The mood in the UK property market has improved over the last two months. The reason is that buyers and sellers no longer wonder which taxes the Chancellor will raise in the Budget. The key question now, though, is how long the momentum will last.

Last week, the RICS talked about rebounding confidence and a market that was ‘finding its feet’.

That sentiment was echoed by Rob Perrins, executive chairman of Berkeley Group, who said demand in early January was stronger than normal on the latest episode of the Housing Unpacked podcast. Furthermore, activity in prime London improved notably late last year.

Certainty has returned, if not the feelgood factor, which means more people have activated their plans. Perhaps the message is that the less a government intervenes in the housing market, the closer it operates to full capacity?

RELIEF RETURNS

More positivity has also returned to the Country market, which covers a range of urban and rural properties above £750,000 outside London.

While the number of exchanges in 2025 was 2% down compared to the previous 12, there was an equivalent increase of 5% in Q4. It reflects how some buyers acted shortly before the Budget, while others did the same ahead of Christmas once the tax landscape had become clearer.

“After the Budget, the market has exhaled,” said James Cleland, head of Country sales at Knight Frank.

“The early signs in 2026 are positive, buyers are feeling relieved rather than buoyant, there is greater activity in the market, but sellers should note that prices are still under pressure.”

Perhaps the biggest risk on the horizon is that the Prime Minister and Chancellor will be replaced, as discussed on a recent episode of Housing Unpacked with former Treasury special advisor James Nation.

There is also the possibility of further tax increases in the autumn Budget given the slender nature of the government’s headroom.

PRICE DROP NARROWS

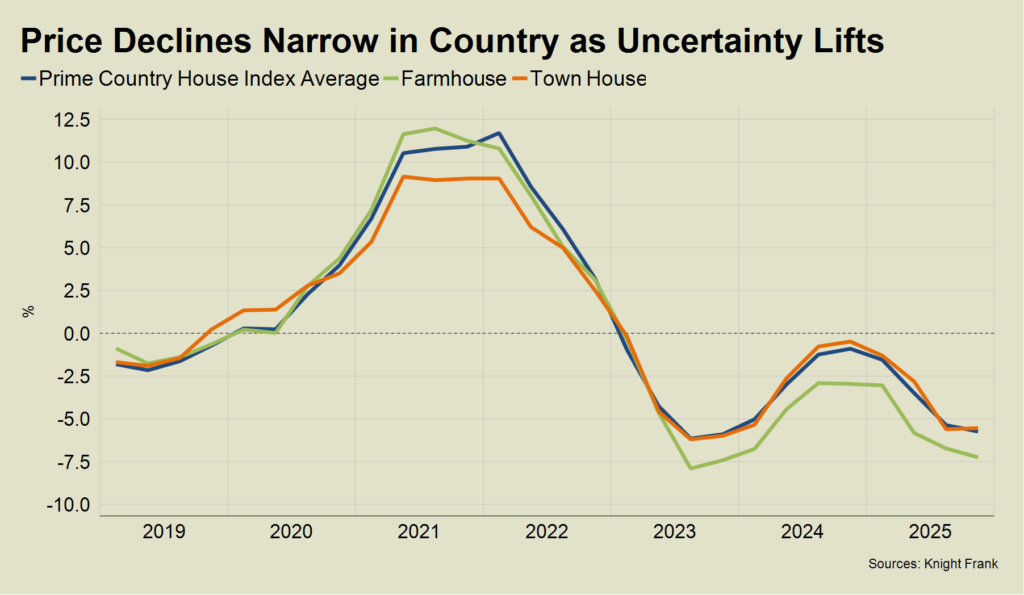

Last year’s uncertainty around the Budget meant average prices in the Country continued to fall in the final three months of 2025.

The annual decline widened to 5.7% in Q4 from 5.5% in Q3. It means average prices are 13% below their last peak in Q3 2022, a period when demand was supported by the ‘escape to the country’ trend during the pandemic.

However, the quarterly price drop narrowed from more than 2% earlier in the year to 0.7% in Q4, suggesting that the decline is bottoming out.

There was a split between rural and urban markets, with demand stronger among needs-driven buyers in towns and cities.

Demand in rural markets is more discretionary, where a higher proportion of sales is second homes. Average price for town houses fell 5.5% in the year to Q4 2025, while the equivalent decline for farmhouses was 7.3%.

What happens over the next three months will tell us much more about the strength of the Country market in 2026.

The good news is that the spring statement on 3 March is likely to be a non-event, which means that speculation around tax hikes is, for now, in the rearview mirror.