Stamp duty receipts are forecast to climb sharply over the remainder of the decade, with the Office for Budget Responsibility projecting that taxes on residential property purchases in England and Northern Ireland will reach £19.7bn by 2030-31.

The OBR’s latest analysis shows stamp duty paid by homebuyers this tax year is expected to exceed £11.5bn, despite a subdued housing market and affordability pressures.

The jump reflects both projected rises in transaction volumes and increases in house prices feeding through to higher tax liabilities.

The figures highlight the growing reliance on stamp duty as a source of Treasury income at a time when buyers continue to face high upfront costs.

FISCAL DRAG

Analysts say the absence of reform in this week’s Budget leaves purchasers exposed to further increases as fiscal drag pulls more transactions into higher tax brackets.

Housing market commentators have long argued that the structure of stamp duty acts as a brake on mobility by discouraging both first-time buyers struggling with deposits and existing homeowners looking to move.

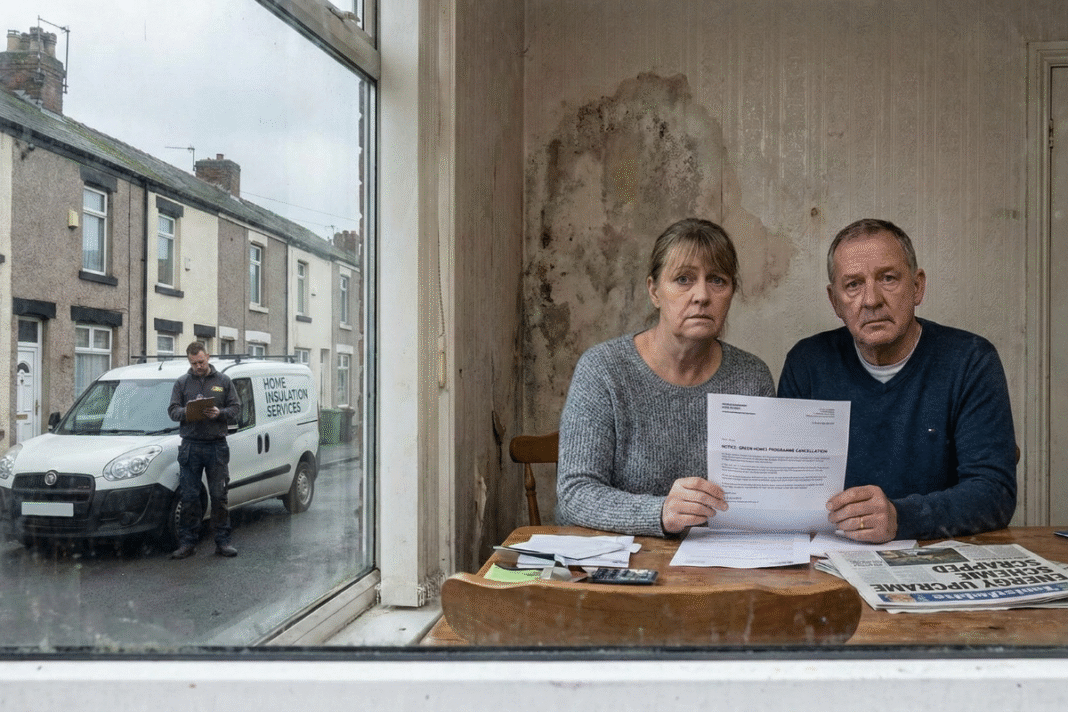

LEFT IN LIMBO

Jonathan Stinton, Head of Mortgage Relations at Coventry Building Society, says: “Keeping stamp duty unchanged will add billions in upfront costs for homebuyers.

“Months of speculation have left buyers and sellers in limbo, and now the only certainty aspiring homeowners have is they will pay more to achieve their ambitions.

“The Budget was an opportunity to modernise a system that has long been criticised for creating barriers to moving.

“While the rumoured proposals weren’t the perfect solution, it’s disappointing that no changes materialised. Doing nothing leaves the system outdated and out of step with the challenges homebuyers are facing today.”