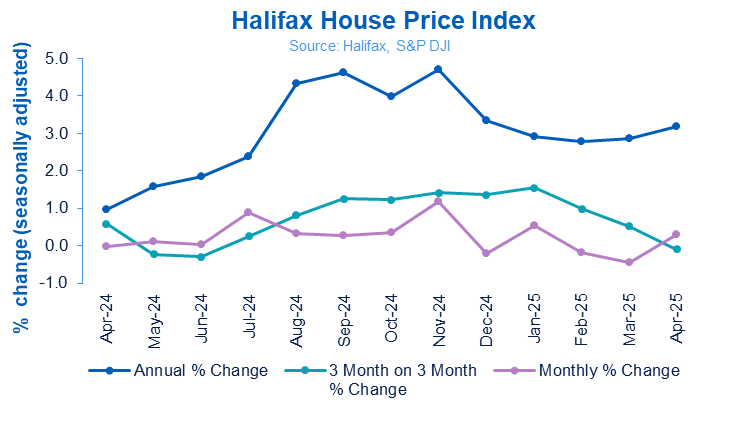

The UK housing market posted a modest gain in April, with house prices rising by 0.3% month-on-month, according to data released from Halifax yesterday.

This follows a 0.5% decline in March and brings the average UK house price to £297,781 – an increase of nearly £900. On an annual basis, prices are now 3.2% higher, up from 2.9% the previous month.

The figures reflect a market that, while no longer surging, remains notably stable. Over the past six months, the average property value has declined by just £48—an unusually narrow fluctuation by historic standards.

Amanda Bryden, Head of Mortgages at Halifax, reckons that while stamp duty changes earlier in the year spurred a short-term increase in transaction volumes, this did not translate into significant price volatility.

STRONG BUYER ACTIVITY

“The market has cooled slightly since this rush, [but] buyer activity remains strong in comparison to recent years,” she says.

Falling mortgage rates – most now below 4% – and real earnings growth have helped improve affordability, contributing to sustained demand despite wider economic headwinds.

“We anticipate a similar trend of modest price growth this year,” she says, adding that potential inflation pressures from rising household bills are likely to be offset by expected further base rate cuts.

REGIONAL DIFFERENCES

Growth remains uneven across the UK. Northern Ireland continues to lead the annual house price tables with an 8.1% year-on-year increase, pushing the average property price to £208,220. Wales followed at 4.7%, and Scotland at 4.6%, reflecting comparatively strong demand across the devolved nations.

In England, the North West showed the highest annual growth at 4.1%, with average prices at £240,975. London remains the UK’s most expensive market at £543,346 but saw a relatively subdued annual increase of 1.3%. The South West recorded the slowest annual growth, at just 0.9%.

INDUSTRY REACTION

Gareth Samples, CEO of The Property Franchise Group, comments: “The latest Halifax data, indicating a welcome uptick in house price growth, suggests the market is not just recalibrating after a period of intense activity, but also building positive momentum.

“A combination of factors, such as easing mortgage rates, rising stock levels, and the cooling of post-deadline buyer urgency, are creating a more balanced and now slightly strengthening environment for both buyers and sellers.

“Encouragingly, we’re still seeing strong underlying resilience in the market. Sales volumes remain robust, with a snapshot of the post-stamp-duty market suggesting movers are carrying on and have adjusted to the tax rise. The level of agreed sales falling through remains steady, with most buyers who missed the deadline still proceeding.

“Crucially, there are more sales being agreed than a year ago.”

“Crucially, there are more sales being agreed than a year ago, alongside an uptick in available homes, which is essential for long-term market health. This subtle strengthening in annual price growth a sign of the return to sustainable and confident market conditions.

“Looking ahead, we expect house pricing to stabilise, further supported by mortgage affordability gradually improving with falling rates and growing confidence around future base rate cuts.

“Time-to-sell metrics are also improving, with Rightmove data showing the average property took 64 days to sell in March, down significantly from January. With sales volumes on track for a potential 5% uplift in 2025, we remain optimistic about market performance through the summer and beyond.”

SHAKE IT OFF

Jason Tebb, President of OnTheMarket, says: “While the stamp duty concession is out of the way, the housing market continues to shake off external economic concerns and demonstrate remarkable resilience.

“Recent base rate cuts have significantly boosted confidence and activity.

“With the stamp duty savings now behind us, a further rate reduction from the Bank of England today would be particularly timely, providing much-needed stimulus for the market as the year progresses.

“With property prices remaining relatively steady, this suggests that affordability is having an impact on the amount buyers are willing and/or able to pay.”

MARKET BARING ITS TEETH

Jeremy Leaf, north London estate agent and a former RICS Residential Chairman, says: “The market is baring its teeth. Even when buyers could no longer take advantage of the stamp duty holiday we found the overwhelming majority continued with their moves.

