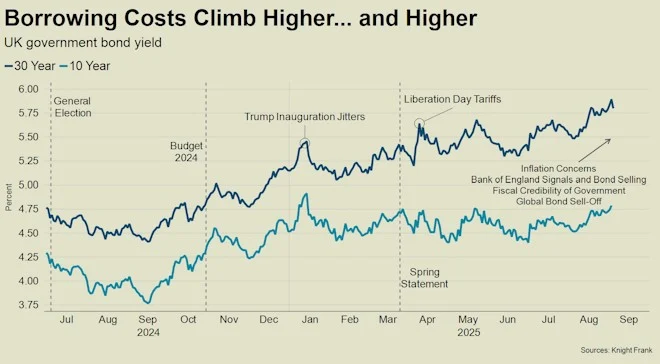

It’s never a good sign when the bond market is in the news. While the recent media coverage hasn’t been wall-to-wall, the appearance of several front-page stories highlights how fault lines could be forming under the government as we head into the autumn.

Not only could that have a negative impact on mortgage rates, but the wider political fallout could be significant.

In simple terms, gilt yields, or the rate at which the government borrows money, have risen because there are concerns ahead of the Budget on 26 November.

Bond investors, who lend the money, were already worried about Rachel Reeves’ lack of financial headroom. The Office for Budget Responsibility estimated her buffer was £9.9 billion in March this year, which is a third of its pre-Covid level.

MAINTAIN HEADROOM

Just to maintain that level of headroom, she will need to find £50 billion, according to one of the more pessimistic estimates by the National Institute of Social and Economic Research.

The true figure moves around as bonds are bought and sold. It’s like having a credit card where the repayment rate is set by financial markets, and it changes by the second.

THE BOND MARKET ALWAYS WINS

If the bond market believes the books won’t be balanced, they price in extra risk, borrowing costs rise excessively and the government becomes financially hamstrung, as happened after the mini-Budget in October 2022.

Officials inside 11 Downing Street must have been nervously glued to their Bloomberg terminals last week as the yield on the 30-year government bond climbed to its highest level since 1998 – see chart.

“The bond market will always win,” said Pepperstone research strategist Michael Brown on Knight Frank’s new Housing Unpacked podcast.

“Fundamentally, if the market is not confident in the government’s stewardship of the economy, then yields are only going to go one way.”

The problem Rachel Reeves faces is that if she raises income tax, VAT or National Insurance to help plug the hole, it will break a manifesto promise, despite the fact the “big three” account for two-thirds of the government’s annual tax revenue.

The other option of forcing through large-scale spending cuts hasn’t worked so far, as we saw with the recent backbench rebellion over welfare payments.

“It is only going to end one way, which is with the bond market getting the upper hand and ultimately forcing through the spending cuts that are required in order to restore things to a more even keel,” said Michael on the podcast. He also anticipates tax rises but warned they could be counter-productive.

A FIVE-POINT PLAN

However, in the spirit of constructiveness, he outlined a five-point plan to dig the government out of its current hole, although it involves some tough choices. You can read the plan HERE.

We also discuss the recent property tax speculation and which of the floated ideas feel more credible. I will be having a similar conversation with a former Downing Street advisor on the next podcast.

Meanwhile, the understandable mood of hesitancy, particularly in prime markets, continues to put downwards pressure on prices.

Average prices in prime central London (PCL) fell 3.2% in the year to August, the widest decline since March 2021.

In prime outer London (POL), the picture was largely flat in a market that is driven to a greater extent by buyers who need to move for reasons that include schooling and jobs. Average prices rose 0.5% in the year to August, although there was a quarterly fall of 0.4% for the third consecutive month.

Meanwhile, transactions across PCL and POL were 6% down in the year to August versus the previous 12-month period.

Any behavioural changes triggered by the Budget speculation will only increase over the next few months. It will be a mix of people hesitating and speeding up their plans, and the approach will depend on whether they are focussed on possible changes to stamp duty or capital gains tax. That said, the former feels too difficult to attempt and the latter feels politically toxic

The only certainty between now and Christmas, and it’s a lesson Donald Trump learned shortly after his tariff announcements in April, is that the bond market will emerge victorious.