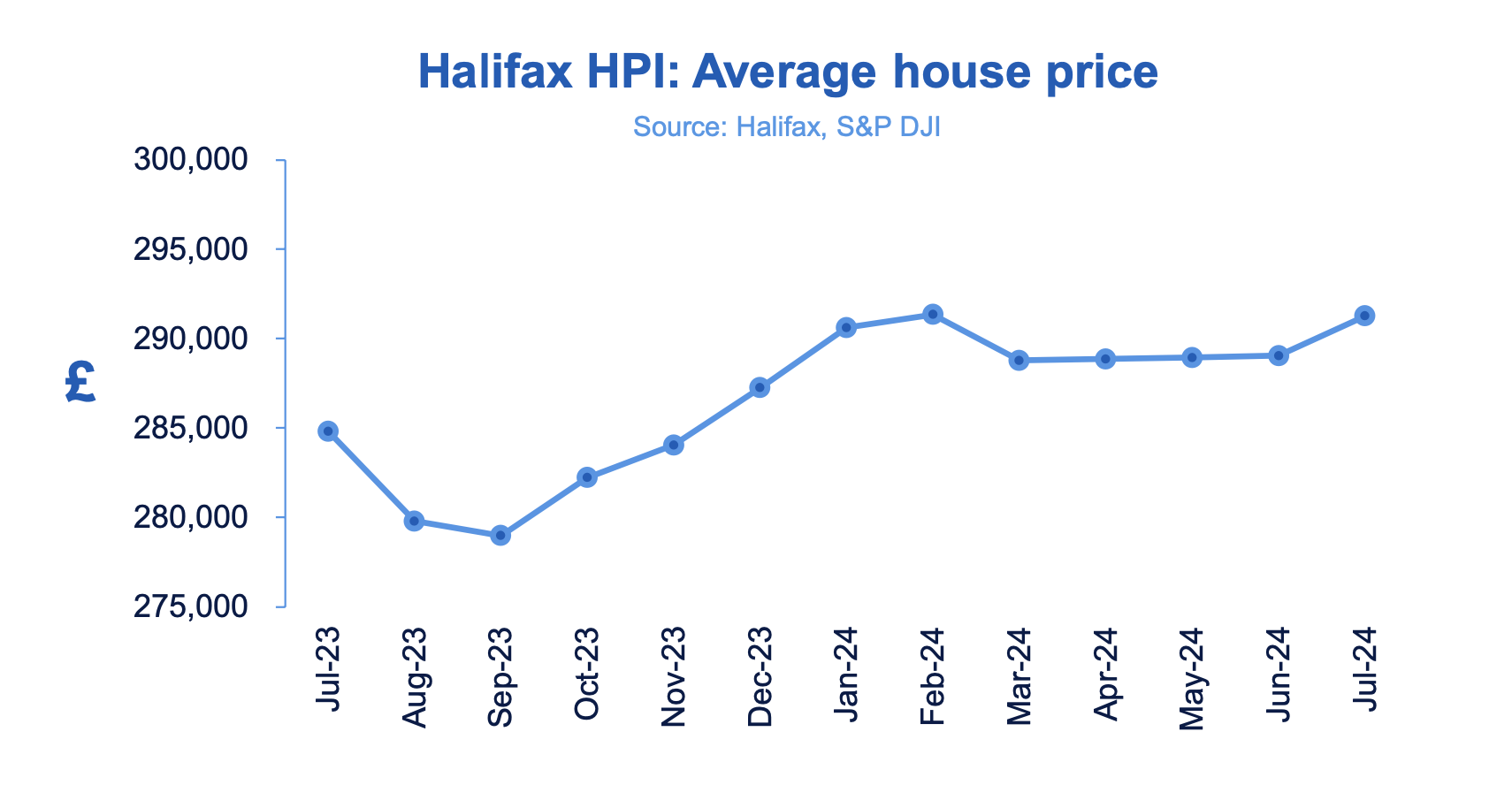

House prices in July increased by +0.8% in July after three relatively flat months and now with an annual growth rate of +2.3% – the highest since January 2024, the Halifax House Price Index reveals today.

According to the Index a typical property now costs £291,268 (compared to £289,042 in June) and Northern Ireland continues to record the strongest annual house price growth.

Halifax HPI

Halifax HPI

Amanda Bryden, HalifaxAmanda Bryden, Head of Mortgages, Halifax, says: “In July, UK house prices increased by +0.8% on a monthly basis, following three relatively flat months. The average house price in the UK is £291,268, up over £2,200 compared to the previous month.

