The number of transactions is forecast to reach 1.18m at the end of the year, TwentyEA has revealed.

Data compiled by the analytics firm showed the volume of sales agreed has reached 791,000 so far this year (Jan – July), 6.8% higher than in 2024 and the highest level seen since the exceptionally busy year of 2022.

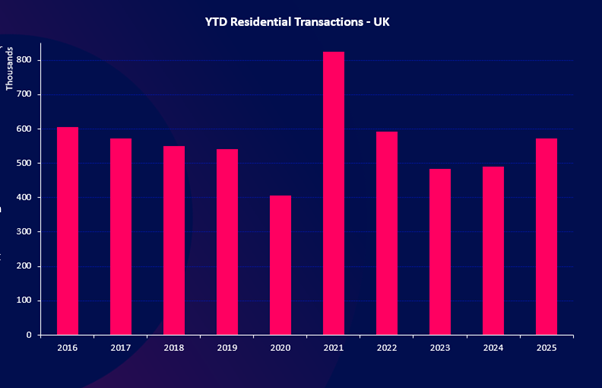

Meanwhile, HMRC data shows that transactions reached 573,000 in the first half of the year (January to June), up 17.1% compared to 2024 and 5.8% higher than pre-pandemic levels in 2019.

Although April and May 2025 saw negative growth due to a stamp duty change ‘hangover’, the market rebounded in June with 4.6% year-on-year growth.

OVER A MILLION MORE TRANSACTIONS

Based on these numbers, the analytics firm now forecasts there will be 1.18m transactions for 2025 – 7% higher than the 1,102,400 purchases recorded in 2024.

Demand in 2025 has grown across all UK regions except Northern Ireland, with the strongest increases seen in the North West (10.9%) and Wales (9.9%).

Overall, growth is more pronounced in the Midlands and the North compared to London and the South.

This upward trend spans all price bands, with the highest growth in the £350k–£1m range (9.5%), followed by the £200k–£350k band (8.8%).

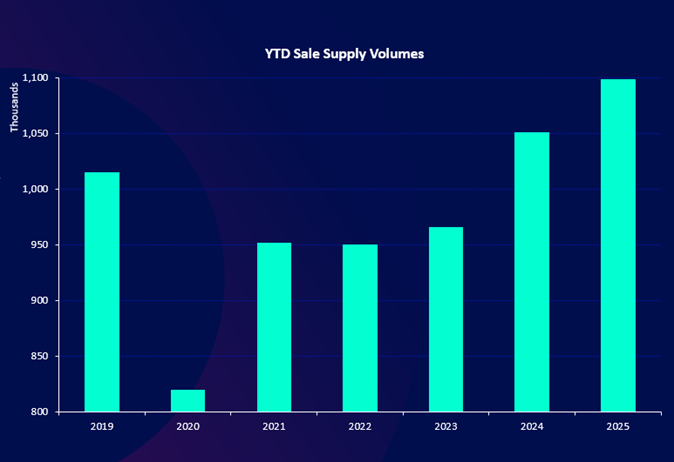

In terms of supply, year on year growth has continued across all price bands, with the strongest growth at 5.8% across £350k to £1m properties, closely followed by a 5.5% growth in the price band of £200k-£350k.

Outer London is leading the way with 8.0% YoY growth, while outside of London, supply has increased most in the Midlands, the East and the North East.

SUSTAINED GROWTH

Katy Billany (main picture, inset), Executive Director of TwentyEA, says: “Despite the changes to stamp duty bringing a noticeable ‘hangover’ to the market throughout April and May, it bounced back with a spring in its step in June.

“Momentum has been further boosted by the most recent interest rate cut last Thursday to 4% and will possibly fall further to 3.75% by the end of the year, injecting a renewed confidence into both buyers and sellers.”

BOUYANT MARKET

And she adds: “When compared to 2024, 2023, and pre-pandemic 2019, demand volumes have been consistently higher in every single month of 2025 so far.

“Given this sustained growth, we’re confident 2025 will remain buoyant, with a healthy pipeline of deals for estate agents. We forecast transactions will be in-line with the pre-pandemic year of 2019 to reach 1.18m by the end of 2025 – 7% higher than in 2024 which is exceptional news for estate agents.”