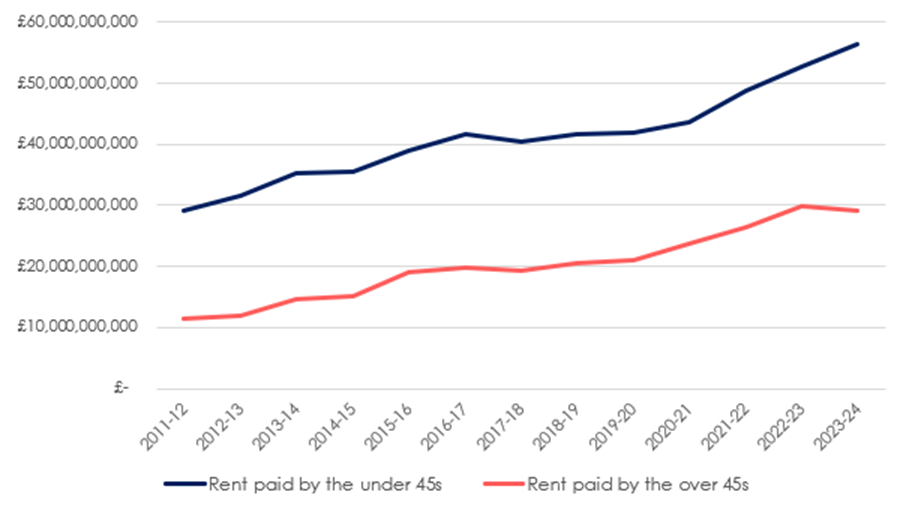

The amount of rent paid by under 45’s each year rose by £3.5bn between 2023 and 2024 to a record total of £56.2bn, latest research from Hamptons reveals.

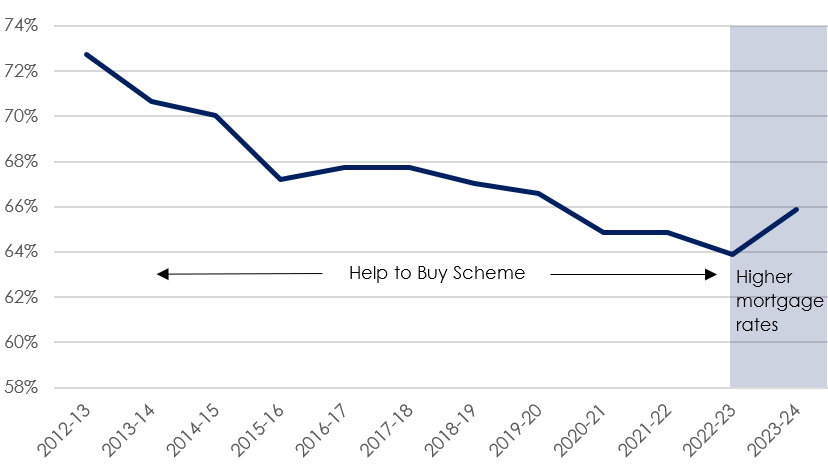

Under 45’s now pay two-thirds (66%) of all rent in Great Britain, up from 64% in 2023 and taking the figures back to pre-Covid levels.

The increase reflects a 149,000 rise in the number of under 45’s renting, the fastest growth in a decade.

This figure is equivalent to around 40% of the people who used the Help to Buy scheme since it began in 2013.

NEW RECORD

Spource Hamptons & English Housing Survey (EHS)

Overall, the annual amount of rent paid by tenants in Great Britain rose to a record £85.4bn in 2024, up 71% over the decade.

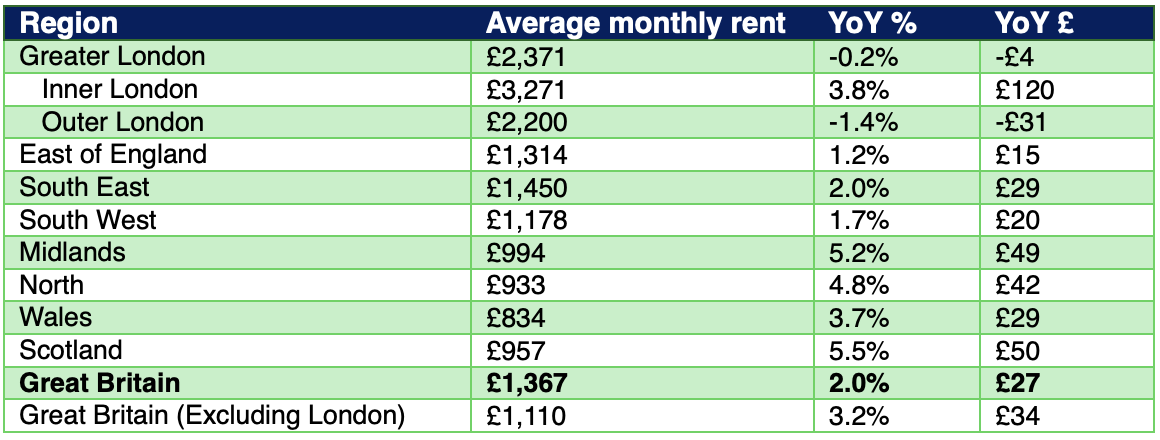

Meanwhile average rents for new lets rose 2.0% across Great Britain over the last year. However, the recovery in the number of rental homes on the market has stalled.