Amanda Bryden, HalifaxAmanda Bryden, Head of Mortgages, Halifax, says: “In July, UK house prices increased by +0.8% on a monthly basis, following three relatively flat months. The average house price in the UK is £291,268, up over £2,200 compared to the previous month.

“Annual growth rose to +2.3%, the highest rate since the start of this year.

“Last week’s Bank of England’s Base Rate cut, which follows recent reductions in mortgage rates, is encouraging for those looking to remortgage, purchase a first home or move along the housing ladder. However, affordability constraints and the lack of available properties continue to pose challenges for prospective homeowners.

“Against the backdrop of lower mortgage rates and potential further Base Rate reductions, we anticipate house prices to continue a modest upward trend throughout the remainder of this year.”

STRONGEST GROWTH

Northern Ireland continues to record the strongest property price growth of any nation or region in the UK, rising by +5.8% on an annual basis in July, up from +4.1% the previous month and the highest increase since February 2023. The average price of a property in Northern Ireland is now £195,681.

House prices in the North West also recorded strong growth, up +4.1%, compared to the previous year, properties here now average £232,489. In Wales, house prices grew +3.4% to £221,102 – the highest price seen since October 2022.

Scotland saw a rise in house prices, a typical property now costs £205,264, +2.1% more than the year before.

The only region or nation to record a fall across the UK was Eastern England. Properties here now average £330,282, down -0.4% on an annual basis.

London continues to have the most expensive property prices in the UK, now averaging £536,052, up (+1.2%) compared to last year.

TWISTS AND TURNS

Iain Mckenzie, The Guild of Property ProfessionalsIain McKenzie, Chief Executive of The Guild of Property Professionals, says: “The property market has seen more twists and turns in the past year than a Simone Biles gymnastics routine, so it’s positive to see some consistent but modest growth.

Iain Mckenzie, The Guild of Property ProfessionalsIain McKenzie, Chief Executive of The Guild of Property Professionals, says: “The property market has seen more twists and turns in the past year than a Simone Biles gymnastics routine, so it’s positive to see some consistent but modest growth.

“The 0.8% monthly increase and 2.3% annual growth rate are encouraging signs, especially considering the economic challenges we’ve faced over the past year. With the average house price now at £291,268, we’re seeing a gradual but steady appreciation in property values.

“It’s particularly heartening to see strong performance in regions like Northern Ireland and the North West, which have recorded impressive annual growth rates of 5.8% and 4.1% respectively. This regional variation highlights the diverse nature of the UK property market and the opportunities available across different areas.

“The recent Bank of England base rate cut and reductions in mortgage rates are positive developments for the market. These factors should help improve affordability for many potential buyers, especially first-time buyers who have been struggling to get onto the property ladder. However, we must acknowledge that affordability constraints and limited housing stock continue to pose challenges.

“We’re optimistic about the market’s direction for the remainder of the year. The combination of lower mortgage rates, potential further base rate reductions, and steady price growth creates a favourable environment for both buyers and sellers.”

ROLLERCOASTER

Nicky Stevenson, Fine & CountryAnd Nicky Stevenson, Managing Director at national estate agent group Fine & Country, adds: “This year’s housing market has been a rollercoaster, but July saw house prices gain momentum.

Nicky Stevenson, Fine & CountryAnd Nicky Stevenson, Managing Director at national estate agent group Fine & Country, adds: “This year’s housing market has been a rollercoaster, but July saw house prices gain momentum.

“Affordability issues and high interest rates left many potential buyers on hold in recent months. However, economic indicators are broadly trending positive and consumer confidence is growing.

“The Bank of England’s recent rate cut is set to further energise the property market as we enter the second half of 2024.

“In response, lenders have ignited a rate war, slashing offers to stay competitive. This shift is a game-changer for prospective buyers. Lower rates translate to reduced monthly payments and increased purchasing power, potentially opening doors for those previously priced out.

“Nationwide has made headlines by reintroducing fixed-rate mortgages below the 4% mark, a move that’s sent ripples through the industry. They’ve slashed rates by up to 0.25% across their two, three, and five-year fixed rate products, setting a new benchmark for affordability.

“Not to be left behind, banking giants Barclays and TSB have swiftly followed suit, announcing their own rate cuts.”

GAME-CHANGING

And she says: “For those who’ve been hesitating to take the plunge into homeownership, this could be a game-changing moment. First-time buyers, in particular, should take note. This shifting landscape could make that first step onto the property ladder more achievable than it’s been in recent months.

“As we look ahead, some financial experts are hinting at the possibility of further rate cuts later in the year. While this paints an optimistic picture, it’s crucial to remember that everyone’s financial situation is unique.

“For now, though, it seems the property market is offering a window of opportunity.”