UK property transactions soared in March 2025, as homebuyers and investors rushed to complete deals before Stamp Duty Land Tax (SDLT) thresholds were lowered at the start of April.

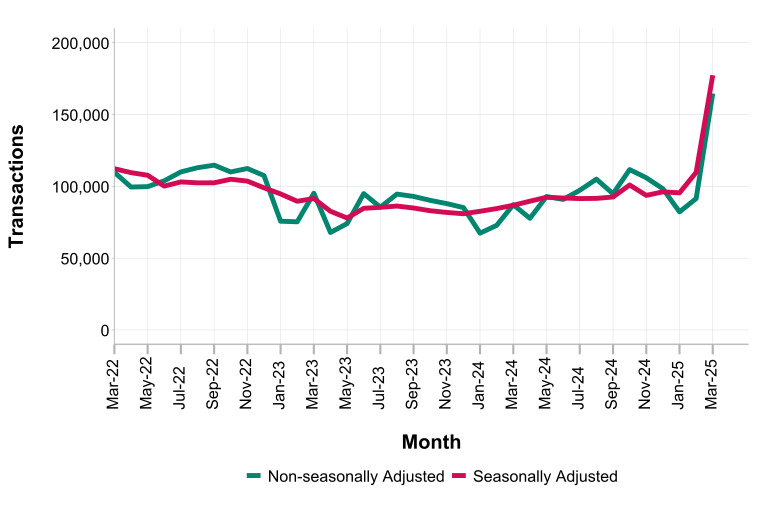

According to HM Revenue & Customs, the seasonally adjusted number of UK residential property transactions hit 177,370 in March, more than double the level seen in March 2024 – a striking 104% year-on-year increase. Compared to February 2025, the figure rose 62%, highlighting the significant pull-forward in activity.

The sharp increase in transactions is widely attributed to the return of SDLT thresholds to pre-pandemic levels.

From 1 April 2025, the nil-rate threshold for all buyers dropped from £250,000 back to £125,000.

FIRST-TIME BUYERS

First-time buyers also saw their threshold reduced from £425,000 to £300,000. The looming change appears to have driven a surge in completions during March, as buyers sought to capitalise on the higher allowances before they expired.

Non-seasonally adjusted figures paint a similarly robust picture, with residential transactions up 80% on February and 89% on the year – the third-largest monthly rise in non-seasonally adjusted data since records began, behind only spikes seen in March 2016 and June 2021, both of which followed other SDLT changes.

Commercial property also saw a lift. Seasonally adjusted non-residential transactions reached 11,200 in March, up 10% on the month and 12% on the year. Non-seasonally adjusted commercial deals climbed even further up – 37% on February.

TRANSACTION EXPLOSION

Richard Donnell, Executive Director at Zoopla, says: “Transaction volumes have exploded in March on the back of the stamp duty holiday and a pick up in housing sales over 2024.

“There has been a slowdown in demand, but buyers are still in the market and sales are 6% up on this time last year.

“We expect an easing in mortgage affordability testing to support sales in the second half of 2025 with a plentiful supply of homes for sale.”

PROACTIVE BUYERS

Iain McKenzie, CEO of The Guild of Property Professionals, comments: “The latest HMRC property transaction figures reveal the momentum that was clearly fuelled by proactive buyers securing their moves ahead of the widely publicised Stamp Duty threshold changes.

“This pre-deadline surge, a common feature before tax adjustments as buyers rush to beat the clock, highlights the strong underlying desire among people to move home.

“While we naturally anticipate a period of adjustment as the market settles into the new Stamp Duty landscape from April onwards, this is a well-understood pattern. Buyers and the market will adapt, as they historically do.

“Crucially, the foundations for sustained activity moving forward look positive.”

“Crucially, the foundations for sustained activity moving forward look positive. The market will continue to be underpinned by ‘needs-based’ movers pursuing their essential life plans. Added to this is the natural boost from the Spring and Summer months, typically the most vibrant period for property transactions.

