The latest UK Residential Market Survey from the Royal Institution of Chartered Surveyors (RICS) indicates the sales market may be moving into a more stable phase, following months of volatility triggered by shifting economic conditions and policy changes.

Headline indicators point to a gradual levelling of activity. New buyer demand turned marginally positive for the first time since December 2024, with a net balance of +3% in June, up significantly from -22% in May. Although modest, the move suggests sentiment among purchasers is improving.

Meanwhile, the national net balance for agreed sales also moved closer to neutral at -3%, compared with -25% and -28% in April and May respectively.

While still technically negative, this marks the least downbeat reading in several months and hints that the slowdown in completions may have bottomed out.

BRIGHTER SALES EXPECTATIONS

Expectations for short-term sales activity have similarly brightened. A net balance of +6% of respondents anticipate an increase in transactions over the next three months – up from -2% in May.

Source: RICS

Twelve-month expectations are also tentatively positive at +5%, though agents report that confidence remains muted and finely balanced.

The supply picture is slightly softer with new instructions edging down, with the net balance slipping from +7% in May to +3% in June.

However, 16% of survey participants reported an uptick in appraisal activity compared to the same period last year, suggesting sellers remain engaged and that listing levels may remain stable in the near term.

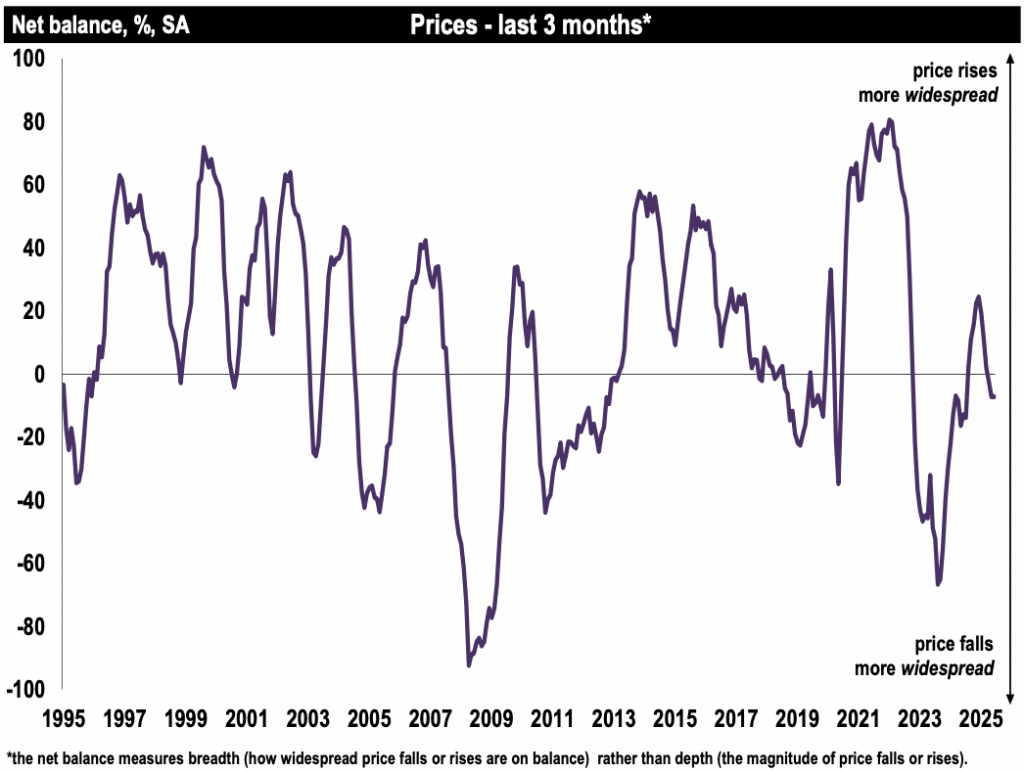

MIXED PRICE MOVEMENTS

Price movements remain mixed with the national house price net balance unchanged at -7%, pointing to broadly flat or marginally declining values across the UK.

However, regional divergence is widening. Northern Ireland continues to lead on price gains, with notable uplifts also seen in the North West, Scotland, and the East Midlands. Conversely, the South East, East Anglia and London reported more significant downward pressure.

TENANT DEMAND PLATEAUED

In the lettings market, tenant demand appears to have plateaued, with a net balance of -2% in June.

The more pressing concern remains the exit of landlords from the sector, as supply constraints tighten further. A net balance of -21% of respondents reported a fall in landlord instructions, the latest in a long-running trend fuelled by taxation, regulation, and shifting investment returns.

Despite this softening in demand, rent expectations remain elevated. A quarter (24%) of respondents anticipate further rental growth in the next three months, though this is down from a markedly higher +43% in May.

The imbalance between demand and supply remains a key concern, particularly in urban markets where affordability pressures are intensifying.

MORE SETTLED

Tarrant Parsons, RICS Head of Market Research & Analysis, says: “The UK residential market appears to be entering a more settled phase, with demand showing signs of stabilising following a period of volatility.

“The earlier distortion caused by transactions being brought forward ahead of the Stamp Duty changes now appears to have largely dissipated, allowing underlying trends to re-emerge.”

And he adds: “Encouragingly, near-term sales expectations have begun to edge higher, pointing to a modest shift in sentiment. That said, confidence in the market remains somewhat delicate, with economic uncertainty at both the domestic and global level still seen as a potential headwind.”

ONE STEP FORWARD…

Jeremy Leaf, north London estate agent and a former RICS Residential Chairman, says: “The market feels a bit like one step forward, one-and-a-half steps back.

“Although doing its best to recover activity levels prevailing earlier in the year, there’s little sign of a significant pick up yet.

“In our offices, demand has improved, particularly for houses rather than flats, and most sales agreed are staying that way despite some price renegotiation.

“However, the amount of property available and worries about the economy – regardless of the prospect of further interest rate cuts later in the year – are proving more relevant for many.”

“Nervousness about the cost of living and tax rises are contributing to tenant affordability concerns.”

And he adds: “Nervousness about the cost of living again and seemingly inevitable Autumn tax rises are contributing to present tenant affordability concerns.

“On the ground, we are finding there’s still interest, particularly in smaller one- and two-bedroom flats.

“Rents are being supported by a continuing lack of stock due to landlords selling up and not being replaced in anything like sufficient numbers by new or existing investors.”

GUESS THE TAX RISE

Tom Bill, head of UK residential research at Knight Frank, says” “Demand is recovering after the March stamp duty deadline meant transactions were pulled forward into the first quarter of the year.

“However, as buyers return, they have a lot of stock to choose from, which is putting downwards pressure on prices.

“Rate cut expectations have grown over the last six weeks due to weak UK economic data, which should support demand over the second half of the year and produce modest single-digit price growth in 2025.

“A re-run of last year’s game of ‘guess the tax rise’ ahead of the Budget is the biggest risk for sentiment.

“A piece of legislation designed to protect tenants may ultimately increase their rent.”

“Rents are heading higher again as supply is squeezed, which won’t be welcome news for tenants.

“The impending Renters’ Rights Bill is one reason more landlords are selling up, which means a piece of legislation designed to protect tenants may ultimately increase their rent.”