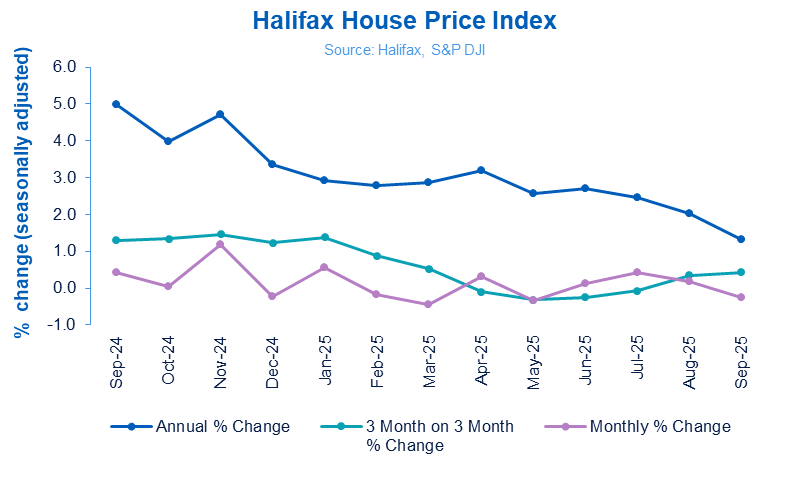

UK house prices slipped by 0.3% in September, equivalent to a £794 drop in the average property price, according to the latest Halifax House Price Index.

The decline follows a modest rise in August and leaves the typical UK home valued at £298,184.

On an annual basis, prices were up 1.3% – the slowest year-on-year rate of growth since April 2024 – while quarterly growth stood at 0.4%, suggesting that the housing market has entered a period of subdued but steady performance.

Amanda Bryden, Head of Mortgages at Halifax, says the figures point to a market that was “broadly stable” despite ongoing affordability pressures and wider economic uncertainty.

PRICES VARY WIDELY

She adds: “This slight monthly dip in house prices reflects a housing market that has remained broadly stable; prices are up +0.3% since the start of the year.

“It’s also important to remember that prices vary widely depending on characteristics like location and property type.

“As a result, many homes are available at a cost well below this headline figure.

“For example, for those looking to take their first step on the property ladder, the typical first-time buyer home costs £236,811, up +1.7% year on year, with pockets of even greater affordability to be found across different regions.

“While affordability remains a challenge, a relatively lower mortgage rate environment and steady wage growth have helped support buyer confidence.

“Although the broader economic outlook remains uncertain, with the affordability picture gradually improving, we continue to expect modest growth through the remainder of the year.”

NATIONS AND REGIONS

Northern Ireland once again lead the fastest annual property price inflation, with average property values up +6.5% over the past year (down from +7.9% last month). The typical home now costs £216,496, though prices remain well below the UK average.

Scotland recorded annual price growth of +4.5% in September to an average of £215,588. In Wales, property values rose a modest +1.9% year-on-year to £227,845.

In England, the North East, recorded the strongest annual growth with prices up +4.8% to £180,443, followed by the North West (+3.9).

The South West saw a second consecutive price fall by -0.2% over the past year (previously -0.7%) with prices now £303,067.

Meanwhile, prices are up only very slightly on the year in London (+0.6%) and the South East (+0.2%), with the capital the most expensive part of the UK, with an average property value of £543,497.

CALM AFTER THE STORM

The data follows a period of relative calm in the property market after two years of sharp volatility triggered by rising interest rates and a cost-of-living squeeze.

Analysts say that while mortgage costs remain higher than in the pre-pandemic era, recent reductions in fixed-rate deals have helped sustain buyer activity.

Average mortgage rates have drifted lower in recent weeks, with several major lenders cutting pricing in response to easing swap rates and expectations that the Bank of England could begin reducing the base rate next year.

Halifax’s figures come after similar findings from Nationwide, which also reported flat or modestly declining monthly prices alongside muted annual growth.

