UK house prices are on track to be 1.5% higher by the end of 2024 as incomes growth begins to ease the impact of higher mortgage rates, Zoopla’s latest House Price Index is forecasting.

The portal says that homebuyers are largely shrugging off the election with a fifth (19%) more homes for sale than a year ago, new sales agreed 8% higher and demand up 6%.

And in signs of a Summer slowdown sales agreed are down slightly month on month across all regions, led by the North East (-6%) and West Midlands (-5%).

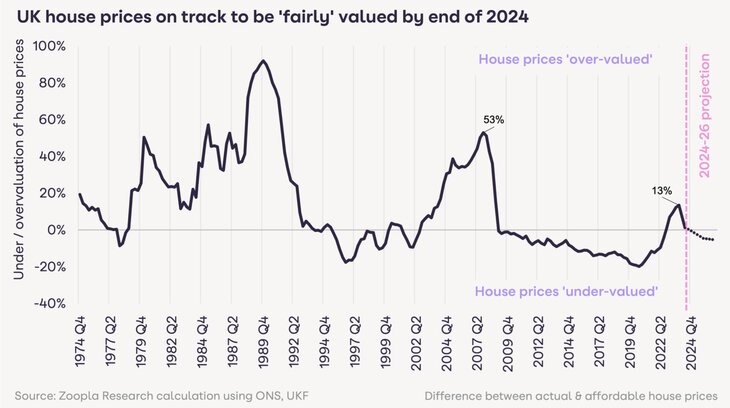

In the run up to the global financial crisis in 2007 house prices were more than 50% over-valued and even more over-priced in the late 1980s housing boom which led to double digit price falls.

But Zoopla’s latest analysis reveals UK house prices are estimated to be 8% over-valued but by the end of the year this will disappear assuming that house prices rise 1.5% and mortgage rates remain at 4.5%.

SUMMER SLOWDOWN

Richard Donnell, ZooplaRichard Donnell, Executive Director at Zoopla, says: “The housing market continues to adjust to higher borrowing costs through modest house price falls and rising incomes.

Richard Donnell, ZooplaRichard Donnell, Executive Director at Zoopla, says: “The housing market continues to adjust to higher borrowing costs through modest house price falls and rising incomes.

“The general election campaign has had a limited impact on market activity although the seasonal summer slowdown is arriving.”

He adds: “Sales agreed continued to increase and more homes for sale means more buyers looking to move in the second half of the year.

“The timing of the first cut in the base rate is a key moment and will give a boost to both market sentiment and sales activity. Overall we expect house prices to be 1.5% higher over 2024”

Guy Gittens, FoxtonsGuy Gittins, Foxtons Chief Executive, says: “With forecast house price rises now roughly in line with current inflation rates, it’s still very clear that property ownership is high on the agenda for hundreds of thousands of people across the UK.

Guy Gittens, FoxtonsGuy Gittins, Foxtons Chief Executive, says: “With forecast house price rises now roughly in line with current inflation rates, it’s still very clear that property ownership is high on the agenda for hundreds of thousands of people across the UK.

“In London, the market is considerably more active today than last year and crucially, aspiring property owners and sellers are undeterred by the looming election.

Nathan Emerson, Propertymark“Historically, when we see this as a trend, it continues to deliver a strong market post-election. With people’s confidence high after the summer, and an expected interest rate cut, the market could be very busy through to the end of the year.”

Nathan Emerson, Propertymark“Historically, when we see this as a trend, it continues to deliver a strong market post-election. With people’s confidence high after the summer, and an expected interest rate cut, the market could be very busy through to the end of the year.”

Nathan Emerson, Chief Executive of Propertymark, adds: “It’s been a positive year so far for the housing market, and it’s extremely upbeat to see confidence returning, despite some of the challenges people have faced such as high inflation and interest rates.

“With the general election now less than a week away, we are keen to see any incoming government lay down their full plans to further support current homeowners on aspects such as energy efficiency, but also to fully get behind key groups like first-time buyers as they set out on their property journey.”

Matt Thompson, ChestertonsMatt Thompson, head of sales at Chestertons, says: “We are now in the last days of the typically busy spring market and are seeing a bounce in buyer activity. As the date for the General Election was announced, house hunters who have been on the fence due to political uncertainty have become more confident about going ahead with their purchase.

Matt Thompson, ChestertonsMatt Thompson, head of sales at Chestertons, says: “We are now in the last days of the typically busy spring market and are seeing a bounce in buyer activity. As the date for the General Election was announced, house hunters who have been on the fence due to political uncertainty have become more confident about going ahead with their purchase.

Myles Moloney, Chase Buchanan“As a result, we expect June to conclude with a heightened level of buyer interest.”

Myles Moloney, Chase Buchanan“As a result, we expect June to conclude with a heightened level of buyer interest.”

And Myles Moloney, area sales manager at Chase Buchanan, adds: “June’s property market to date has remained positive and house hunters with larger equity and buying power have pushed on to agree a sale as they feel the result of the election is forgone.

“Buyers who are only just starting their property search, however, have been slightly more cautious to observe how the manifestos could benefit them during their property buying journey – particularly first-time buyers.”