The UK housing market is experiencing a decade-high surge in property listings, offering prospective buyers the widest selection of homes for sale since 2015.

But for many buyers in England this newfound choice comes with a financial sting as the deadline for current stamp duty savings looms at the end of March.

The average asking price of properties newly listed this month has risen by 1.1% (+£3,876) to £371,870, aligning with the long-term seasonal trend for March.

Rightmove data suggests that many sellers are pricing competitively rather than pushing for overly ambitious valuations, a sign of market resilience amid economic uncertainty.

MOST SUCCESSFUL

Historically, February and March have been the most successful months for sellers, with the highest proportion of homes listed during this period going on to secure buyers.

However, this year presents a different challenge: a surge in supply means that sellers face their highest level of competition in 10 years.

For buyers, the influx of new listings is a welcome development, providing an expanded range of options.

Yet many will miss out on the existing stamp duty savings, as an estimated 74,000 transactions – including 25,000 first-time buyers – are set to complete in April, just beyond the deadline.

Rightmove estimates that these delayed transactions will collectively incur an additional £142 million in tax. With the government’s Spring Statement arriving just before the deadline, there remains hope for an extension, though expectations are fading.

MORTGAGE RATES

Despite global economic turbulence, the UK property market has demonstrated resilience, with sales activity continuing at a steady pace.

The number of agreed sales is currently 9% higher than at this time last year, while new seller listings are up by 8%, reinforcing optimism for the months ahead.

However, persistently high mortgage rates remain a barrier for many.

The average 5-year fixed mortgage rate stands at 4.74%, down from its July 2023 peak of 6.11% but only marginally lower than last March’s 4.84%.

Lenders are responding to seasonal demand by adjusting rates where possible, yet first-time buyers and those with smaller deposits continue to bear the brunt of financial constraints.

Matt Smith, mortgage expert at Rightmove, says: “Lenders are pricing competitively where they can, but global economic factors are driving weekly fluctuations.

“The next Bank of England rate decision is expected to maintain the current hold, with a potential cut in May. However, as we’ve seen, market conditions can shift rapidly.”

SELLER STRATEGIES

Property experts report a renewed willingness among sellers to engage with the market after months of hesitation.

Sarah Bush, Head of Residential Sales and Lettings at Cheffins, says: “Many sellers are tired of sitting on the fence and are keen to move forward this year. Realistic pricing remains crucial, particularly in countryside markets and at the upper end of the market.”

And Chris Rosindale, Chief Operating Officer at Connells Group, adds: “The sales market is showing positive momentum, with exchanges surpassing last year’s levels.

“The upcoming stamp duty changes haven’t dampened buyer demand, though setting the right asking price remains essential for securing a sale.”

SINGLE-DIGIT GROWTH

Tom Bill, Head of UK Residential Research at Knight Frank, says: “Buyers have started the year in circumspect mood, despite the prospect of a stamp duty increase in April.

“Most mortgage rates have remained stubbornly on the wrong side of 4% due to volatility on global markets, which means equity-rich, needs-driven buyers have been more active by comparison.

“We expect low single-digit house price growth this year, but this month’s spring statement and the future rate of UK inflation will be key factors in setting the trajectory of the housing market in 2025.”

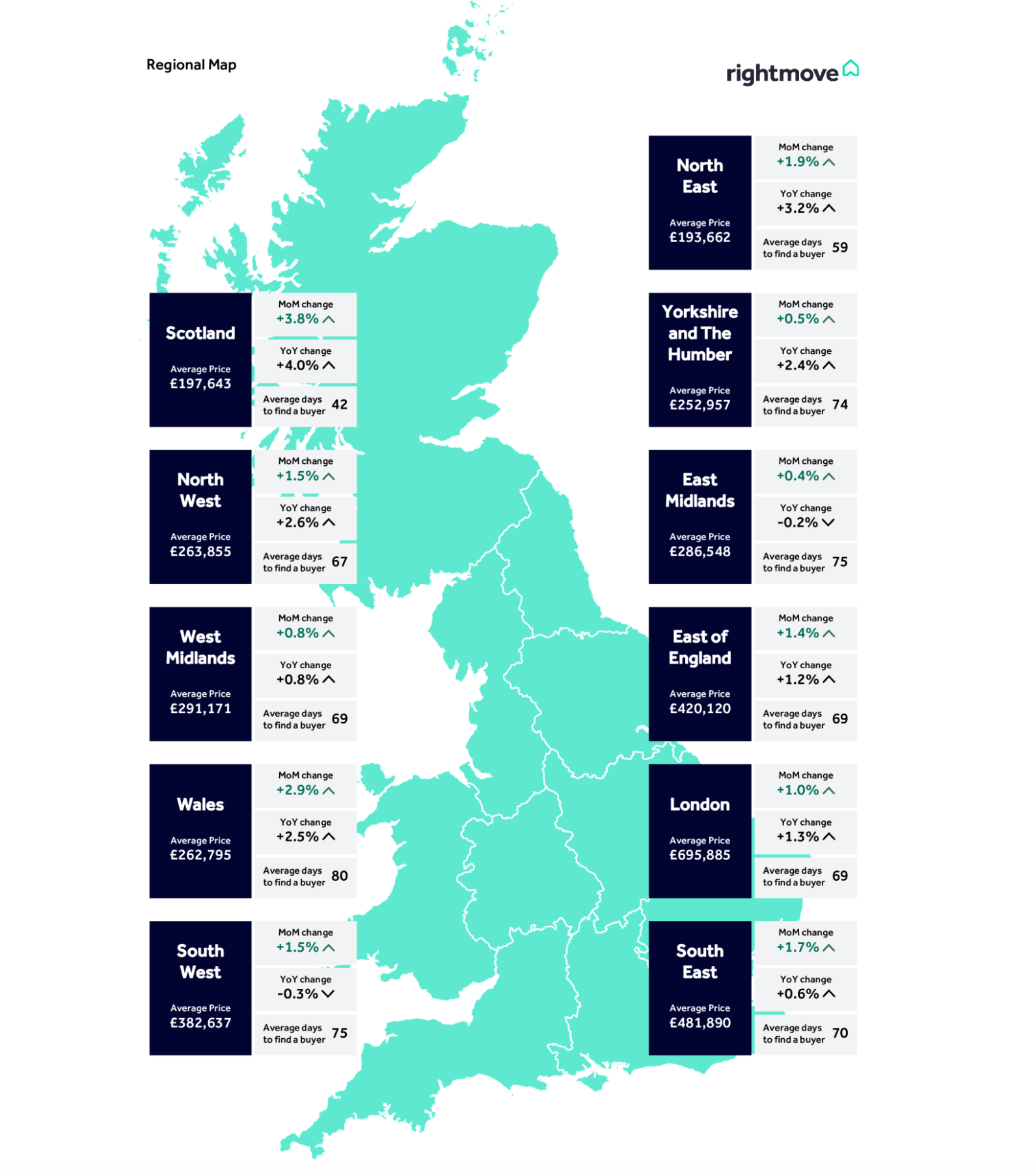

REGIONAL TRENDS