The UK housing market is ending 2024 on a high with property sales surging ahead of the stamp duty change in April 2025.

According to Zoopla’s latest House Price Index, buyer activity in the final quarter has propelled sales to levels not seen in four years, with a 23% year-on-year increase in the past month alone.

This represents a sales pipeline worth a staggering £104bn, up 30% compared to this time last year.

The rebound in activity comes after many households delayed moving decisions earlier in the year due to elevated mortgage rates.

SALES GROWTH

The return of buyers and sellers to the market, combined with a broader range of homes available, has underpinned the sales growth.

However, rising mortgage rates and the economic uncertainties following the Budget are making buyers more cautious.

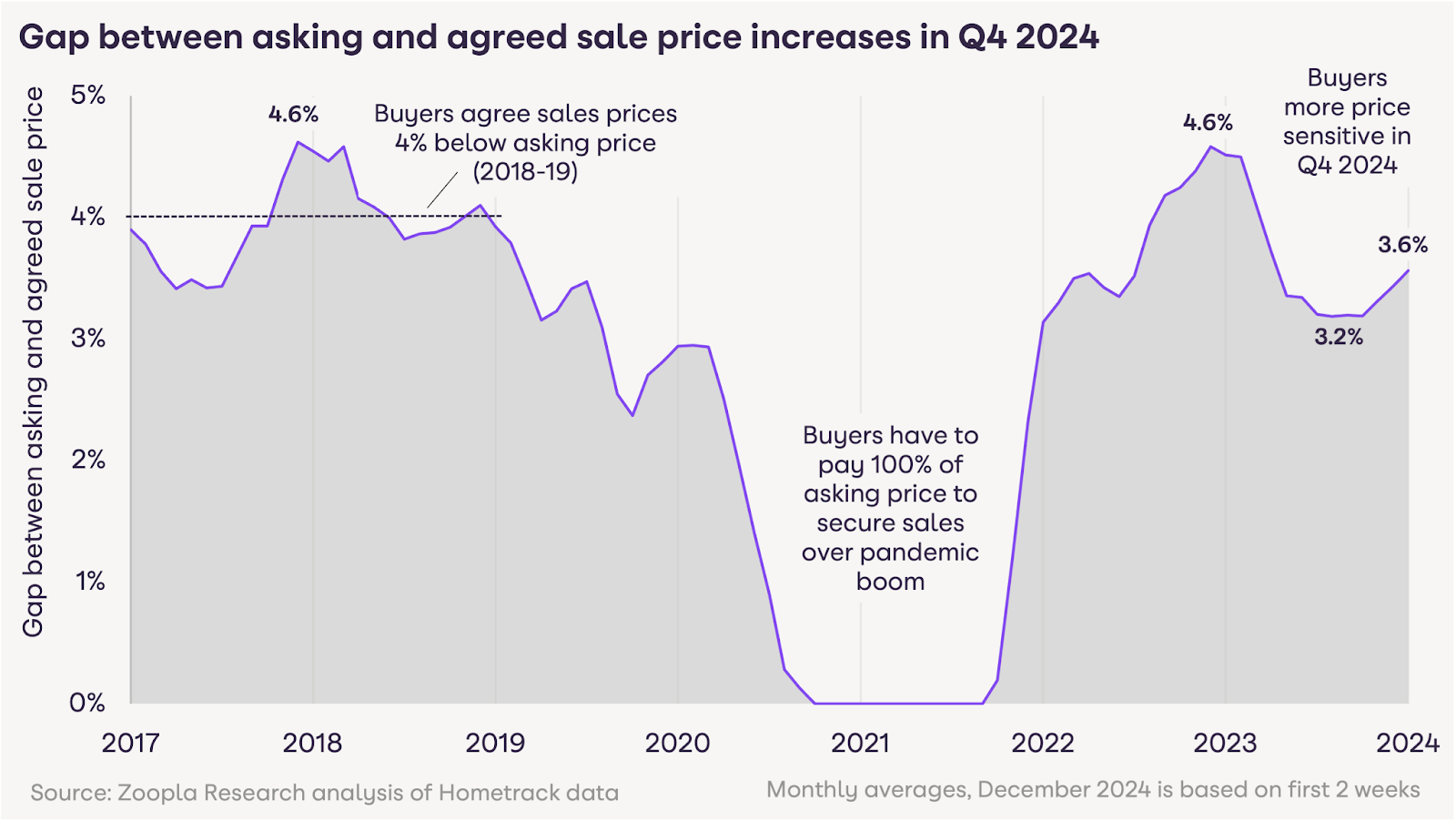

On average, sales are being agreed at 3.6% below asking prices, compared to a 3.2% discount during the summer when falling mortgage rates had bolstered buyer confidence.

House prices are showing resilience, with annual growth at 1.9% in the 12 months to November, a sharp turnaround from the -1.2% decline recorded a year ago.

The average UK house price now stands at £267,500.

Northern Ireland leads regional growth with a 6.8% rise, followed by 3.5% in the North West. In contrast, the South East saw a modest increase of just 0.7%.

