The UK housing market showed signs of gradual recovery in 2025, with modest price growth, rising new listings and a small increase in rental supply, according to Propertymark’s latest annual reports covering sales, fall-throughs and rents.

Across 2025, 1.65 million properties were listed for sale, up from 1.61 million in 2024, while the average exchange price rose from £361,501 to £365,179.

The strongest month for new instructions was May, when 162,031 homes came to market, while the highest average price was recorded in November at £372,968. December remained the quietest month for activity.

Nathan Emerson, Chief Executive of Propertymark, reckons that the year marked progress despite continuing economic volatility.

SWITCHED ON

He says: “Despite a myriad of challenges, 2025 has proven progressive for the housing market.

“We have witnessed inflation track downward to 3.2% and four base rate cuts throughout the year, all of which will contribute towards enhanced consumer confidence and affordability.

“There have been occurrences throughout the year however which have brought market instability, such as the lead up to stamp duty threshold changes last April across England and Northern Ireland, and on the lead up to the Autumn Budget where we witnessed people take a deliberated view until fiscal plans for the forthcoming year were clear.

“The housing market continues to provide a substantial contribution towards wider economic growth, and it is vital that the UK Government and the devolved administrations remain switched on regarding all ambitions to meet their respective home building targets.

“Although 2025 has been a year of transition, we now sit in a much healthier position than only twelve months ago, with the housing market displaying strong potential for the forthcoming year ahead.”

UNDER PRESSURE

However, the sales market also showed signs of strain. The number of transactions falling through rose to 250,092 in 2025, up 3.9% year on year. July recorded the highest number of collapsed deals, reflecting the continued impact of affordability checks, mortgage rate repricing and lengthy conveyancing times.

Rental dynamics shifted too. The average number of rental properties coming to market each month increased from 99,739 in 2024 to 108,348 in 2025, but agreed rents were broadly flat, slipping slightly from £1,511 to £1,505.

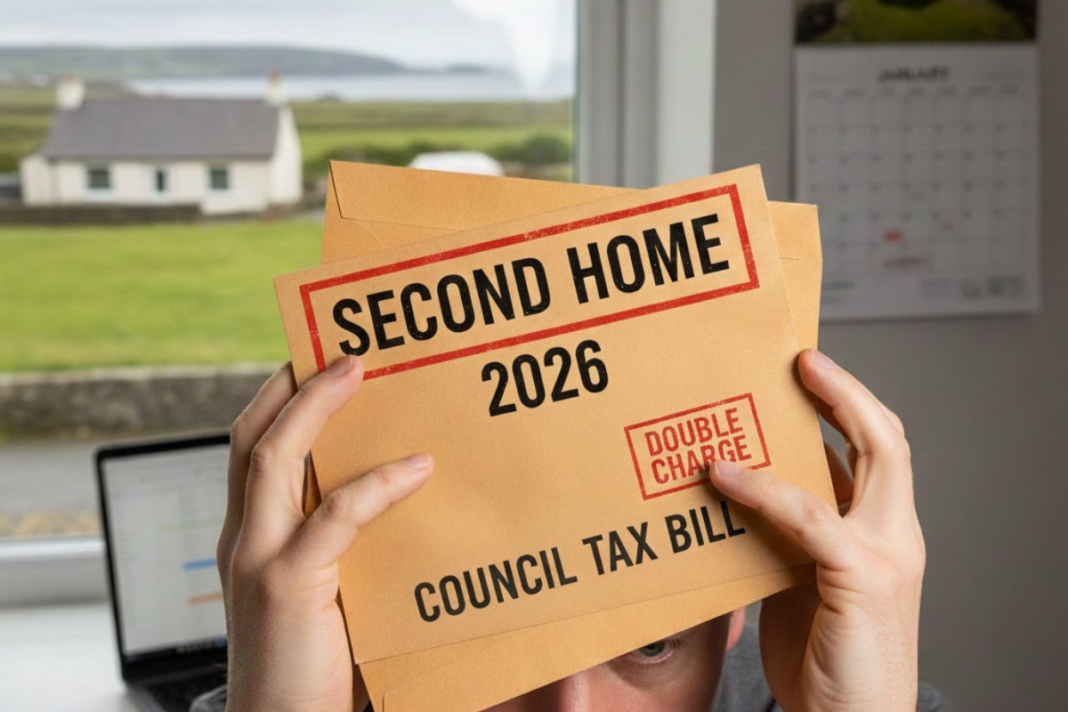

Tenant demand remained strong, while landlords continued to navigate new legislation in England and Scotland, tax changes and energy efficiency requirements.

Propertymark said 2026 was likely to be defined by adjustment as reforms are phased in and borrowing costs stabilise. Despite ongoing pressures on households and local markets, the trade body argued that the sector enters the new year with improved sentiment and clearer signs of price stability.