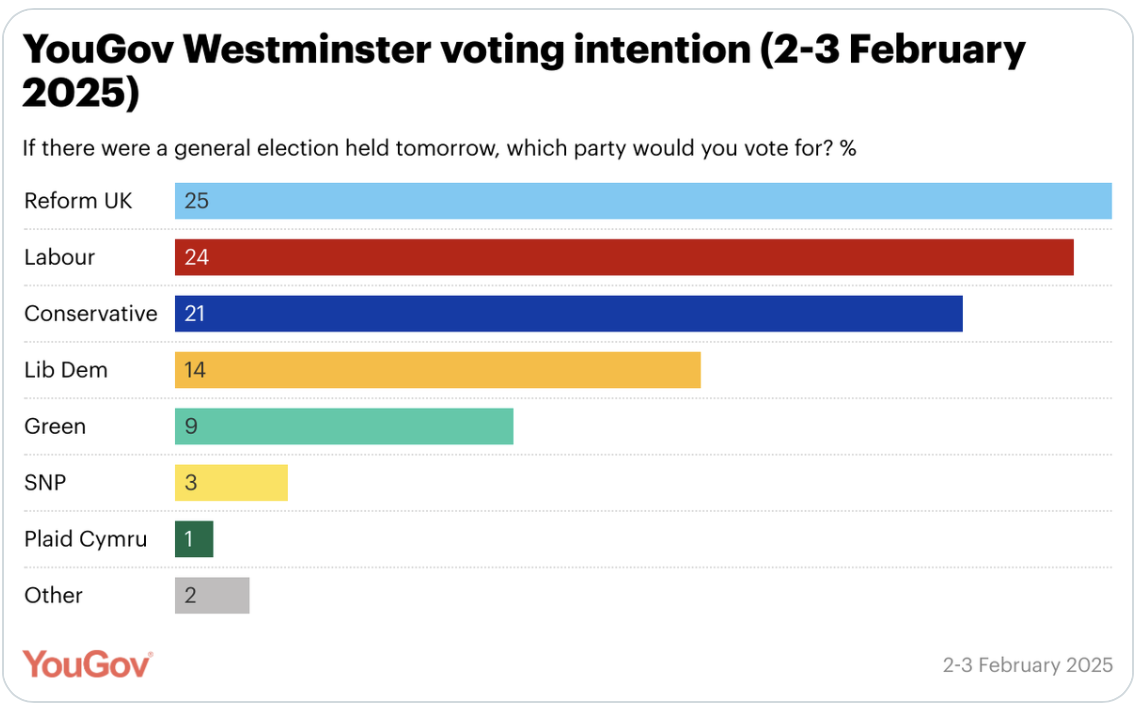

If an election were held tomorrow – for some, it couldn’t come soon enough – YouGov predicts the following results:

Reform UK in front for the first time, although the 1pt lead is within the margin of error. Ref: 25% (+2 from 26-27 Jan) Lab: 24% (-3) Con: 21% (-1) Lib Dem: 14% (=) Green: 9% (=) SNP: 3% (=).

In a remarkably short time Labour has managed to upset the pensioners, the farmers, the disabled, the employed, the unemployed, the non-doms, the parents of private school pupils, the Unions and anyone else whose paycheck is suffering ‘end-of-the-month-itis’.

Which is pretty much all of us!

SHARPENING THE ‘EATING IRONS’

As if this is not enough, amongst the chattering classes it is rumoured that they are sharpening their ‘eating irons’ in-order to have a tax grab, aimed at the wealthy and high earners in the autumn Budget this year.

Lest we forget that in 1980, the top 1% of earners paid 11% of the total tax take but this has risen to 29% today.

Britain has some of the highest property taxes in the world and the average council tax bill will soon be £1,770 in England, which is up by 64% from 2015.

Some 60% of all income tax is paid by those earning £70,000 or more and these are the ‘geese that are laying the golden eggs.’

I am a believer that there should be two more bands on Council Tax at the higher end. A wealth tax of say 2%, would be an economic and societal car crash.

A DROP IN A LARGE ECONOMIC BUCKET

Like Christmas TV repeats, or the flu, a wealth tax comes round on a regular basis and each time it has collapsed in a heap.

In 1990, 12 of the 36 OECD countries had a wealth tax and by 2017, this had gone down to just five.

When the Spanish tried it, they raked in a paltry 0.5 billion euros. Compared to behemoths such as Capital Gains or National Insurance, it’s a mere drop in a very large economic bucket. It’s also expensive to administrate, because the rich are adept at moving their money elsewhere or investing in property.

The truth is that the Exchequer will earn 100% of nothing from penalising the non-doms and private schools. If anything, it’ll cost Reeves money to implement these follies, demonstrating the triumph of left-wing political dogma over fiscal pragmatism.