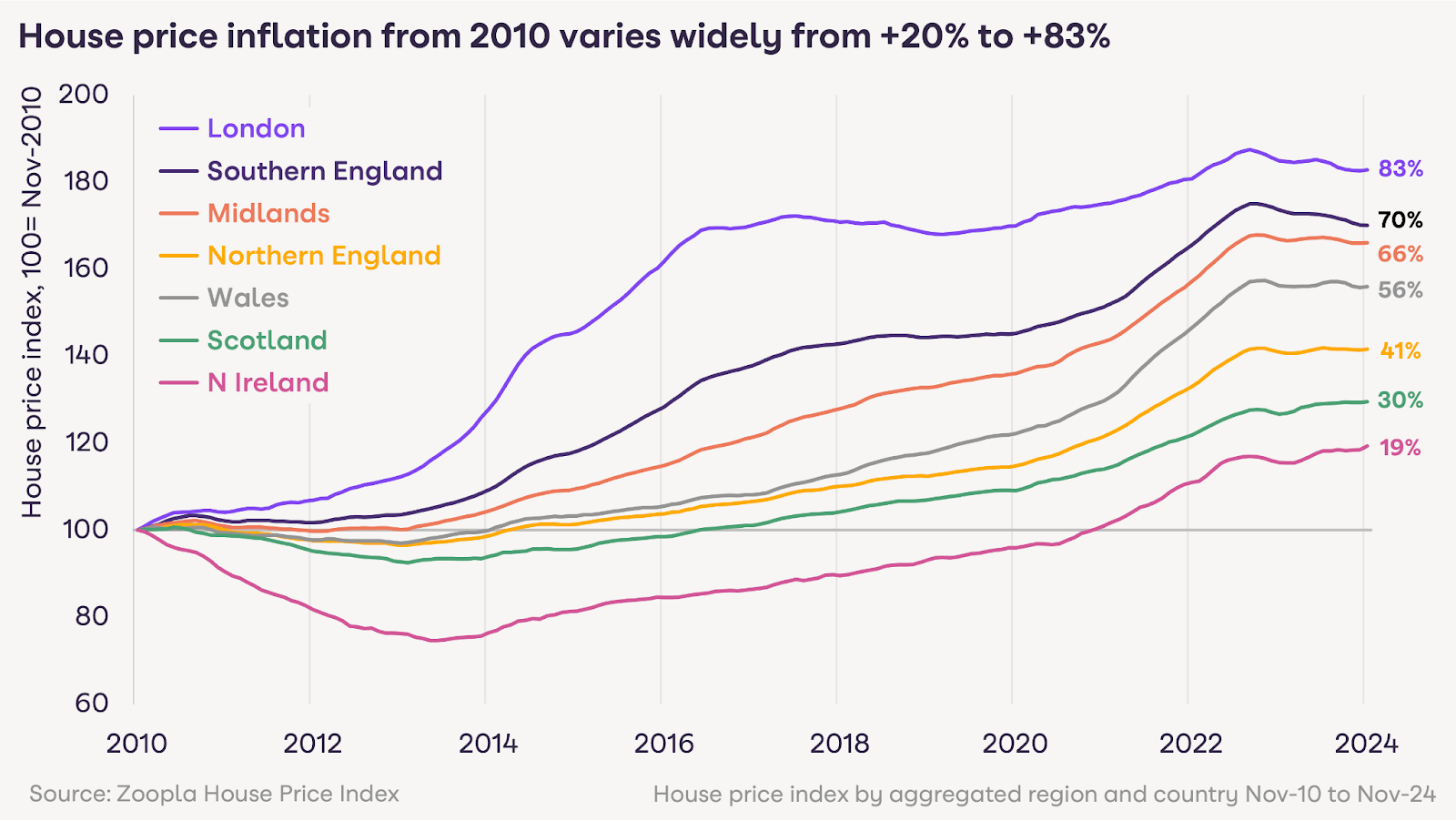

Regional affordability continues to shape price trajectories. While London and the South have experienced sharp rises since 2010 – up 83% and 70%, respectively – Northern Ireland and Scotland have seen much lower gains, leaving room for further growth.

Zoopla forecasts a tempered 2.5% increase in house prices for 2025, driven by regional affordability and restrained by cautious buyer behaviour.

While southern England is expected to lag, northern regions and devolved nations could see stronger performance.

BUYER’S MARKET

Mortgage rates, a critical factor influencing the market, are predicted to hold steady at current levels.

Combined with economic and labour market uncertainties, this will likely maintain a buyer’s market, with price sensitivity continuing to play a defining role.

SIZABLE PIPELINE

Richard Donnell, Executive Director at Zoopla, says: “Buyers and sellers returned to the housing market in 2024 having delayed moves in the face of higher mortgage rates.

“There is a sizable pipeline of sales that will complete in the first half of 2025 with many hoping to avoid higher stamp duty costs from next April.

“More sales have supported a return to house price growth across the country but home buyers have become more price-sensitive in recent weeks as mortgage rates drift higher.

“Affordability constraints will keep the pace of house price growth in check over 2025 but there will be enough price inflation to support 5% more home moves.”

INCREDIBLE JOURNEY

Nathan Emerson, Chief Executive of Propertymark, says: “When you compare how the housing market entered 2024 to where we stand as we head into 2025, it’s an incredible journey that has seen consumer confidence and affordability grow consistently across the entire year.

