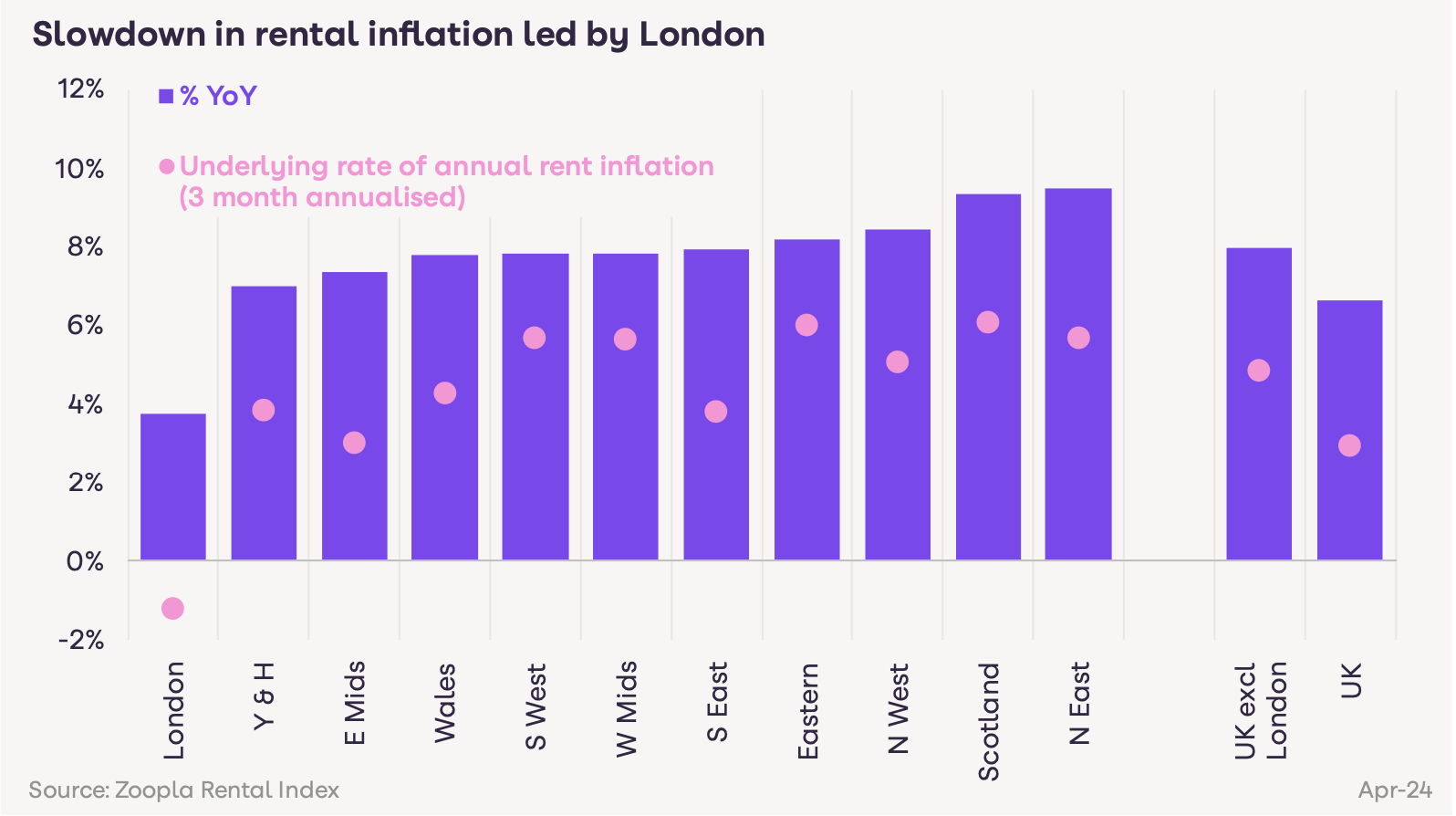

Rental growth has slowed to its lowest level for 30 months as affordability and the cost-of-living continues to hit renters’ wallets, Zoopla’s latest Rental Market Report reveals.

