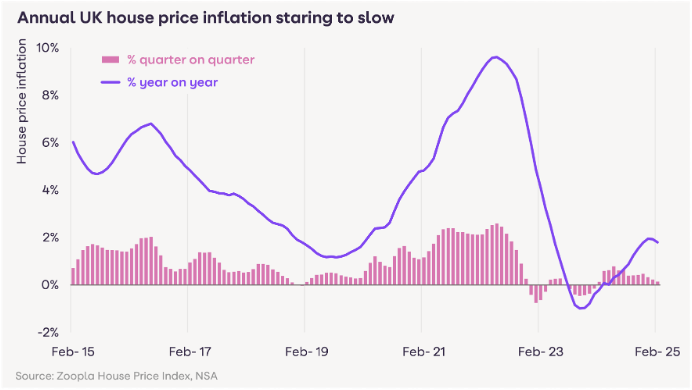

House price growth is slowing after a sustained recovery over the last 12 months, Zoopla’s latest House Price Index reveals.

The annual rate of UK house price growth dipped to 1.8% in February, down from 1.9% in January and is set to slow further in the coming months.

The average price of a UK home is currently £267,500, £4,750 higher than a year ago.

House price growth is slowing as the growth in the number of homes for sale outpaces the increase in the number of sales being agreed.

SALES AGREED HIGHER

There are 11% more homes for sale compared to this time last year, while sales agreed are 5% higher, strengthening the buyers’ market. The average estate agent has 33 homes for sale compared to 29 last year.

The number of homes for sale is set to rise even further as the market enters the spring selling period. The months of March, April and May account for almost 30% of homes listed for sale each year.

Static mortgage rates, averaging 4.4% for a 5-year fixed rate, compared to 4% in late 2024 have also reduced buying power in recent months, while a return to higher rates of stamp duty from April means higher buying costs.

Eight out of 10 (80%) of home owner buyers and four out of 10 (40%) of first-time buyers will pay more stamp duty land tax to move home from April which they will want to reflect in the price they pay.

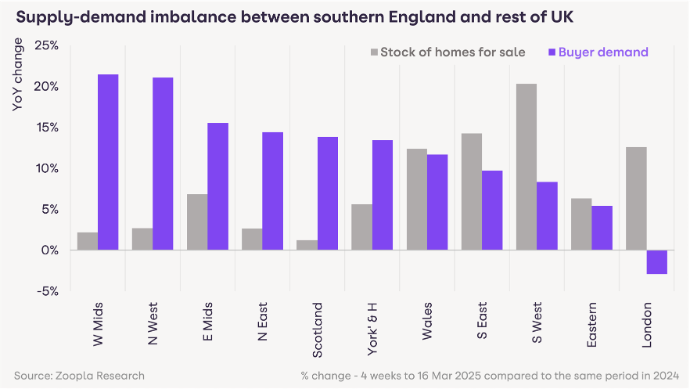

NORTH SOUTH DIVIDE

The closely watched Zoopla report reveals different trends in supply and demand between southern England and the rest of the country.

Buyer demand in southern England is higher than a year ago, however is failing to keep pace with the increase in homes for sale.

This explains why house price growth is low across southern England, running at +1% or lower across London, the South East, South West and Eastern regions. At a local level, house prices are falling in the Dartford (-0.8%), Ipswich (-0.2%) and NW London (-0.1%) postal areas.

DOUBLE COUNCIL TAX

From 1st April, an estimated 150 councils across the UK are set to double council tax on second homes, further boosting supply in areas with a greater share of second homes, such as the South West of England. At a localised level, prices are falling in Truro (-0.8%) and Torquay (-0.7%) in the South West, both second-home hotspots.

Lower house prices in regions outside southern England mean better affordability for home buyers and greater potential for house prices to increase at a faster rate. In northern England, the Midlands and Scotland, buyer demand is 10% higher than a year ago, while the supply of homes for sale has grown more slowly. This is supporting above-average house price growth which is running three per cent higher in the North West and 2.5% higher in Scotland over the last year.

At a localised level, house prices are rising fastest in Motherwell (4.3%) and Kirkcaldy (3.8%) postal areas in Scotland. In Northern England prices are rising over twice as fast as the national average in Wigan (3.8%), Blackburn (3.7%), Lancaster (3.6%) and Bradford (3.6%) postal areas. In all of these areas average house prices are between £130,000 and £220,000 versus a national average of £267,500.

