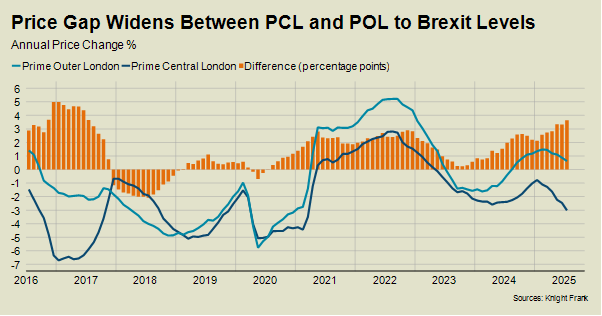

The London property market is more split than it has been since Brexit. Average prices fell 3% in prime central London (PCL) in the year to July due to doubts around the government’s treatment of wealthy foreign investors.

Meanwhile, there was an increase of 0.6% in prime outer London (POL), in a market largely driven by domestic buyers moving due to changes in their personal circumstances.

The last time the gap was wider was in 2017, when prices in central London were correcting after the EU vote in June 2016.

Demand was kept in check by an inconclusive general election a year later and the spectre of a no-deal Brexit created a subdued mood in 2018 and 2019, as the chart shows.

Fast forward to 2025 and a similar gap is opening up. We face a summer of speculation as the government comes under pressure to tweak the rules that have replaced the non-dom regime.

Under the old system, non-doms could live in this country without paying UK tax on their overseas wealth. The new rules impose a residence-based framework with a four-year time limit and a proposal to charge inheritance tax (IHT) on global assets.

The changes have had real-world consequences, with wealthy foreign investors departing and adding to the pressure on government finances, as we recently flagged.

Underlining how the London property market has been affected, the average number of exchanges in south-west London in the first seven months of this year was 1% below the five-year average. In prime central London, the equivalent decline was 10%.

“Buyers will generally jump on a property if it’s priced correctly,” says Luke Ellwood, head of south-west London sales at Knight Frank.

“We are currently not far from last year’s position, which was a record 12 months for us.”

Overall, it was a bumpy start to the year thanks to a stamp duty cliff edge in April, which saw activity pulled forward into the first quarter.

However, last week’s dip in swap rates following weak US jobs data would have further supported the sort of domestic demand that drives the market in POL.

That said, more buyers in PCL are attracted by the relative value on offer, according to Stuart Bailey, head of prime central London sales at Knight Frank.

Average prices are 20% below their last peak in August 2015, which compares to an equivalent decline in POL of 7% since mid-2016.

“Some buyers have now been to places like Italy and Dubai and realise they still want a long-term base in London”, says Bailey. “When they see prices in Belgravia within 10% to 15% of areas like Fulham it is tempting some of them to look in more central areas.”

It is still a buyer’s market across most of the capital due to high levels of supply. An overhang from the stamp duty cliff edge, decisions put off due to last year’s general election and a growing number of landlords selling up are among the causes.

However, the picture is slowly improving as the distortive effect of April’s stamp duty increase passes through the system.

There were 6.7 new buyers for every new sales instruction in July in PCL and POL, which was lower than a figure of 7 last July, but it’s an improvement on 5.1 in April.

However, we would expect the price growth gap between PCL and POL to widen for now.

London still calling: International tenant demand defies economic gloom

The UK remains an attractive destination for overseas workers despite a recent bout of disappointing economic news.

GDP, retail sales and employment data have all fallen short of expectations in recent weeks and the latest GfK sentiment survey essentially suggested some consumers are adopting the brace position ahead of the autumn Budget.

“Demand from the corporate relocation sector in London and the surrounding area has held firm.”

However, despite the uncertain backdrop, demand from the corporate relocation sector in London and the surrounding area has held firm.

The number of enquiries in the first seven months of this year from companies looking to send staff to the UK was 8.5% higher than the same period last year, Knight Frank data shows.

Corporate relocations to the UK are typically from the energy, finance, professional services, legal and tech sectors.

Tenant demand will have been helped by the fact tech giants including Meta, Apple and Amazon recently posted strong financial results for reasons that include previous cost-cutting measures and the AI boom.

Meanwhile, in the legal sector, a number of US law firms have expanded their London presence as a strategic European hub for mergers and acquisitions activity.

“London is still seen as a premier location to send staff,” said John Humphris, head of relocation and corporate services at Knight Frank.

“There is a critical mass of talent already here that pulls people in, as well as the appeal of the language and time zone.”

The rental market will also be supported by growing demand from international students, according to UCAS figures. There was a 2.2% increase in the number of overseas students in the last 12 months, it reported. The largest group is from China (10% increase) and the US (+14%).

Meanwhile, demand hasn’t been particularly dented by new rules for non doms, which are “not particularly relevant” for the corporate relocation market, according to John.

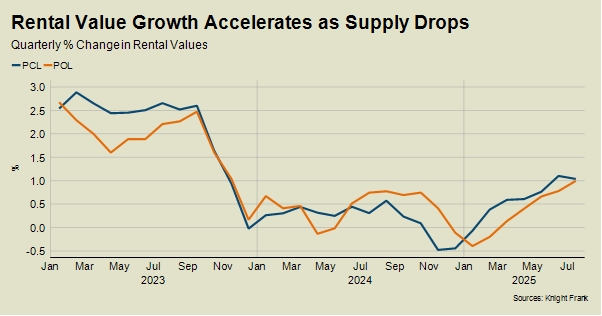

A more pressing issue for all tenants is that rental value growth is starting to rise again, primarily due to tighter supply.

Average rents in prime central London rose 1.7% in the year to July, which was the strongest increase in a year. In prime outer London, a rise of 1.8% was the strongest since last October.

More landlords are exploring a sale due to the tougher regulatory environment. In addition to the prospect of stricter energy efficiency rules, the Renters’ Rights Bill could make it more onerous to regain possession of a property and raises the risk of void periods.

The number of new lettings instructions in the year to July was 9% lower than the previous 12-month period in London, Knight Frank data shows.

Not all landlords are achieving their desired asking price, which means some are currently bouncing between the lettings and sales market, as we explored here.

However, healthy demand and tighter supply means we expect rental value growth to keep climbing through the rest of this year.