For most of the last decade, older households who didn’t purchase a home in their 20’s and 30’s drove the growth of the private rented sector.

According to the English Housing Survey, between 2013/14 and 2023/24 the number of renters aged 45+ rose by 24% (from 1.43m to 1.77m).

Meanwhile, government-backed homeownership schemes, including Help to Buy, alongside low interest rates, helped the number of households in Great Britain aged under 45 who were renting, fall by 1% over the last 10 years (from 3.45m to 3.43m), despite the population growing over this period.

Higher interest rates have reversed this trend. The pace at which younger people buy their first home has slowed sharply.

SHIFT CHANGE

Between 2022/23 and 2023/24 the growth in the private rented sector has been wholly driven by the under 45’s. This shift has added £3.5bn to the amount of rent paid by the under 45’s over the last year, meaning they’re paid a total of £56.2bn in rent in 2024.

Under 45’s now pay two-thirds (66%) of all rent in Great Britain, up from 64% in 2023 and back to pre-Covid levels.

Over the last 12 months, the number of under 45’s renting privately rose by 149,000 across Great Britain to a total of 3.4m.

This increase equates to around 40% of the people who, over the last decade, bought using the Help to Buy scheme.

The total amount of rent paid by the under 45’s has risen 59% over the last 10 years, a reflection of rising rents rather than an increase in the number of younger tenants.

Source: Hamptons / EHS

Meanwhile, despite rising rents, the over 45’s are now collectively paying £716m less in rent than they were a year ago, predominantly due to the fall in the number of older renters.

The number of over 45’s renting privately decreased by 79,000 over the last 12 months. These older households, generally with larger savings, are more likely to be able to buy in a world of higher interest rates.

However, over the course of the last decade, the total amount of rent paid by those over 45 has almost doubled (up 98%), rising from £14.7bn to £29.1bn.

While this has been a choice for some, others have found themselves locked out of homeownership due to stricter stress testing implemented after the financial crisis.

It’s likely that elevated interest rates and continually rising rents will slow or even reverse the growth of this group.

Source: Hamptons / EHS

By the end of 2024, the total amount of rent paid by private tenants in Great Britain had risen to a record £85.4bn, £2.8bn up on 2023’s total.

Slower rental growth and a limited rise in the number of tenants kept this increase modest in comparison to recent years.

The annual change marked the smallest increase in four years and only around a third of the hike recorded in 2023.

Even so, 60% of the increase in 2024 came from rising rents, while the other 40% came from the slightly higher number of renters.

RENTAL GROWTH

Nationally, the cost of moving into a rented home rose by just 2.0% over the last 12 months, the smallest increase since October 2020 when rents were falling in the aftermath of the Covid outbreak. This reflects rents rising from an already high level. In December 2023, rental growth stood at 10.2%.

Average rents have risen by 31.2% in Great Britain since October 2020, from £1,042 per month to £1,367, costing the average tenant an extra £3,912 per year.

Scotland continues to have the fastest-growing rents in the country, with prices on a new let up 5.5% over the last 12 months. Rental growth in the Midlands and the North of England tracked closely behind. Here, rents rose by 5.2% and 4.8%, respectively, in December (table 1).

Meanwhile, Greater London was the only region where rents fell (-0.2%) over the last year (table 1). This is partly because rents rose at double-digit pace in December 2023 (11.4%).

There were more rental homes on the market in 2024 than in 2023, with numbers up 10% annually.

However, there are strong signs that the recovery in stock levels has peaked, given numbers were up 34% year-on-year back in January 2024.

The number of homes on the market still stands 13% lower than during the same time in 2019, a figure which has trended downwards in more recent months and is likely to put pressure on rental growth in 2025.

Source: Hamptons

Aneisha Beveridge, Head of Research at Hamptons, says: “Higher mortgage rates have clipped the wings of many young aspiring homeowners in the last couple of years, meaning Millennials increasingly outnumber older generations in the rental market.

“Renters face saving for longer and earning more to borrow similar amounts of money to buy a home. Just like rapidly rising house prices, higher interest rates will keep younger generations of tenants renting for longer.”

RECORD RISE

And she adds: “For most of the last decade, the government’s flagship Help to Buy scheme played an important role in transferring tenants from the rental market into homeownership.

“However, the record rise in the number of younger renters over the last year highlights the impact of higher mortgage rates and the need for a similar scheme if the government wants to achieve its ambition to help more people become homeowners.

“The pace of rental growth continues to cool, and rents are now rising at a similar rate to house prices.

“And just like house prices, the bulk of the growth is coming in Northern England.

“But the recovery in stock levels looks to have peaked, keeping rental growth positive. While new purchases by landlords held up in December, early signs in January suggest the new 5% stamp duty surcharge is starting to bite, which could fuel more rental growth in the coming months.”