Anyone familiar with the prime London property market will have found the conclusions of a study last week into non dom tax reform unsurprising.

One key finding by former Treasury economist Chris Walker was that the government relied on a flawed analysis of how many non doms would leave the country if the system was scrapped.

The report also warned of a tax shortfall if enough non doms left the UK and underlined how new inheritance tax rules were a key deterrent.

The government was warned about all of the above and more during months of lobbying by groups including Foreign Investors For Britain.

NEW REGULATIONS

Under the old rules, individuals could live in the UK without paying tax on overseas income and gains.

The new regulations limit this to four years and mean their worldwide assets are subject to UK inheritance tax.

As a result, countries like Italy, which operates an annual flat tax that ringfences overseas income, have become more attractive.

ACTIVITY DOWN

The new rules explain why the number of sales in prime London property markets in the six months to May fell 7% versus the previous year. The number of new prospective buyers registering fell by 13% over the same period, Knight Frank data also shows.

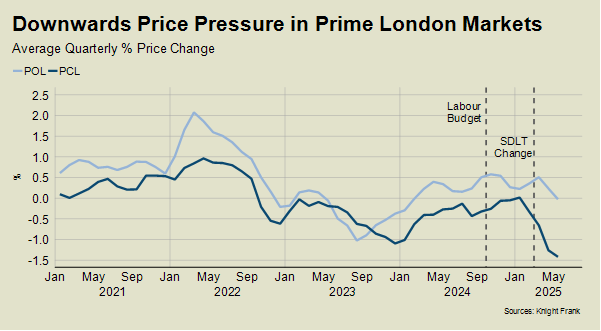

Average prices in prime central London declined 2.2% in the year to May, which was the steepest annual drop since last August. A quarterly price fall of 1.4% was the widest in almost five years.

In prime outer London, where a higher proportion of demand is driven by needs-based and domestic buyers, average prices rose by 1.1% in the 12 months to May.

A stamp duty hike in April has kept demand even further in check over the last two months. The second home surcharge rose to 5% from 3%, which will take some time to digest, as we analyse here.

Against this tougher backdrop, which meant we recently revised down our 2025 price forecast for PCL, sellers are responding by cutting asking prices.

“The bigger picture looms large,” said Stuart Bailey, head of prime central London sales at Knight Frank.

“Serious sellers, looking to sell in the next year, are cutting their asking prices to attract buyers, whose confidence lies just below the surface.

“Where a property has been listed for six to 12 months, double-digit reductions mean they are selling. Smart buyers have spotted there is value now while the competition is less intense, and the next Budget is still some months away.”

THE AUTUMN BUDGET

This week’s spending review may provide a few clues about the government’s priorities and political framing for the Budget, which is expected to take place in late October or early November.

The key question is: will the Chancellor interrupt the process of a market that is re-pricing and getting back on its feet?

The government will not be enjoying headlines about departing wealthy foreign investors, as we analysed here, but the issue of how it treats wealth is a live discussion inside the cabinet.

Prime Minister Keir Starmer recently said the UK can’t tax its way to growth. However, it followed the leaking of a memo from deputy PM Angela Rayner to the Chancellor last month which set out ways to do precisely that.

Rachel Reeves faces three difficult choices in order to meet her own fiscal rules.

Cut spending, which will annoy both backbenchers and frontbenchers.

Raise taxes, which voters won’t like and could be self-defeating.

Or convince highly sceptical financial markets that she is going to loosen her own fiscal rules without sending bond yields and mortgage rates higher.

It’s an unenviable position. But it’s also why any policy that drives away foreign investment or shrinks the tax base in such circumstances has obvious flaws.

TAX UNCERTAINTY SPPORTS PRIME LONDON LETTINGS MARKET

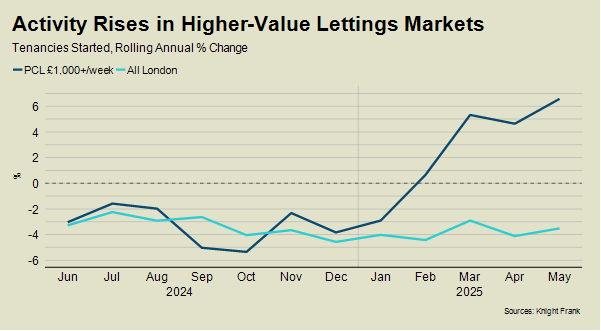

While some wealthy foreign investors are leaving the UK due to the tougher tax landscape, others are keeping their options open. It means demand in the lettings market is stronger than the sales market in prime central London (PCL).

The number of tenancies started above £1,000 per week in PCL in the year to May was 7% higher than the previous 12 months, Knight Frank data shows. Meanwhile, the number of sales above £2m fell 4% over the same period.

Non doms rules were scrapped in April, which has led to speculation about how many wealthy foreign investors will leave the country.

Under the old regulations, individuals could live in the UK without paying tax on overseas income and gains. The new rules limit this to four years and mean their worldwide assets are subject to UK inheritance tax.

As a result, countries like Italy, which operates a flat tax to ringfence overseas income, have become more attractive.

More recently, the rate of stamp duty for second homes was increased to 5% from 3%, which has further kept demand in check.

“The uptick experienced by the lettings market aligns with the political and economic backdrop that began unfolding from the middle of last year,” said Tom Smith, head of super-prime lettings at Knight Frank.

“The general election uncertainty, the prolonged period of speculation ahead of the Budget, and SDLT changes all increased demand in the lettings market and continue to do so.”

In the super-prime lettings market (£5,000+ per week), the uptick has been even more noticeable, with the number of tenancies agreed in PCL in the year to May rising by 15% compared to the previous 12 months.

“We have seen a good amount of prime lettings stock come across from the sales market after the owners failed to achieve their asking price,” said David Mumby, head of prime central London lettings at Knight Frank.

“That now includes areas like Notting Hill and Kensington where the sales market had been very strong.”

The increase in the number of tenancies started compares to an overall decline of 4% across the whole of London in all price brackets, as the chart shows.

The wider decline is largely due to shrinking supply as landlords are put off by new legislation including the Renters’ Rights Bill.

Average rental values and prices are also moving in opposite directions. While prices in PCL fell by 2.2% in the year to May, rental values rose 0.9%.

However, most of the growth was skewed towards the higher-value end of the market. Between £500 and £1,500, average PCL rents increased 0.3% over the year. The equivalent figure was 1.9% above £1,500 per week.

Average rents in prime outer London rose 1.7%, which was also driven by the higher-value market. An increase of 0.3% between £500 and £1,500 per week compared to a rise of 1.3% above £1,500 per week.

In the super-prime price bracket, where pricing is less transparent due to the relatively low number of deals per year, rental values have experienced downwards pressure in recent months due to higher supply, said Tom.

“Pricing has softened as more high-quality stock comes to the market,” he said. “More owners are looking at their options overseas and renting out their property in the meantime.”

It’s not just buyers and tenants that are keeping their options open.

Tom Bill is Head of UK Residential Research at Knight Frank