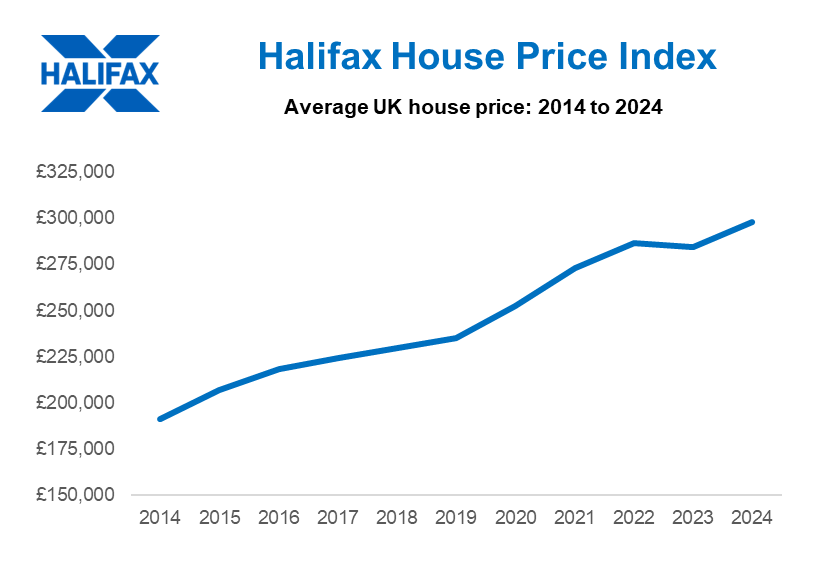

UK house prices are projected to rise by 3% in 2025, with a slight increase in transactions, according to Halifax’s latest forecast.

The UK housing market outperformed predictions in 2024, driven by lower mortgage rates and robust wage growth.

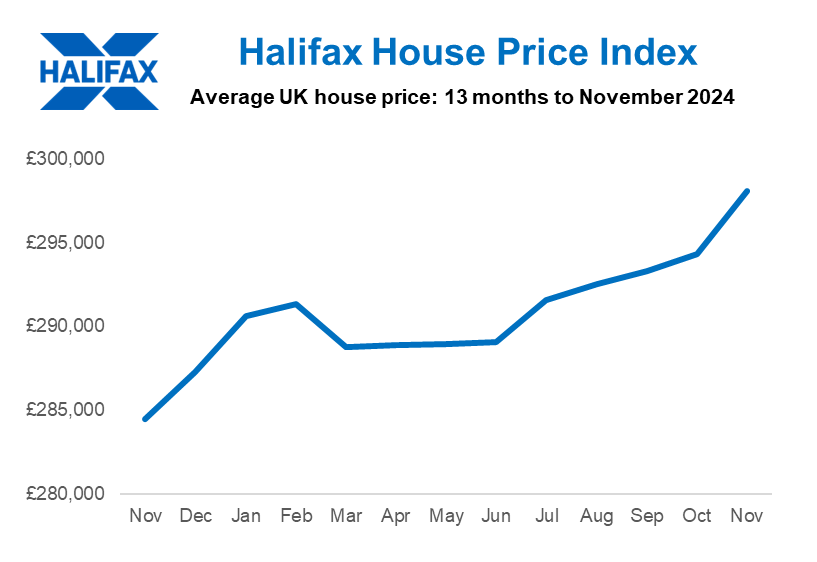

Halifax reports that property prices reached a record high of £298,083, reflecting a 4.8% annual growth, as transaction volumes returned to pre-pandemic levels.

But despite improved affordability, challenges persist for many buyers.

STANDOUT YEAR

Amanda Bryden, Head of Halifax Mortgages, says: “2024 was a standout year for the UK housing market.

“After a flat first half, most of the growth occurred in the second half, driven by two key factors: mortgage rates that fell significantly from 2022-2023 peaks and income growth catching up with inflation.

“Monthly mortgage costs as a percentage of earnings dropped from 33% to 29%, boosting buyer confidence and driving demand to its highest levels in over two years.”

UNEVEN SUPPLY

However, the uneven supply of homes continues to support prices. Higher mortgage rates deter some homeowners from selling, and new-build completions hit their lowest levels since 2018, excluding lockdown periods.

Looking to 2025, Halifax anticipates modest growth of up to 3% and a further small rise in transactions.

However, affordability challenges will persist as many homeowners refinance at higher rates. Gradual Bank Rate reductions may offer some relief, while strong employment conditions should underpin buyer demand.

Meanwhile, estate agency Chase Buchanan predicts an average rise in property prices of 3.4% across the UK, with London averaging 3% and the South West performing slightly stronger at 4%.

Looking ahead further, it forecasts the average pricing in London to increase by 13.9% by 2028 and 23.4% in the South West in the same period.

COMPETITIVE PRODUCTS

Toby Leek, NAEA Propertymark President, says: “Mortgage lenders have introduced more competitive mortgage products to the market compared to those seen last year, however with the slight dampening news of a rise in inflation, it is likely that mortgage offers will only continue improving once inflation tracks downward so that interest rates can be cut.

“With wages on a slight upward trajectory and affordability pressures easing for many, buyers and sellers will gain the extra confidence and financial boost needed to make their next home move a reality.

“Alongside this, home movers across England and Northern Ireland will be pushing their next home move in order to beat the commencement of rises in Stamp Duty from April 2025 so a flurry of market and mortgage activity is to be expected in the coming months.”