“With plenty of choice of flats in particular, prices have inevitably softened but have held up much better for houses where longer-term need is more apparent.

“Activity has been supported by strong employment, steady inflation and the southerly direction of travel for mortgage rates, even if cuts are made later rather than sooner than anticipated.”

STANDING FIRM

Jean Jameson, Chief Sales Office for Foxtons, says: “The UK property market has stood firm so far this year, with property values up on both a monthly and annual basis in April, reversing the downward monthly trend observed in previous months.

“We’ve also seen an uplift in market activity on all fronts with respect to buyer enquiries, more sellers entering the market and more deals being negotiated.

“With another base rate reduction expected later today, the outlook for the year ahead is very positive. We’ve already seen many lenders reintroducing sub four percent mortgage products and, as greater mortgage affordability continues to fuel buyer market activity, the expectation is that house prices will climb further over the course of the year.”

SUSTAINABLE FOOTING

Iain Mckenzie, CEO of The Guild of Property Professionals, says: “The latest Halifax data, indicating a continued positive momentum in house price growth, points towards a market that is not only maintaining its strength but also developing a sustainable and balanced footing.

“While a period of recalibration was expected after the significant, stamp duty-driven surge in March, this underlying resilience is encouraging.

“What’s crucial to highlight are the underlying positive trends supporting this. We’re seeing mortgage rates continue their welcome descent, with sub-4% deals now reappearing, which is a clear boost for buyer affordability and confidence. Despite persistent higher-than-expected inflation, the International Monetary Fund’s more optimistic outlook on interest rate cuts further underpins this positive sentiment.

“Buyer demand remains robustly above last year’s levels.”

“While buyer demand has understandably settled from the pre-deadline frenzy, it remains robustly above last year’s levels. More importantly, stock levels are up significantly, offering buyers greater choice, and agreed sales are also higher year-on-year. This increased activity is also reflected in faster selling times, with properties now moving much quicker than at the start of the year.

“The engine of the market – transactions – remains strong. We anticipate this trend of steady, and perhaps even slightly firmer, price growth to continue, potentially settling in the 1.5-2.5% range annually. Critically, sales volumes are on track for a healthy 5% uplift this year.

“This isn’t a market grinding to a halt; it’s a market demonstrating sustained activity and finding a sensible equilibrium, which is good news for both serious buyers and sellers in the long run.”

BOUNCING BACK

Verona Frankish, Chief Executive of Yopa, says: “We saw the market momentarily pause for breath ahead of the recent stamp duty deadline which caused the monthly rate of house price growth to slow.

“However, it’s clear that now this deadline has passed, the market has immediately bounced back, as buyers and sellers push forward with their plans to move in 2025.

“This further boost to current market sentiment will only strengthen the performance of the property market and we expect that house prices will continue to climb over the remainder of the year.”

GROWING CONFIDENCE

Marc von Grundherr, Director of Benham and Reeves, says: “The housing market continues to demonstrate its resilience and not only have we seen prices start to climb on a monthly basis, but the annual rate of growth has also accelerated to its fastest pace seen so far this year.

“This has been driven by the return of the nation’s homebuyers who have grown in confidence as interest rates have reduced and this momentum is only likely to strengthen as the year progresses.”

PRICE SENSITIVE

Amy Reynolds, Head of Sales at Richmond estate agency Antony Roberts, says: “The end of the stamp duty concession removed some of the urgency from the market.

“Some buyers accelerated purchases to beat the deadline while others adopted a ‘wait and see’ approach, hoping that with inflation largely under control, the Bank of England might cut interest rates again. The possibility of lower mortgage rates is keeping many buyers cautious, especially first-time buyers and second steppers.

“Sellers’ price expectations, particularly in prime and popular areas, are still often unrealistic compared to the offers buyers are willing to make. While there are committed buyers out there, we are finding that they are highly price-sensitive and many are no longer prepared to ‘overpay’ in areas where stock is low.

“Stock levels have improved compared with the end of last year but choice remains limited – particularly for good-quality family homes and well-located flats with outside space. In many parts of London there is more available property than a year ago but it’s a steady trickle rather than a surge as vendors finally accept that the post-pandemic frenzy is over.”

SUSTAINED CONFIDENCE

Nathan Emerson, Chief Executive of Propertymark, says: “This is a sign of sustained confidence in the UK’s housing market following a recent Stamp Duty surge in homebuying, and it should give those sellers hoping to take advantage of the traditionally busier spring and summer months motivation to move up the housing ladder.

“There has been recent data showing confidence in the mortgage market is fragile, and other reports suggesting that mortgage rates are at their lowest level since 2022. Hopefully, the Bank of England can provide further clarity to aspiring homeowners when they meet later today, and if the conditions are right to reduce interest rates, then this should make mortgages more affordable.”