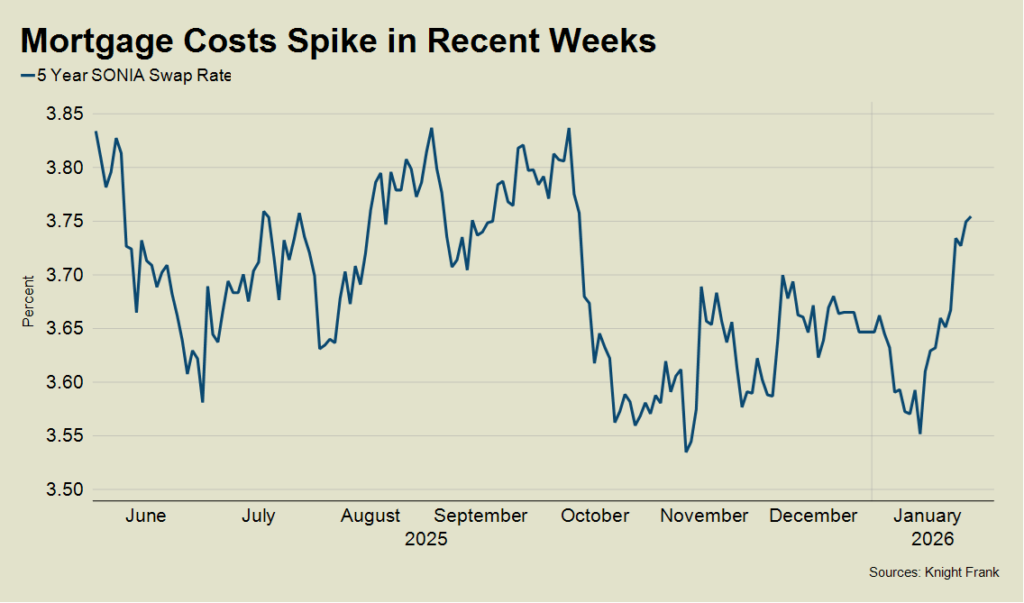

Borrowing costs have risen in recent weeks for reasons that include stronger-than-expected UK economic data and tempering the outlook for cheaper mortgages.

However, an uncertain domestic and global outlook means downwards pressure could return.

One of the key reasons we expect upwards pressure on house prices this year is the prospect of lower mortgage rates.

Despite lacklustre economic growth, rising unemployment and the likelihood of an upheaval on Downing Street, we believe UK prices will rise by 3% in 2026.

RATE CUT CHANCES DROPPING

But an underlying assumption of two Bank Rate cuts this year has become less certain in recent weeks. While markets were fully pricing in two quarter-point cuts on 14 January, they were only assuming a 45% chance of the same happening a fortnight later.

The 5-year swap rate, which is based on market expectations and used to price fixed-rate mortgages of the same length, rose to 3.75% from 3.55% over the same period.

It means borrowers can expect fewer headlines about mortgage lenders dropping their rates. The chart below is also something for borrowers to consider if they are sitting on a relatively more favourable mortgage offer that predates the latest spike.

There are various reasons for the mildly alarming but reversible jump in borrowing costs, as discussed on the latest episode of the Knight Frank podcast Housing Unpacked with Pepperstone research analyst Michael Brown.

TREATED WITH CAUTION

Stronger-than-expected UK economic data is one, but recent figures should be treated with caution, said Brown.

Retail sales grew 0.4% in December, which pointed to consumer resilience, and the latest Purchasing Managers Index (PMI) score showed the fastest pace of economic expansion in nearly two years. Both were signals the Bank of England was under less pressure to cut.

“A lot of company earnings have been talking about the uncertain environment and headwinds they’re facing,” said Brown on the podcast.

“So, I’m not saying I distrust the PMI, but I don’t think we should overreact to one report that doesn’t sing from the hymn sheet that all of the other reports do. We need to look at the data through February in terms of how the labour market is evolving.”

In other words, if more economic cracks start to show, expect markets to start betting more heavily on a second rate cut this year. And prepare for more optimistic news on mortgages.

One area of weakness that could increase the chances of a second cut this year is the jobs market.

“The recent jobs numbers pointed to a fourth straight monthly decline in employment,” said Brown.

“It was the biggest month-on-month fall in employment since November of 2020 when we were going into a lockdown.”

PRE-CHRISTMAS RUSH

Before the recent jump in borrowing costs, the housing market had responded positively to the certainty that followed November’s Budget. The number of transactions in December was in line with the five-year average, HMRC said on Friday.

However, mortgage approvals were down 9% in the same month, suggesting a pre-Christmas rush to complete rather than the start of a more meaningful upturn in demand.

Two other factors have put upwards pressure on borrowing costs in recent weeks, which are also discussed on the podcast.

First, the prospect of a debt-funded spending spree by the Japanese government, which has pushed global bond yields higher in recent weeks, a theme we explored last week.

PM CHALLENGE

Second, there is a similar concern closer to home. The possibility that Prime Minister Keir Starmer could be challenged unnerved bond markets last month when Manchester Mayor Andy Burnham announced he would stand in this month’s Gorton and Denton by-election.

He was blocked from doing do, but the market reaction to the mere possibility showed investors were still concerned about the government’s tight financial headroom, said Brown.

“The fact the market cared sends a very strong message that actually, although things have calmed down and there is less focus on the fiscal side of things than in the run up to the Budget, fundamentally, the market is still very concerned about the backdrop and sentiment is still very fragile.”

If nothing else, it was a useful reminder that a Labour loss in this month’s by-election would be bad news for the Prime Minister but also anyone with a mortgage.