The prime Country market has gained some momentum over the last six months, driven more by an absence of bad news than the presence of good.

Activity has been building since April, when confidence was dented by a stamp duty increase and tariff-related turmoil on financial markets.

Despite media speculation this summer that property taxes may rise in November’s Budget, downwards pressure on prices and stable mortgage rates have supported demand, particularly among needs-driven buyers.

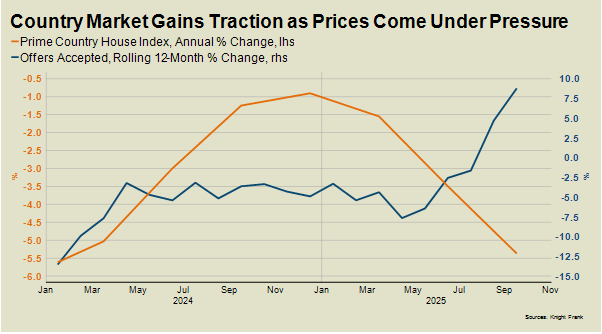

The number of offers accepted in the Country, which covers a range of urban and rural markets above £750,000 outside London, was 9% higher in the year to September than the previous 12 months.

COMPETITIVE PRICING

“Vendors who want to move have figured out the importance of competitive pricing, while mortgage rates are at reasonably sensible levels,” said James Cleland, Head of Country Sales at Knight Frank.

“The combination of those two things means it’s a good time to buy.”

The below chart shows how traction has increased as prices have fallen.

RESILIENCE OF NEEDS-DRIVEN BUYERS

However, after six months of relative calm, hesitation is returning as the Budget on 26 November approaches.

This is particularly true in higher price brackets, where demand is more discretionary and the tax speculation has been more intense.

Prices below £1 million fell 4.7% in the year to September, compared with a decline of 6.7% above £5 million, which reflects the mood of apprehension in higher price brackets.

Underlining the resilience of needs-driven and more urban markets, flat prices fell 4.5% in the 12 months to September, which compared to a decline of 6.7% for manor houses and farmhouses.

Overall, prices fell by 5.4% due to higher levels of supply and faltering buyer confidence. The decline widened from -3.5% in June, which mirrors a wider trend. Both Halifax and RICS pointed to downwards pressure on house prices last week.

Potentially adding to this pressure, some sellers have accelerated plans following Budget-related speculation that capital gains tax will be levied on main residences above £1.5 million. The general mood among sellers though, especially in higher price brackets, is one of trepidation.

SUPPLY STAYS HIGH

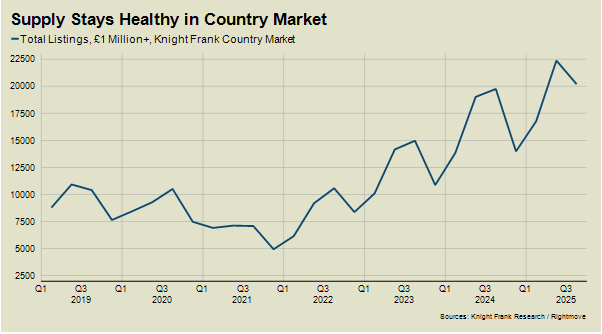

Supply has risen for a variety of reasons that include a stock overhang from April’s stamp duty cliff edge, decisions delayed from last year due to the general election and a degree of financial distress as mortgage rates reset from historic lows.

The total number of £1 million-plus properties on the market in Q3 was the second-highest figure in 10 years according to Rightmove, as the below chart shows. The highest number was in Q2 this year.

Meanwhile, demand has been supported by a stable mortgage market and the continued availability of sub-4% rates.

As things stand this side of the Budget, financial markets are not expecting further cuts by the Bank of England this year but are broadly pricing in two reductions in 2026.

Finally, a word on Tory plans announced last week to scrap stamp duty.

Apart from the fact it could freeze the housing market ahead of a general election, particularly if the Reform Party follows suit in its manifesto, its removal would boost housing market transactions, social mobility and the wider economy.

However, with the next scheduled general election some way off, the most significant thing about last week’s announcement is that it appears to have shifted the political debate in the direction of scrapping one of the UK’s most unpopular taxes.