Cardiff’s CF24 postcode has overtaken Manchester’s M14 as the UK’s top buy-to-let hotspot, according to new data from Paragon Bank covering the 12 months to the end of June.

The area, which includes the city centre and the suburbs of Roath, Cathays and Splott, climbed from fifth place last year to first in the lender’s latest rankings, driven by strong tenant demand and yields averaging 8.9%.

Over 42% of properties in CF24 are now privately rented.

Paragon said that landlords are targeting CF24 for its proximity to major institutions, including the University Hospital of Wales, St David’s Hospital and Cardiff Royal Infirmary, and the large student population.

BIG STUDENT POPULATION

More than a quarter (27%) of residents are students, with three major universities nearby: Cardiff University, Cardiff Metropolitan University and the University of South Wales.

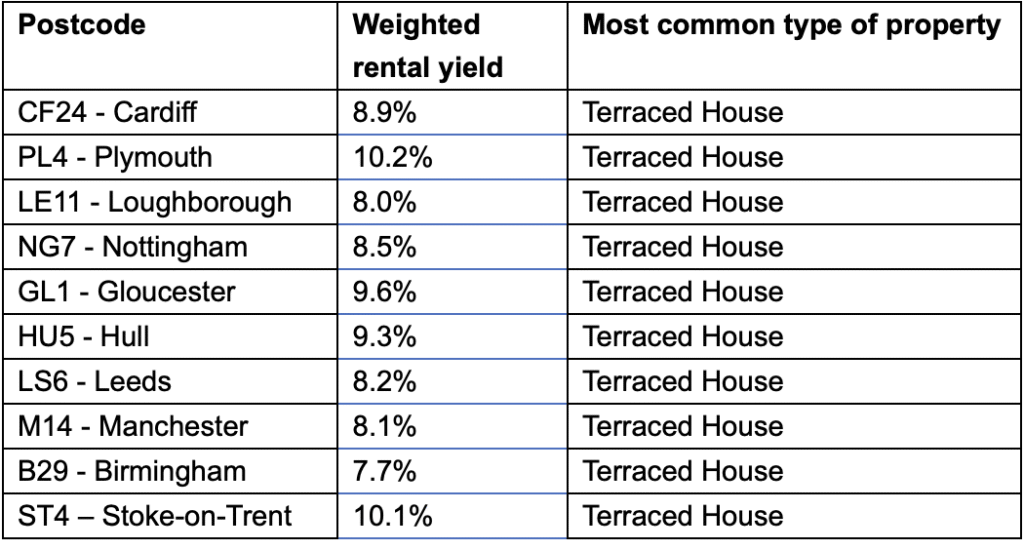

Plymouth’s PL4 postcode – encompassing the city centre and nearby student districts – ranked second, fuelled by a combination of high rental yields, averaging 10.2%, and an average property price of £216,000, well below the England average of £286,000.

The area also benefits from a strong student base and local NHS workforce, with three universities and the Mount Gould Hospital within or near the postcode.

Loughborough’s LE11 placed third, rising from eighth position last year. Home to Loughborough University and Loughborough Hospital, the area is seeing growing demand from students and local workers, with average annual rental yields of 8.0%.

Other returning hotspots include NG7 in Nottingham, which retained fourth position, and Stoke-on-Trent’s ST4, Birmingham’s B29, and Manchester’s M14 – which dropped from first to eighth place.

SIMILAR INVESTMENT STRATEGIES

Louisa Sedgwick, Managing Director at Paragon Bank, says: “Looking at our lending data covering the 12 months to the end of June, we can see similarities in landlord investment strategies.

“Our data also shows that landlords typically purchase properties in larger town or cities and within relatively close proximity to universities or large local employers, benefitting from strong and stable demand.

“This support of higher education and healthcare, in addition to important sectors such as software, manufacturing and logistics, highlights the often-overlooked contribution of the PRS to the UK economy.”

HIGHER YIELDS

And she adds: “Terraced houses were the property type most often bought by landlords in each of the hotspot locations.

“Smaller terraces are often more affordable than other property types, making them a good place to start for newer landlords or those looking to expand their portfolios.

“At the other end of the scale, HMOs are often classified as terraced properties but benefit from typically higher yields owing to the capacity for multiple tenancies.”

Source: Paragon