STAMP DUTY HANGOVER

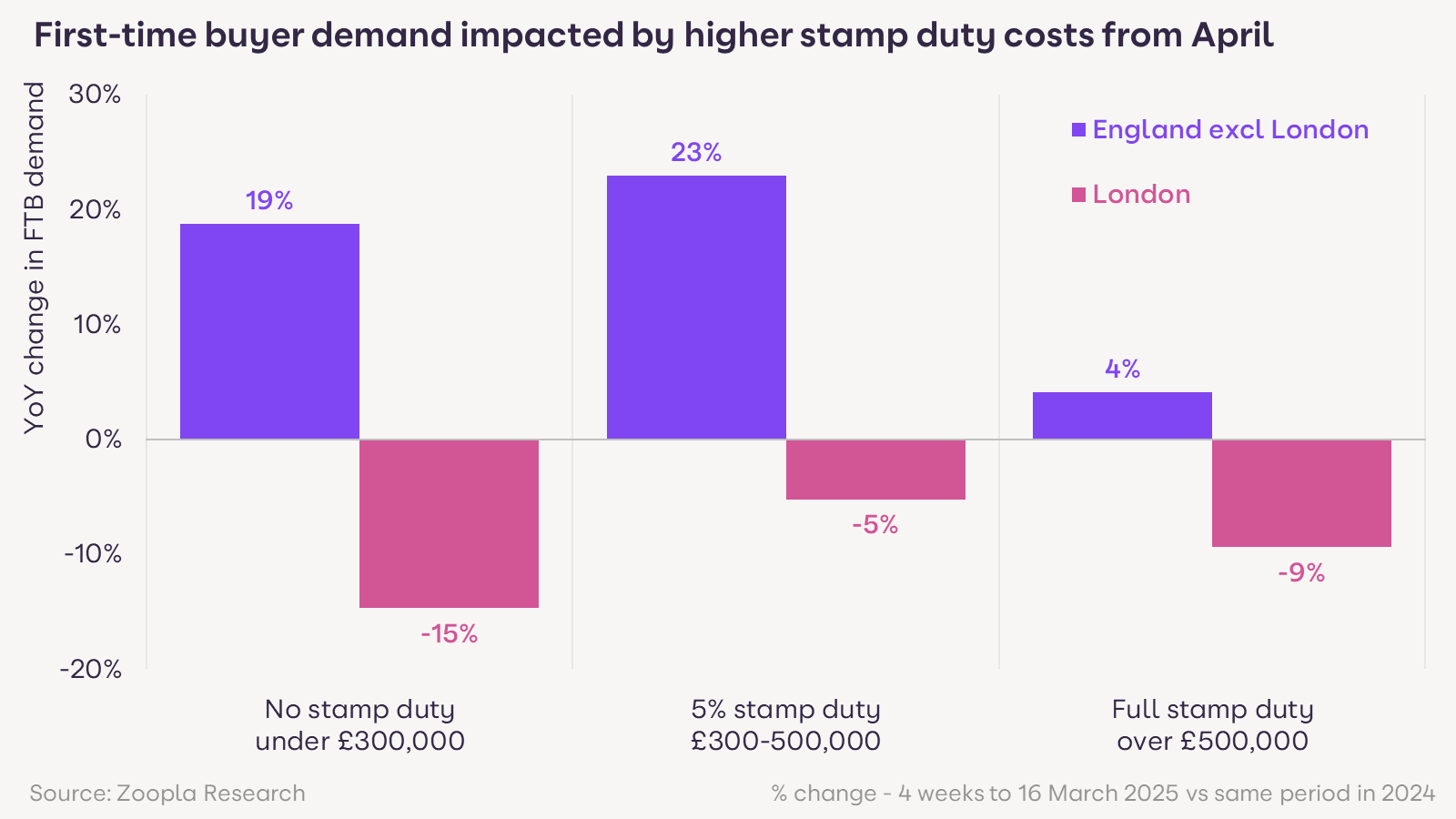

London is the only area of the country where buyer demand is lower (-3%) than a year ago. Many first-time buyers brought forward decisions to buy homes late last year to avoid paying higher stamp duty from 1 April 2025, creating a lull in first-time buyer demand as the stamp duty deadline approaches.

Eight in 10 first-time buyers in London will pay stamp duty from April 2025, compared to less than half under the current thresholds. First-time buyer demand is down across all price bands in London and this has contributed to the decline in buyer demand across the capital.

First-time buyer demand is higher across the rest of England where the majority of first-time buyers (six in 10) will continue to pay no stamp duty on purchases below £300,000 from April.

First-time buyer demand is noticeably higher than a year ago in the South East and the Midlands as first-time buyer demand is displaced from London into markets with better value for money.

GOWTH WILL SLOW FURTHER

Richard Donnell, Executive Director at Zoopla, says: “We expect the growth in sales agreed to continue rising at a steady pace over 2025 as more sellers, most of whom are also buyers, enter the market in the coming months.

“House price growth is set to moderate further as supply grows and the extra costs of stamp duty in England feed through into house prices.

“A slowing in house price growth is not a major concern although the market needs some growth in prices to encourage sellers to come to market and buyers to make realistic offers on homes for sale.

“There is plenty of demand for homes but also lots of choice. Households looking to sell their home in 2025 need to be careful when setting their asking prices if they are to attract sufficient demand to agree a sale. It’s important to seek the advice of local estate agents to inform the most suitable pricing strategy for every home.”

ACT FAST

Matt Thompson, head of sales at Chestertons, says: “Despite the recent rush of first-time buyers entering the market to beat the stamp duty deadline having slowed down, sellers anticipate a busy spring market.

“We have seen an increasing number of homeowners listing their property for sale in March which is currently creating a greater choice for house hunters.

“Still, with London having one of the most competitive property markets in the world, buyers are required to act fast and start their search as early as possible.”

MISSING URGENCY

Toby Leek, President or NAEA Propertymark and practicing estate agent, adds: “It’s inevitable that the changes in Stamp Duty thresholds were going to push many buyers to enter the market, in some cases, quicker than they potentially would have liked.

“By doing this and by acting quickly on their next home, lots of people may have saved thousands in the process.

“However, we’re now likely to witness the return to normality on the tail end of this spike as the sense of urgency has gone for a lot of buyers.

“Moving forward, we are now possibly going to see a further tapered slowing in house price growth, especially in areas like London, as a new middle ground to entice buyers starts to emerge.”