“Perhaps most significantly, the improving landscape for mortgage rates, combined with the growing expectation of interest rate cuts later in the year, should provide a floor for activity. These factors should help bolster buyer confidence and affordability.

“So, while the first quarter of this year reflects a unique snapshot influenced by the tax deadline, the underlying drivers – resilient demand, positive seasonality, and improving financial conditions – give us solid grounds for cautious optimism about the health and direction of the property market throughout the rest of 2025.”

STAMP DUTY RUSH

Nathan Emerson, Chief Executive of Propertymark, says: “The rush to avoid stamp duty threshold changes across England and Northern Ireland spurred many people to prioritise their purchase before the recent 1 April 2025 deadline.

“However, it will now be key to see sustained momentum in the sector during the traditionally busy spring and summer months.

“As the housing market starts to follow the usual buoyant seasonal trends, we are likely to see an influx of properties for sale for those in a prime position to find their next ideal home.

“Recent data demonstrates a growing array of two-year fixed-rate mortgages delivering more affordability that only twelve months previous, giving consumers more choice and greater financial flexibility.

“With many mortgage rates starting to dip down again, there is still yet some distance to go before they are still generally lower than they were prior to 2022. Should inflation decrease to 2 per cent or less, it would give the Bank of England potentially far more flexibility to consider further interest rate cuts, which would typically result a far wider range of more affordable mortgage products in the medium to long term.”

LOWER MORTGAGE RATES

Jason Tebb, President of OnTheMarket, says: “The significant uptick in transaction numbers underlines the importance of the stamp duty holiday as buyers brought forward purchases to beat the deadline.

“Two rate reductions in the second half of last year gave buyer and seller confidence a real boost. With one cut already this year – and more expected, perhaps as soon as next week – there is cautious optimism.

“A number of lenders have recently reduced their mortgage pricing and criteria, which is helping ease affordability.

“Increased property stock, as sellers try to take advantage of the spring market, means buyers have more choice than has been the case for a while. This is putting them in a stronger negotiating position and they remain price sensitive.”

RATE CUTS EXPECTED

Amy Reynolds, Head of Sales at Richmond estate agency Antony Roberts, says: “These figures offer valuable insight into overall activity and are a key indicator as to how the market is likely to shape up over the next few months.

“The end of the stamp duty concession has removed some of the urgency from the market. Some buyers accelerated purchases to beat the deadline, as reflected in these numbers. Others simply dropped back into ‘wait and see’ mode, hoping that with inflation now largely under control, the Bank of England will cut interest rates again, perhaps as early as next month.”

DETERMINED BUYERS

Jeremy Leaf, north London estate agent and a former RICS residential chairman, says: “Although these figures inevitably reflect the determination of buyers and sellers to take advantage of the stamp duty holiday before it ended at the beginning of April, many would still have been unable to do so.

“Since then, on the ground, we have seen very few withdraw although a fair proportion have tried to renegotiate in order to reflect the financial loss involved.

“Strong employment, complemented by healthy earnings growth in real terms as well as reducing borrowing costs in anticipation of lower base rates, are for the most part outweighing concerns about the wider economic picture.”

MARKET SENSITIVE TO TAX POLICY

Mark Tosetti, Chief Executive of CAL (part of Movera), says: “The sharp rise in residential transactions in March reflects a predictable response to the stamp duty threshold changes coming into effect in April.

“Buyers moved quickly to complete purchases while the higher nil-rate thresholds were still in place, resulting in one of the biggest month-on-month jumps we’ve seen outside of previous policy deadlines.

“The scale of the increase – over 100% year-on-year and 62% up on February – shows just how sensitive the market remains to tax policy. This was not limited to residential transactions either; the uplift in non-residential activity suggests broader confidence in the market when timelines are clear and incentives are strong.

“As with past stamp duty changes, at times the pressure that can be seen across different areas of the property sector was intense.

“We hope the whole industry took lessons from earlier surges. We worked closely with our conveyancing partners to prepare early, manage capacity, and avoid bottlenecks. This kind of responsiveness is exactly why Movera exists – to bring together trusted services that keep the market moving efficiently, even under pressure.”