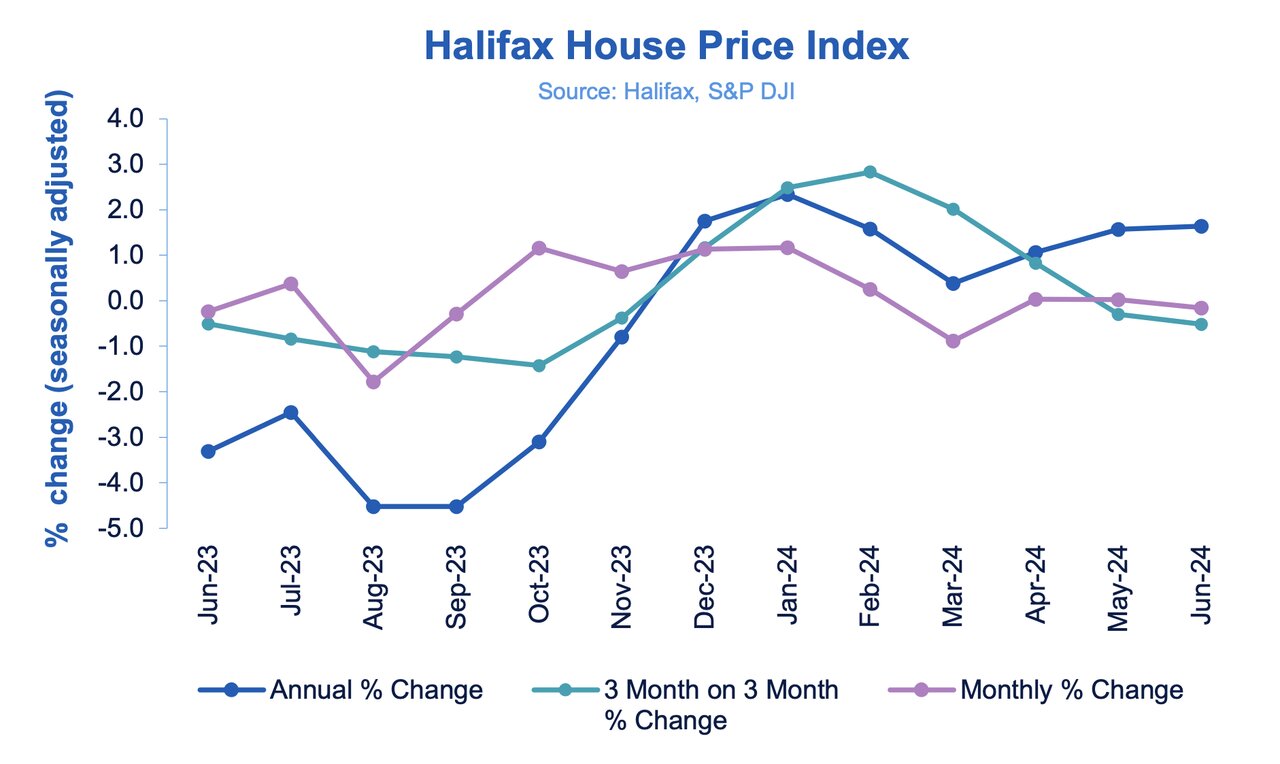

Average house prices remained largely flat in June, down by just -0.2% on a monthly basis, latest data from the Halifax House Price Index reveals.

The annual rate of house price growth was unchanged from last month at +1.6% with a typical UK home now costing £288,455 (compared to £288,931 in May).

Once again Northern Ireland recorded the strongest annual house price growth in the UK, rising by +4.0% on an annual basis in June, up from +3.3% the previous month.

Amanda Bryden, Head of Mortgages, Halifax, says: “UK house prices stayed relatively flat for the third successive month in June, with the slight fall equivalent to less than £500 in cash terms.

Amanda Bryden, Halifax“On an annual basis, house prices posted a seventh consecutive month of year-on-year growth, with the average UK property value now standing at £288,455.

Amanda Bryden, Halifax“On an annual basis, house prices posted a seventh consecutive month of year-on-year growth, with the average UK property value now standing at £288,455.

“This continued stability in house prices – rising by just +0.4% so far this year – reflects a market that remains subdued, though overall activity has been recovering.

“For now, it’s the shortage of available properties, rather than demand from buyers, that continues to underpin higher prices.

“Mortgage affordability is still the biggest challenge facing both homebuyers and those coming to the end of fixed-term deals. This issue is likely to be eased gradually, through a combination of lower interest rates, rising incomes, and more restrained growth in house prices.

“While in the short-term the housing market is delicately balanced and sensitive to the pace of change to Base Rate, based on our current expectations property prices are likely to rise modestly through the rest of this year and into 2025.”