House price growth in the UK has slowed to 1.4% as an influx of new listings gives buyers more negotiating power, according to the latest Zoopla House Price Index.

The average UK home now costs £268,400 – just £3,960 more than a year ago – with values falling in some higher-value southern markets and accelerating only modestly in more affordable areas.

Estate agents are now marketing an average of 37 homes each, up from 32 this time last year.

This expanded inventory has helped fuel a 6% annual rise in sales agreed, as increased choice re-energises the market.

STALLING PRICE GROWTH

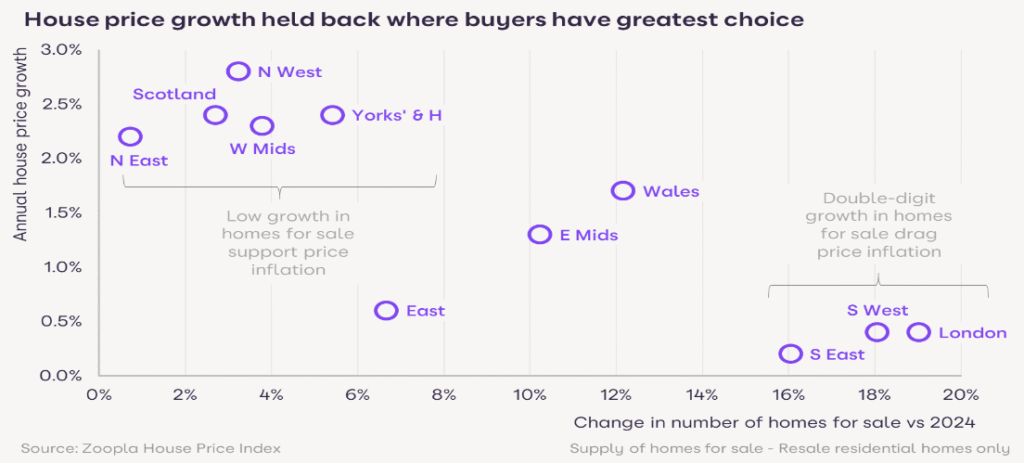

In London, the South East and South West – where housing stock is up 16% to 19% year-on-year – price growth has nearly stalled, rising by less than 0.5% over the past 12 months.

By contrast, regions with only modest supply growth – including Scotland, the West Midlands and the North – are seeing house prices climb at a faster rate of 2% to 3%.

