The first three months of the year don’t provide many clues about what will happen during the rest of 2025 in London’s prime residential property market.

It was a period marked by uncertainty and volatility but some of that will begin to lift.

A stamp duty deadline at the end of March artificially inflated demand and meant the number of exchanges that month was 17% higher than last year, Knight Frank data shows. The figure was also 7% higher than the five-year average (excluding 2020).

The maximum SDLT saving was £2,500 or £11,250 for first-time-buyers transacting before April, which boosted activity to a greater extent in lower price brackets. Exchanges above £2 million were 6% down in the first quarter, for reasons that include the proportionately smaller saving.

TRANSACTIONS LULL

What will follow is an inevitable lull in transactions as buyers come back into the market now the playing field has been re-levelled.

They will have plenty to choose from. The number of new prospective buyers in London was 5% below the five-year average in Q1 while the number of new sales instructions was 28% higher.

The imbalance points to downwards pressure on prices and the continuation of a buyers’ market.

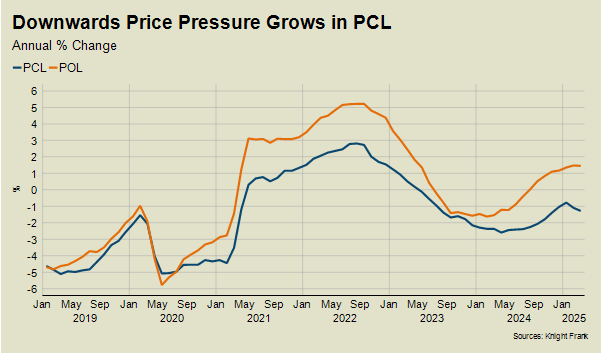

DOWNWARDS PRICE PRESSURE IN PCL

Indeed, average prices in prime central London fell 0.7% in the three months to March, which was the steepest quarterly decline since January 2024. The annual decline widened to 1.3% in March from 0.8% in January.

Prices were firmer in prime outer London, a market supported by equity-rich, needs-based buyers. The annual price change on POL was 1.5% for the second consecutive month in March.

We expect transaction levels to pick up towards the summer in both markets as the impact of the SDLT deadline fades.

The last 12 months have been dominated by prolonged periods of speculation, starting last May when the UK general election was called. After the election, buyers and sellers faced the longest wait for a Budget in more than 50 years.

TARRIFF VOLATILITY

Jitters on financial markets then heightened ahead of Donald Trump’s inauguration in January, which pushed up borrowing costs.

Markets will now be digesting the impact of the reciprocal tariffs Trump announced last week, with the UK facing a rate of 10%.

“The Office for Budget Responsibility said a 20% rate would wipe out the Chancellor’s financial headroom by the end of the Parliament.”

Any narrowing of the government’s headroom puts upwards pressure on borrowing costs and mortgage rates, which would keep housing demand in check.

However, UK bond yields and swap rates moved lower following the tariff announcement in volatile trading last week. The 10% figure would be painful for the UK economy, but it was half the rate feared. The UK government will be hoping that a trade deal with the US can be reached at some stage to remove the need for tariffs altogether.

The US dollar is particularly exposed to tariff volatility and initially traded lower last week against the pound before recovering.

GOOD NEWS FOR MORTGAGES, FOR NOW

Stock markets slumped and expectations around rates turned more dovish as markets focussed their attention on the economic damage tariffs could do rather than the inflationary risk of higher prices. Investors are betting central banks may have to cut more aggressively but that could change in coming months if inflation creeps up.

Either way, markets were pricing in almost three rate cuts this year by the Bank of England late last week, which was up from two on Monday.

Does that mean we will see headlines about Donald Trump being good news for the UK mortgage market? Whatever happens next, it’s important to remember that the tariff announcement was the start of a period of volatility not a one-time event.

Despite the instability on financial markets, buyers and sellers increasingly know where they stand from a tax perspective.

The introduction of the Finance Bill will see new rules for wealthy foreign investors come into effect this quarter. A new residence-based scheme replaces the centuries-old non dom regime, which has also put downwards pressure on prices in PCL in recent months.

The government has so far ignored the concerns of lobby groups that the UK will look less competitive on the international stage for foreign investors under the new rules. The timing of its new scheme does feel particularly unfortunate given the US tariff announcements last week.

However, a new tax landscape is taking shape in the UK, which means buyers and sellers will increasingly be able to plan.

Tom Bill is Head of UK Residential Research at Knight Frank