Together, the data points to a market adjusting to a “new normal” of slower growth and greater regional variation, with northern regions and Scotland continuing to outperform parts of the South East and London.

And economists say the latest data underlines a housing market that is neither overheating nor collapsing – a reflection of cautious optimism among both buyers and lenders. With inflation easing and wage growth remaining relatively strong, market watchers expect modest price rises to continue through the final quarter of 2025.

INDUSTRY REACTION

Tom Bill, Head of UK Residential Research at Knight Frank, says: “Sellers are getting the message that house prices are under pressure due to higher levels of supply and a creeping mood of caution as November’s Budget approaches.

“Stable mortgage rates have supported demand but we believe prices will continue to dip modestly before ending the year broadly flat.”

STEADY MOMENTUM

Guy Gittins, Chief Executive of Foxtons, says: “Market momentum remains steady and this underlying stability is encouraging buyers and sellers back into the fold, albeit with a degree of caution ahead of November’s budget.

“For those looking to sell, the key to success is a pragmatic approach to pricing in line with current market conditions, but those looking to complete their sale before Christmas need to be entering the market now with the right agent and an added sense of urgency.”

UNCERTAIN TIMES AHEAD

Marc von Grundherr, Director of Benham and Reeves, says: “The UK property market has weathered a year of market uncertainty and buyer indecision with house prices continuing to show positive annual growth, albeit we’ve seen a marginal month on month decline due to an air of hesitation ahead of next month’s Autumn Statement.

“Of course, the homebuying process itself remains one fraught with potential delays and pitfalls and so it’s somewhat commendable to see Labour finally pledge to fix it.

“However, the Government has long known the struggles facing both buyers and sellers and so their renewed claim to act feels more like political point-scoring than meaningful reform.

“In reality, these proposals are unlikely to materialise anytime soon, and the mere suggestion of change could actually cause the market to stall in the short term, as buyers hold out for greater certainty and protection that simply isn’t on the immediate horizon.”

SLOW BUT SUSTAINABLE

Verona Frankish, Chief Executive of Yopa, says: “It’s been very much a case of the tortoise not the hare when it comes to the performance of the UK property market this year and this has arguably been a far healthier market landscape for both buyers and sellers alike.

“Slow but sustainable rates of house price growth have ensured that sellers are motivated to move, whilst buyers aren’t being priced out by sizable shifts in property affordability.

“It will be interesting to see where we go from here given Labour’s latest pledge to overhaul the homebuying process and, as an industry, we’ve long called for reform around the speed and certainty of the property transaction timeline.

“If implemented properly, these changes could go a long way toward boosting confidence among buyers and sellers. The key now will be ensuring that the ambition translates into tangible progress on the ground, rather than getting lost in consultation and delay.”

RESILIENT MARKET

Jason Tebb, President of OnTheMarket, says: “Despite the average house price decreasing slightly in September, the market continues to demonstrate resilience, shaking off external economic concerns and holding up remarkably well even as speculation continues as to what the Autumn Budget might hold in store.

“The average price is only part of the picture as behind the headline figure are considerable regional variations and differences according to property type.

“Confidence among buyers and sellers has been boosted by base rate cuts over the past 13 months.

“Our own research shows that those focused on buying or selling remain optimistic about their own prospects, with the majority of buyers confident in their ability to raise the funds needed for their next purchase.

“As lenders boost borrowing ability by continuing to relax criteria, any further rate reductions from the Bank of England will help stimulate the market and encourage activity.”

CAUTION CREEPING IN

Iain McKenzie, Chief Executive of The Guild of Property Professionals, says: “This latest Halifax data underlines what we’ve been seeing on the ground, a housing market that’s stable, resilient, and adapting well to the current rate environment.

“A small monthly dip of just -0.3% doesn’t signal weakness; rather, it highlights a market finding its balance after a modest summer uptick.

“Mortgage rates have remained steady since the Bank of England paused rate hikes, and that consistency is helping buyers plan with greater confidence.

