Britain’s housing market is shaking off the usual summer slowdown with buyer demand and agreed sales both rising yet house price growth remains firmly subdued amid a flood of new listings and the drag of higher stamp duty.

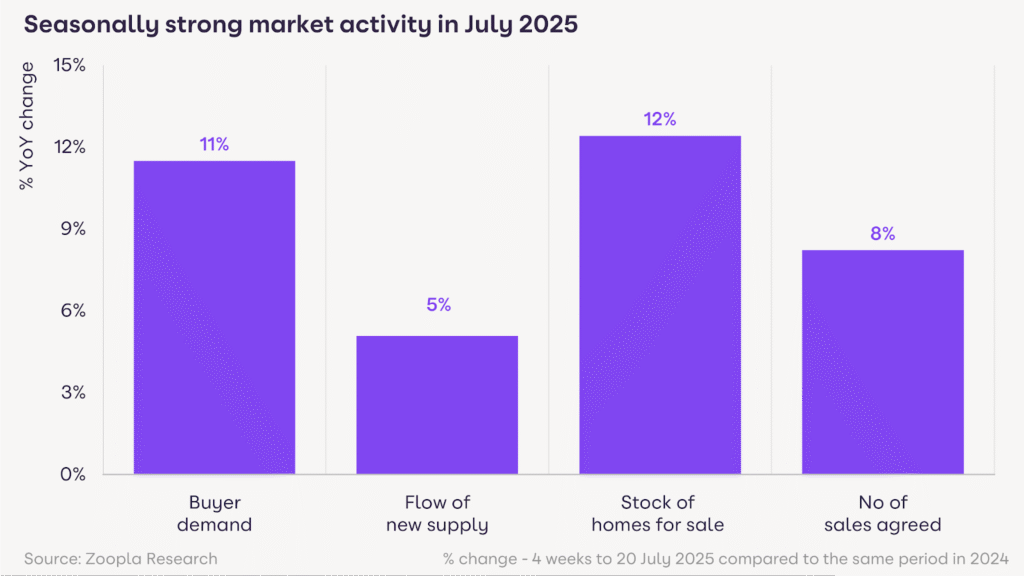

Zoopla’s latest House Price Index reveals buyer demand is up 11% year-on-year, with sales agreed up 8%, fuelled by more flexible mortgage affordability rules and a rush to complete deals before the August holiday lull.

The number of homes for sale has reached a five-year high, averaging 37 per estate agent branch, tipping the market further in favour of buyers and increasing competition among sellers.

A key driver behind the uptick is a 20% jump in mortgage borrowing power for many buyers, thanks to revised affordability testing. But while transactions are gaining pace, price growth is not following suit.

HOUSE PRICES SLOW

UK house price inflation has slowed to 1.3%, with the average home now valued at £268,400 – just £3,350 more than a year ago and well below the 2.1% rate recorded in December.

Richard Donnell, executive director at Zoopla, says: “The housing market is broadly in balance. We’re seeing healthy levels of demand and sales, but this isn’t sparking faster price inflation.

“In fact, more homes for sale, particularly across southern England, is re-enforcing a buyer’s market, keeping price rises in check.

“Many more home buyers are paying stamp duty since April and want this extra cost reflected in the price they pay. While mortgage rates are holding steady, less stringent affordability testing has boosted buying power and is supporting more sales despite increased uncertainty.”

HOUSE PRICES

And he adds: “At the start of the year, we predicted house prices would rise just 2%, at the lower end of forecasts for house price inflation.

“Prices are on track to be 1% higher over 2025, half the level forecast. Greater supply of homes for sale and mortgage rates remaining higher than expected are the key reasons for weaker growth.

“Low house price inflation is not a bad thing so long as there is enough market confidence for people to list their homes and make bids to buy homes.”

STAMP DUTY PUTS BRAKE ON INFLATION

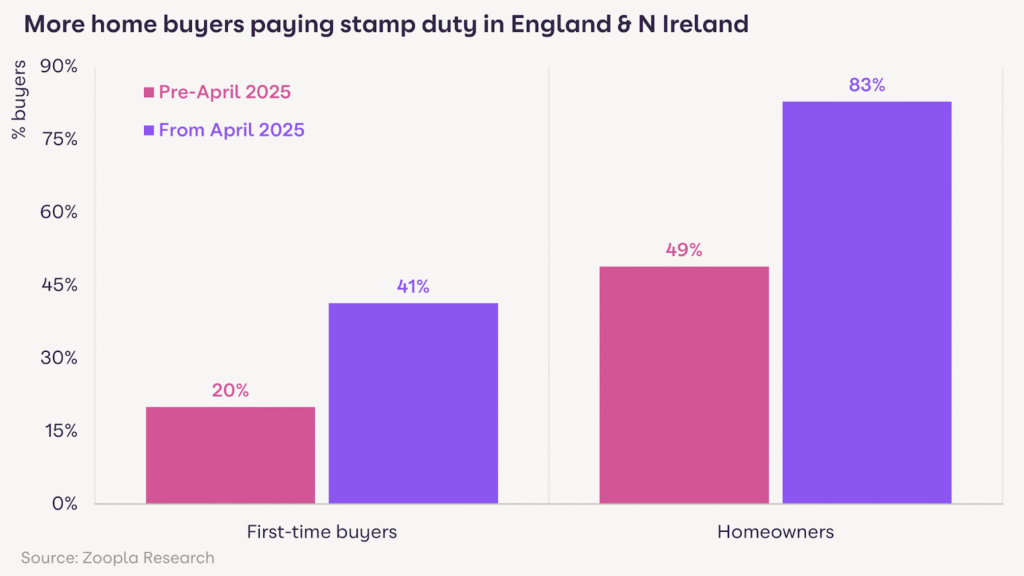

The end of temporary stamp duty reliefs in April has introduced a new headwind to price growth, particularly in southern England.