“While there may still be aspects of the wider economy that need to find greater stability overall, the housing market sits in a strong position to deliver growth.

“We are expecting to see a busier than normal first quarter, especially across England and Northern Ireland, as people look to complete on their purchases before the proposed stamp duty thresholds change in April.”

GREATER CHOICE

Malcolm Prescott, Managing Director of Devon estate agents Webbers, adds: “Zoopla’s latest House Price Index reveals a 1.9% year-on-year growth and here in the South West we can report that individual homes have performed a little better.

“All of this is supported by rising salaries (4% up in real terms on average) and the current competitive mortgage rates, which we see continuing. This resilience underscores the long-standing strength of the UK housing market.”

And he adds: “Additionally, buyers now have greater choice, with many estate agents including ourselves here in the West Country, reporting a 30% increase in available stock compared to last year. This gives prospective buyers a better chance of finding their dream home.”

FIRST-TIME BUYER DEMAND

And Matt Thompson, head of sales at Chestertons, says: “We are seeing one of the busiest Decembers in years in terms of buyer demand.

“This is mostly driven by first-time buyers who are keen to get on the property ladder before next year’s changes to Stamp Duty but also by second-steppers including young families, wanting to upsize.

“Looking to 2025, despite the uplift in buyer enquiries, rapid price increases are unlikely, however, improved affordability, pent-up demand and renewed confidence in the market should provide support for steady growth in property values. As such, we predict property prices to rise by 3.4% across the UK and 3% in London in 2025.”