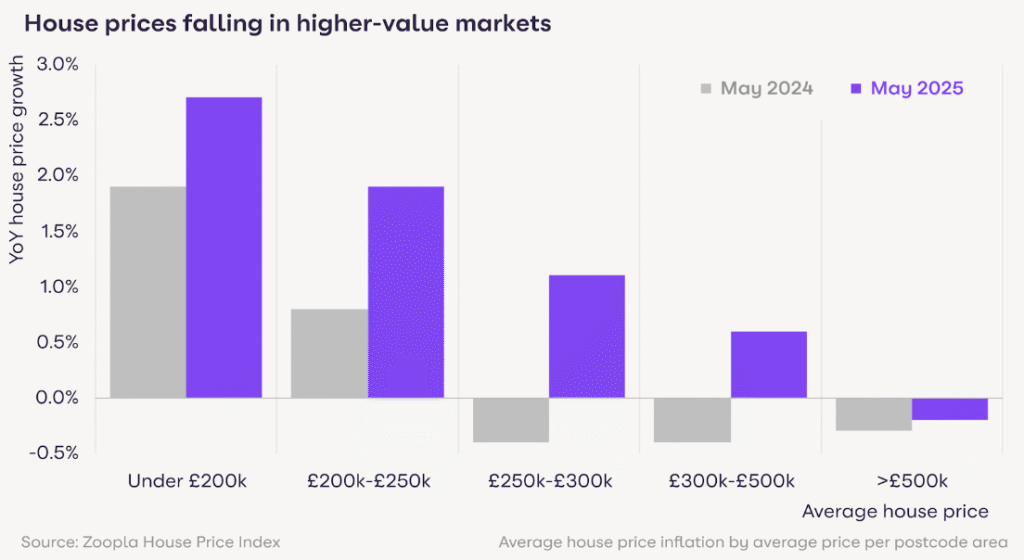

House prices have fallen by an average of 0.2% in areas where the average home exceeds £500,000 – a segment that accounts for 8% of the market and includes parts of inner London and southern coastal hotspots. Prices are now down by 4.3% in West Central London (WC), 1.7% in Torquay (TQ), and 1.3% in both West London (W) and Truro (TR).

OUTPERFORMING MARKETS

Conversely, lower-value markets continue to outperform. Areas where average prices fall below £200,000 are up 2.7% on the year, while markets priced between £200,000 and £250,000 have seen gains of 1.9%. Together, these segments account for half the UK housing market.

The fastest-growing areas include Wigan (WN, +4.3%), Falkirk (FK, +3.8%) and Blackburn (BB, +3.6%), with affordability and limited supply supporting continued upward pressure on values.

Tax and policy changes aimed at second homeowners and landlords are also having a dampening effect on prices in certain regions, compounding the impact of supply dynamics and buyer caution.

REALISTIC SELLERS

Despite improving buyer confidence, pricing remains critical to success in today’s market.

The average time to sell stands at 45 days – ranging from 35 days in the North East to 57 in Wales. Southern regions are averaging over 50 days, reflecting greater buyer choice and more price sensitivity.

More than one in five homes (22%) currently listed have been on the market for over six months without a sale. A further 23% have remained unsold after three to six months. The average time on the market for unsold homes now stands at 75 days.

PRICE SENSITIVE

Richard Donnell, Executive Director at Zoopla, says: “The number of buyers and sellers agreeing home sales continues to increase year-on-year, demonstrating a continued desire of more households to move home in 2025. Improving mortgage affordability will support buying power in the second half of the year.

“However, buyers remain price-sensitive, especially in higher-value markets where the number of homes for sale has grown the most in the last year, boosting choice for home buyers. Serious sellers need to be realistic on where they set their asking price in order to achieve a sale and secure a home move in 2025.

“The market remains on track for 5% more sales in 2025 but house price inflation will remain between 1% and 2%.”

PRICE POSITIVELY

Sarah Cartlidge, Branch Manager at Fraser Reeves estate agents in the North West, adds: “We’re delighted to be seeing increased vendor confidence this year, with more properties coming on to the market than in 2024.

“However, property price remains key to agreeing a sale.

“We’re always keen to emphasise to prospective vendors that they do need to price positively and realistically from the get-go, in order to secure a good buyer in good time, and to make the best first impression possible when their property hits the market.

“We know that any property can sell for the right price, taking into account the local competition and the particular characteristics of each individual home.”

IMPROVED CERTAINTY

Nathan Emerson, Chief Executive at Propertymark, says: “It’s encouraging to see further house price growth, as people continue to approach the buying and selling process with improved certainty.

“Although we are still seeing elevated base rates currently sitting at 4.25 per cent, we are starting to see some high street lenders offering sub 4 per cent mortgage deals.

“We have witnessed the recent announcement of a National Housing Bank which hopes to combine a public investment of £16bn and a potential private investment of £53bn to help make 500,000 new homes a reality, which will likely be universally beneficial to all when it comes to homeownership.”

GEOPOLITICAL RISKS FADING

Tom Bill, head of UK residential research at Knight Frank, “The current supply glut has put downwards pressure on asking prices, which sellers must take into account if they need to transact sooner rather than later.

“Geopolitical and tariff risks appear to be fading, which points to a smoother ride for the housing market in the second half of the year, which should be boosted by at least two rate cuts.

“However, the government’s non-existent financial headroom means tax rise speculation is likely to intensify ahead of the autumn Budget in a re-run of last year.”