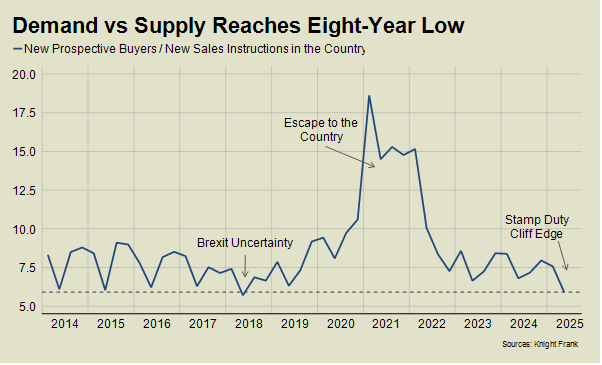

The second quarter of 2025 was the most favourable market for buyers in the Country for seven years.

High levels of supply and downwards pressure on prices meant conditions have only been more advantageous once in the last two decades.

For every new sales instruction in the three months to June, there were 5.9 new prospective buyers. That compares to nearly 19 at the height of the ‘escape to the Country’ boom during the pandemic, when competition was particularly fierce (see chart below).

The last time buyers were in such a strong negotiating position was in Q2 2018, when doubts surrounded the UK’s Brexit deal and the longevity of Theresa May’s government.

COUNTRY MARKET

The Country market covers a range of urban and rural markets above £750,000 outside London.

The number of new sales instructions in Q2 was 9% higher than 2024 for several reasons.

They include a stock overhang due to March’s stamp duty cliff edge, buyers re-activating plans put on hold last year due to the political upheaval, landlords selling due to red tape and holiday homes coming to the market due to recent council tax changes.

Stamp duty thresholds were changed in April, which meant completing in March enabled a maximum saving of £2,500 or £11,250 for first-time buyers.

Meanwhile, demand was predictably more subdued after activity was pulled forward into the first three months of the year to beat the stamp duty deadline. The number of offers made in Q2 fell 9% versus last year.

The imbalance has increased downwards pressure on prices, which has led to more sales activity.

The number of exchanges in June was 7% higher than last year, although the 2024 figure was slightly depressed ahead of the general election.

BUYERS POUNCE

Momentum will continue to grow after a slow start to Q2, said James Cleland, head of the Country business at Knight Frank.

“Prices are correcting and as a result activity is noticeably picking up,” he said. “June was busy, and a number of deals were agreed in all price brackets, which means the next few months look even better for exchanges. It’s all about pricing. If you get it right, buyers pounce but if you get it wrong, not a lot happens.”

The Country House Price Index fell 3.5% in the year to June 2025, which compared to a decline of 1.6% in the year to March.

Underlining the extent of the imbalance between supply and demand, average prices fell 2.5% in the three months to June.

For context, that was the second steepest quarterly decline since the global financial crisis in Q1 2009.

Sale prices were on average 94% of the initial asking price in Q2, which compares to 97.3% this time last year and 99.7% in Q2 2022.

It’s quite clear where the negotiating power sits at the moment.