SLOUGH OF DESPOND

We are more likely to end up in the slough of despond and lower employment, productivity, and growth than the sunny uplands of prosperity.

As the somewhat naïve Chancellor is finding out to her dismay, there is nothing more ultra-mobile than the ultra-wealthy.

Those who can, will move to fiscally more attractive climes such as Italy, Monaco, Cyprus, and Dubai who welcome high-net-worth individuals. Before you know it, London will be a ravaged husk of its former self.

Labour needs only to look at the examples of New York and California, where high taxes have degraded these former shining beacons of affluence, run down by their self-righteous, virtual signaling, Democrat governors and mayors.

Whilst their financial infrastructure collapses, the wealthy have voted with their Gucci-clad feet and run to the fiscal safe havens of Texas, Arizona, and Florida, which are only too happy to have them.

GOLDEN VISA PROGRAMME

Trump has just announced a ‘golden visa’ programme whereby wealthy entrepreneurs can become US tax residents, paying only taxes on the money earnt in the USA, if they part with $5million of their booty.

Apparently, this innovative idea will raise $billions for the US Treasury and why on earth don’t we ape this ingenious proposal for the UK?

And, whilst on the subject of Trump; do I hear the cacophonous squeals of outrage and indignation from the ‘blue bloods’ of the economic world as the penal tariffs are being thrown around the world like confetti, whilst the WTO rule book is being incinerated?

The predictable cataclysmic falls in the capital markets tells us that they certainly do not like tariffs wars, in any shape or form, no siree. Their fears of higher inflation and a recession are palpable.

However, as the expression goes, ‘don’t take the orange artful dodger from Mare Largo literally, take him seriously’.

Everyone knows (including even the Don!) that long-term tariffs are mutually harmful for trading countries, but as a short-term tactic to reset some historic imbalances, you never know, it may work a treat for the USA.

Already certain countries are acquiescing, and, for instance, it won’t take long before the flabby EU bureaucrats will crack under the pressure and show some contrition, which will result in a reform of the trading arrangements between them and the USA.

Let’s face it, in order to break up some of these historic, arthritic, fiefdoms, you’re not going to do it by ‘tinkling a bell’ and asking politely. Instead, you need to metaphorically ‘throw a grenade into the shopping mall’, to get a reaction and by golly, he has certainly done that.

You could argue why bother to spend all day fly fishing when in the alternative you could throw Semtex into the river and hey presto, all the fish come to the surface which you can hoover up. It’s not pretty, but it works.

FOOLHARDY STAMP DUTY CHANGES

Back at the ranch in the UK, the foolhardy stamp duty changes imposed by the self-congratulatory former Chancellor Osborne in 2014 has ensured that residential prices at the higher end of London have stagnated, if not fallen, with little chance of revival in the future.

The ONS predicts that mortgage interest rates will rise over the next five years, making it even more difficult for house-buyers and leaving the market in a state of suspended animation.

Angela Rayner’s genius idea is to encourage a collapse of the Residential Property market, which according to her, will make homes more affordable for some but leave others with the scourge of negative equity. May I suggest that she should cancel her subscription to The Beano!

SHOWBIZ FOR UGLY PEOPLE

The government has forgotten that their job is to carry out the will of the people. We give them the mandate through our vote, but I don’t know anyone who wants to be poorer. Our rulers are impelled by a perverse drive to deliberately cross the road and slip on a banana skin.

The Labour Party has become ‘showbiz for ugly people’ and they don’t seem to care about the implications of their policies.

No one is safe from their predations.

The Chancellor’s fanatical adherence to fiscal rules at the expense of the good of the Country, means that she’s become an object of ridicule even amongst stalwart cabinet ministers and Union leaders, let alone the wider Labour Party supporters.

We all know that the lack of the elusive growth for the UK stems from the thoroughly imprudent Budget last year, where they sucked £40billion in additional taxes from commerce but I am sure that this will be blamed on the tariffs as the Chancellor tries to escape responsibility from her actions, Houdini style.

BREXIT DIVIDENDS FLOW

Whilst on the subject, the Brexit dividends are now flowing thick and fast, since we have half the tariff rate as our counterparts on the continent of Europe and there is every chance that even these will fall away if the much-heralded trade agreement is sorted with America.

Isn’t it a good thing that our service sector makes up 85% of our economy, which is tariff free?

There is even talk about accelerating the trade deal with India which will certainly be good for the UK if it happens, and another Brexit gain.

Since the Prime Minister is bereft of any economic strategy there is talk of him recruiting a Sir Alan Walters-lookalike (who was Margaret Thatcher’s chief economic adviser in the ’80s) but I am wondering if the mantra ‘none so blind as those who do not want to see’ is going to prevail.

Ringing in our ears will be the adage ‘when you are up to your lower lip in a barrel of sewage… don’t make waves!’

Trevor Abrahmsohn is Founder and Director of Glentree International