“Activity levels are holding firm, with approvals and transactions broadly in line with earlier in the year, clear evidence that demand is still there, even if buyers are a little more measured, particularly at the top end of the market.

“As we move toward the Autumn Budget, a note of caution is creeping in.”

“As we move toward the Autumn Budget, a note of caution is creeping in, especially for higher-value homes, where both demand and new listings have eased slightly. But across most price brackets, the fundamentals remain sound: employment is strong, borrowing costs are stable, and sellers who price sensibly continue to attract serious buyers.

“Overall, this is a market in equilibrium, steady rather than spectacular, and that stability is exactly what’s needed to give buyers and sellers confidence heading into the final months of the year.”

SOFTENING PRICES

Jeremy Leaf, north London estate agent and a former RICS residential chairman, says: “A fall in listings and buyer numbers is prompting a softening in prices.

“As Budget day draws closer, so speculation about property tax rises increases although in our offices it is not noticeably deterring our motivated buyers and sellers who form the overwhelming majority.

“Both buyers and sellers are negotiating hard and taking their time but few are giving up, especially on house transactions rather than still-overstocked flats.”

PRICE SENSITIVITIES CONTINUE

Amy Reynolds, Head of Sales at Richmond estate agency Antony Roberts, says: “Serious buyers are committing and keen to move before the end of the year, with the market surprisingly resilient.

“Well-priced property continues to sell, and the gap between serious buyers and sellers has narrowed. Competition is strong for the best homes, particularly in areas where stock levels are constrained.

“Buyers remain price-sensitive, with those motivated to move pressing ahead.”

AFFORDABILITY CONSTRAINTS

Nathan Emerson, Chief Executive of Propertymark, says: “A fall in house prices reflects the ongoing pressure on the housing market from higher borrowing costs, economic uncertainty, and affordability constraints.

“While price declines may raise concerns among homeowners and sellers, they also present opportunities, particularly for first-time buyers who have struggled with stretched affordability in recent years.

“A cooling in prices is not unexpected given the current economic backdrop and should be viewed in the context of the significant gains seen over the past few years.

“As we look ahead, the key to restoring momentum lies in improving market confidence, whether through interest rate stability, better mortgage accessibility, or policy measures that ease the transaction process.

“Regional variations remain important to monitor, as not all areas will experience price movements equally. Policymakers and industry stakeholders must continue to support a functioning, fluid housing market that works for both buyers and sellers.”

LIGHT AT THE END OF THE TUNNEL

Professor Joe Nellis is economic adviser at MHA, the accountancy and advisory firm, and a co-creator of the Halifax House Price Index, says: “Prices are now only 1.3% higher than a year ago, a clear slowdown from the 4.6% year-on-year growth in September 2024 and the faster growth rates seen in the second half of 2024 more generally.

“The actions of first-time buyers drive the market, and they remain under intense pressure from high deposits, elevated mortgage rates, and rising living costs, as well as having a particular interest in potential property tax reforms.

“Yet there could be some light at the end of the tunnel. There is speculation that the Treasury is considering spreading stamp duty land tax (SDLT) payments across several years to jump start the property market.

“Breaking SDLT into instalments would lower the cash needed at the point of purchase, unlocking capital and giving buyers more breathing room for deposits, moving costs, and renovations, while helping more first-time buyers onto the housing ladder.

“Further relief is emerging as fixed-rate mortgages dip below 4%, but borrowing hurdles remain high.

“Price growth is expected to pick up at a gentle pace through the remainder of 2025, with a slight rise in 2026 if inflation cools and mortgage costs fall further. But with affordability stretched and policy decisions looming, the next few months could set the tone for whether the market cools further or stabilises into a soft landing.

“Ahead of the Budget, slower house price growth is not what the Chancellor would have wanted, with the chance of reduced stamp duty receipts narrowing her room to manoeuvre on spending pledges. We wait to see if her decisions on 26th November will do anything to kick the market into gear.”