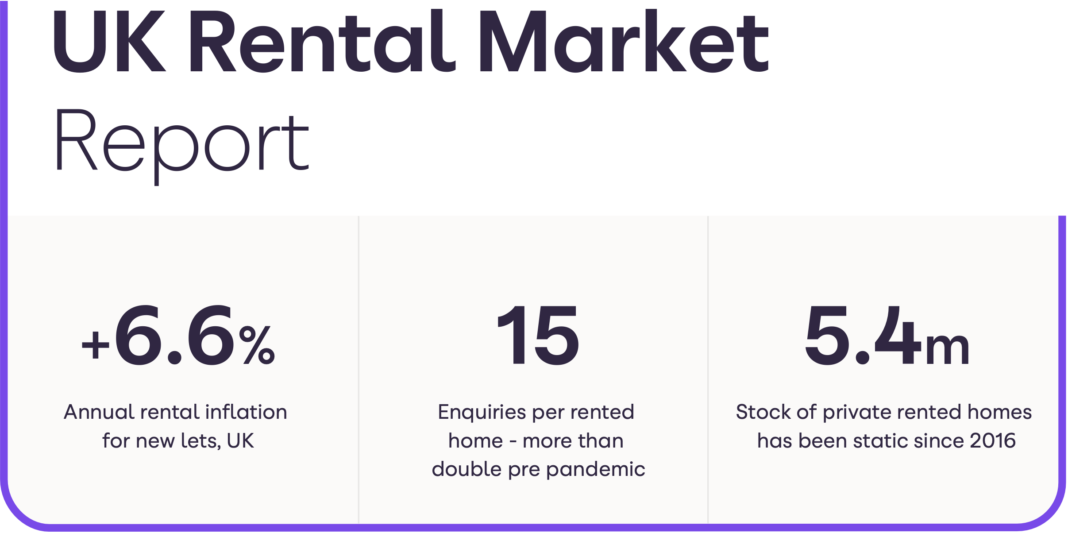

Average monthly UK rent now stands at £1,226 per month with growth slowing to +6.6% and expected to fall to 5% by the end of the year.

Affordability has been the key driver pushing rents down with the proportion of gross earnings spent on rent at the highest level for a decade across all regions and countries.

However, there are major regional differences – in London some 41% of gross earnings are spent on rent compared to 21% in Scotland and the North East leading to rising rents in those areas.

Over the last quarter rents have fallen in regional cities including Nottingham (-1.4%), Brighton (-1.1%), York (-0.4%) Glasgow (-0.4%), Cambridge (-0.3%) and London (-0.3%).

But despite the slowdown there are still 15 people competing for every property for rent – more than double the pre-pandemic average – driven both by a lack of supply and unaffordability.

GROW FASTER

Richard Donnell, ZooplaRichard Donnell, Executive Director at Zoopla, says: “The increase in the cost of renting has slowed to a 30-month low. Rents continue to grow faster than average earnings although the gap is much narrower than a year ago.

Richard Donnell, ZooplaRichard Donnell, Executive Director at Zoopla, says: “The increase in the cost of renting has slowed to a 30-month low. Rents continue to grow faster than average earnings although the gap is much narrower than a year ago.

“Rental demand continues to run well ahead of available supply which is keeping the upward pressure on rents but there are some areas where rental growth has stalled.”

He adds: “Growing the supply of rented homes, both private and affordable, should be among the top housing priorities for the next Government.

“A healthy private rented sector is vital for economic growth and a more balanced housing market. More supply is the fastest route to easing the pressure on renters and improving the overall quality of rented homes.”

Nicola Thivessen, KFHNicola Thivessen, Director of Group Compliance at KFH, adds: “It is positive to see rental inflation at its lowest in 30 months, although demand for available property remains high, with supply still a third lower than pre-pandemic.

Nicola Thivessen, KFHNicola Thivessen, Director of Group Compliance at KFH, adds: “It is positive to see rental inflation at its lowest in 30 months, although demand for available property remains high, with supply still a third lower than pre-pandemic.

“As we head into the peak summer period, the sector would benefit greatly from a continuation of more available homes to rent, which would help level out the ongoing imbalance between supply and demand, easing the pressure off tenants in terms of affordability.”

Tom Bill, Knight FrankTom Bill, Head of UK Residential Research at Knight Frank, says: “Rental growth has calmed down since the pandemic but it’s still high by historical standards.

Tom Bill, Knight FrankTom Bill, Head of UK Residential Research at Knight Frank, says: “Rental growth has calmed down since the pandemic but it’s still high by historical standards.

“Landlords have left the sector as red tape, tax and legislative uncertainty have proliferated, which has ultimately hurt tenants.

“Average rents are 22% higher than they were before the pandemic and the figure is even higher in many areas.

“Abandoning the Renters Reform Bill before the election will only prolong the sense of limbo for landlords, which means more may sell up.”

And Adam Jennings, head of lettings at Chestertons, adds: “London is home to one of the world’s most competitive rental markets but the recent increase in the number of available properties has created a slightly better environment for tenants wanting to move.

“We have seen a momentary slowdown of rent increases but are expecting more tenants to start their search over the summer months. It is therefore only a matter of time before demand levels outgrow supply to a degree that triggers rents to go up again.”