With a Prime Minister on borrowed time, the UK housing market is once again operating in an uncertain political landscape.

Buyers and sellers can reasonably assume that Keir Starmer won’t be in Downing Street this Christmas but until a leadership challenge happens, there are almost too many ramifications to process.

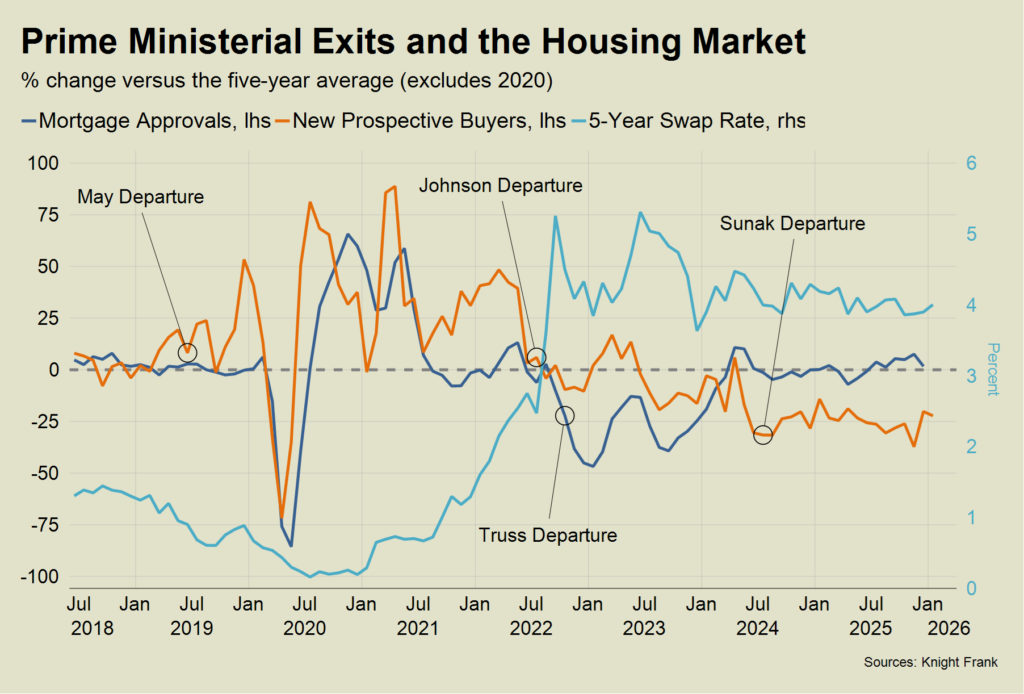

The market has experienced similar moments in recent years with the resignations of Boris Johnson, Theresa May and Liz Truss. Even Rishi Sunak’s departure after the general election in July 2024 was a virtual certainty.

“The prime minister has a mandate from 14 million people to get a job done” was a familiar-sounding comment made days before Boris Johnson left office in July 2022.

NO WAY OUT

Unfortunately for Keir Starmer, there doesn’t appear to be an obvious way out from his current predicament.

A worse-than-expected result at the Gorton and Denton by-election next week, more revelations about government appointments or a poor set of local election results in May are three possible triggers for his exit. The only uncertain thing is the timing.

Recent reports from the RICS, Nationwide and Halifax all painted an improving picture for house prices and demand in January, but they predated the latest political upheavals, which were caused by the appointment of Peter Mandelson as US ambassador.

So, how did the housing market cope during the last four prime ministerial departures?

The answer is not very well in the short-term. Resignations have tended to cause mortgage approvals and new buyer registrations to temporarily dip, as the chart shows.

MORTGAGE RATES MATTER

However, the politics can’t be looked at in isolation. Mortgage costs (represented by the five-year swap rate) also set the tempo.

A spike in borrowing costs sent demand lower and ushered in the departure of Liz Truss in October 2022 but housing market activity was supported in early 2023 as rates initially fell back.

And when Theresa May resigned in June 2019, the availability of sub-2% 5-year fixed-rate mortgages softened the blow.

Any new occupant of Downing Street will still be worried about another ‘Liz Truss moment’ but increases in government spending will put upwards pressure on borrowing costs.

A negative reaction on bond markets towards his successor is one reason Keir Starmer has given to justify remaining in office. He may be proved right.

“The identity of a new Chancellor could prove more important for fiscal policy and the housing market.”

What is certain now is that the Labour Party will tack to the left politically to appease its own MPs. In some ways, the identity of a new Chancellor could prove more important for fiscal policy and the housing market.

While rates have jumped in recent weeks they could begin to stabilise at lower levels in coming months.

Expectations of an imminent cut grew following the Bank of England’s meeting this month. Soft labour market and inflation data this week will further increase the likelihood of a cut next month and another before December.

It would help sustain buyer demand through the next few months as the drama at Westminster unfolds.

LONG TERM HORIZONS

I discuss the impact of political volatility among overseas investors with Mike Hussey, chief executive of central London developer Almacantar on the latest episode of Housing Unpacked.

Almacantar’s developments include Centre Point, One and Two Southbank Place and Marble Arch Place, which includes The Bryanston, a collection of 54 luxury apartments.

He calls such moments “reasonably impactful in a very short period of time” but says investors tend to make decisions based on longer-term horizons.

“London sits in the same place it has done for a long time, which is right up there in terms of its geography, its time zone, legal structures, education and culture. It’s all very important to people building businesses and some of the wealthier people in the world having families here.”

TAX CHANGES

He conceded that recent tax changes, including the scrapping of non dom rules in April last year, had reduced the appeal of the UK but said a range of factors influence decision-making, particularly in the residential market.

“I asked a friend of mine whether he was put off by the recent changes and he said ‘if I pay a bit more tax, I’ll pay it here. But the main driver for me staying is that my wife doesn’t want to move to Dubai.’”

He added: “If there’s a bit more tax to pay, so be it, but explain it. Give plenty of notice. Do it sensibly, apply it logically. It’s when it’s random and all over the place, and they do one thing and then U-turn, that people are put off investment.”

It’s an important message for any new Chancellor.

He also talks about his early career at Canary Wharf Group and Landsec and his role shaping different London neighbourhoods during the last four decades. It’s a process that requires enough vision to see through the sort of short-term political strife we are experiencing.

Tom Bill is Head of UK Residential Research at Knight Frank

|

|