According to Zoopla, 83% of buyers now pay stamp duty, up from 49% earlier this year, adding up to £2,500 to the average purchase – a cost now being factored into buyer negotiations.

The impact is most pronounced in London and the South East, where higher property values mean stamp duty bills are steeper.

A first-time buyer in the capital now pays £6,100 in stamp duty on an average purchase – compared to zero just months ago. While first-time buyers still benefit from reduced rates, 41% are now liable for stamp duty, more than double the 19% affected before April.

REGIONAL DIVIDE

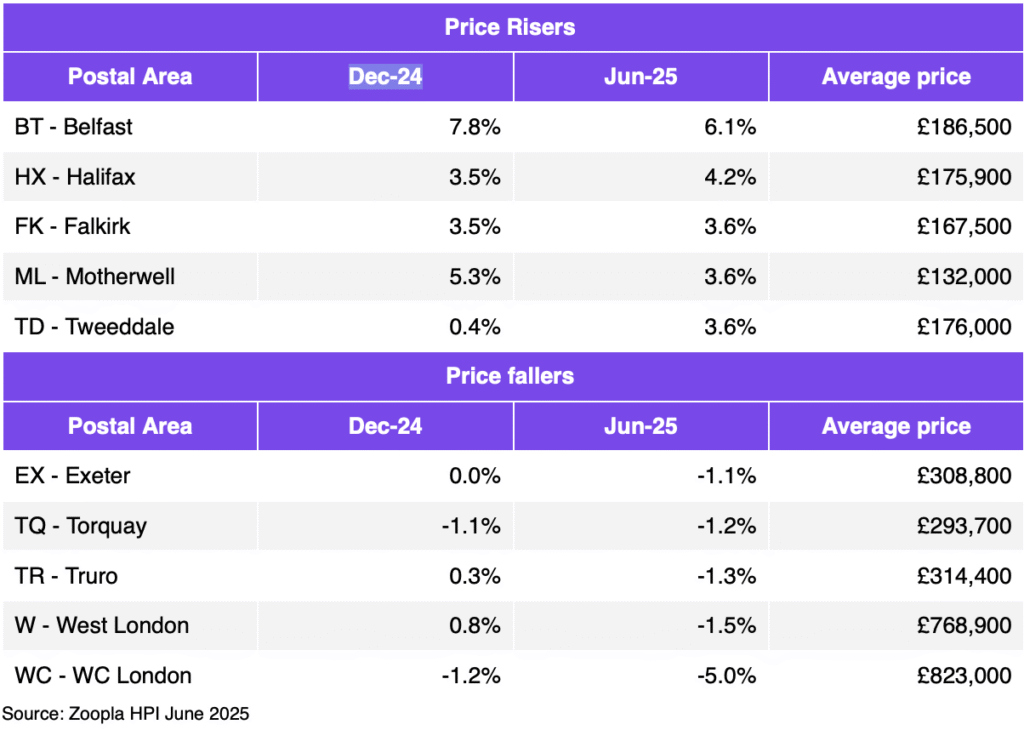

While the national picture reflects subdued growth, regional variation is stark. Northern Ireland leads the market with prices up 6.1%, and Belfast even higher at 7.8%.

In contrast, southern regions such as the South East and London are seeing minimal inflation, with growth of just 0.2%, and some markets – like Truro (-1.3%), Torquay (-1.2%), and Exeter (-1.1%) – recording outright price declines.

Despite weaker price growth, market confidence appears resilient, with a growing consensus among analysts that low, steady inflation coupled with greater housing supply may represent a healthier long-term environment for both buyers and sellers – especially as borrowing power improves and political uncertainty begins to clear.

INDUSTRY REACTION

David Powell, Chief Executive of Andrews Property Group, says: “The market is continuing to find its new normal since the stamp duty incentive was withdrawn at the end of March 2025.

“In addition businesses are coming to terms with the increases in National Living Wage and National Insurances.

“The market continues to show incredible resilience, however the slow down in house prices is starting to impact consumer confidence illustrated by the increased numbers of properties currently on the market for sale.

“Without a reduction in interest rates or Government intervention its difficult to see any material change for H2.

“The obvious and immediate route is to create a more palatable and permanent solution to stamp duty to help ignite the market.

“The Government will certainly need a more flamboyant market to provide confidence to developers to build towards the targeted 1.5 million homes.

“The affordability challenge to buyers remains and I would advocate for immediate remedies to help consumers buy with confidence.”

REAL WORLD EFFECTS

Nathan Emerson, CEO at Propertymark, says: “As the year advances, it remains upbeat to witness greater levels of market activity when compared to only 12 months earlier.

“Both affordability and consumer confidence continue to steadily improve, with more competitive mortgage products gradually finding their way to the market.

“However, higher Stamp Duty costs have impacted house prices in some cases, and this is creating additional regional disparities in terms of house price growth.

“The UK Government may need to reconsider the real world effects that increased stamp duty thresholds across England and Northern Ireland have caused, to better invigorate the market across the long-term.

“It remains vital the UK Government and devolved administrations meet their individual housing targets to keep pace with anticipated demand over the forthcoming years and to ensure there is a viable mix of affordable housing constantly flowing into the marketplace for those who aspire to buy.”

MORE ACTIVE MARKET

Matt Thompson, Head of Sales at Chestertons, says: “Compared to summer of last year, we have seen a more active property market which has been driven by an influx of vendors putting their home up for sale.

“This has given some house hunters a larger selection of properties to choose from which inevitably led to more contracts being exchanged.

“Some buyers, however, are still pausing their search in the hope that the Bank of England will announce another rate cut in August.”