Britain’s housing market saw its slowest month in over a year this February as the wave of buyers rushing to finalise deals ahead of the upcoming stamp duty changes began to ease.

The latest UK Residential Property Survey from the Royal Institution of Chartered Surveyors (RICS) revealed that growing uncertainty is dampening momentum in the housing market.

Buyer demand weakened significantly, with a net balance reading of -14% in February – down from -1% in January and marking the softest result since November 2023.

The looming stamp duty changes on April 1, which will see the threshold reduced from £250,000 to £125,000, are expected to further curb market activity, with many believing this shift is already weighing on buyer sentiment.

WIDER FOCUS

Broader geopolitical and economic concerns are also contributing to a more cautious outlook.

Despite these challenges, house prices at a national level continue to rise, though at a more moderate pace. February’s net balance for price growth stood at +11%, reflecting a gentle uptick in prices, albeit easing from +25% in December and +21% in January.

Interest rates remain a pressing issue for property professionals. While the recent Bank of England rate cut was welcomed, many agents and surveyors are calling for further reductions to help stimulate activity.

Looking ahead, market confidence seems to hold steady. Most respondents to RICS’ latest survey expect house prices to rise over the next 12 months, with the net balance for year-ahead price expectations sitting at +47% — broadly in line with the average reading of the past six months.

LETTINGS LANDSCAPE

The buy-to-let market continues to face headwinds with tenant demand posting a negative net balance of -4% in February – the fourth consecutive month in the red and the longest stretch without a positive reading since RICS’ lettings dataset began in 2012.

Simon Rubinson, RICS Chief Economist, says: “The UK housing market appears to be losing some momentum as the expiry of the temporary increase in stamp duty thresholds approaches.

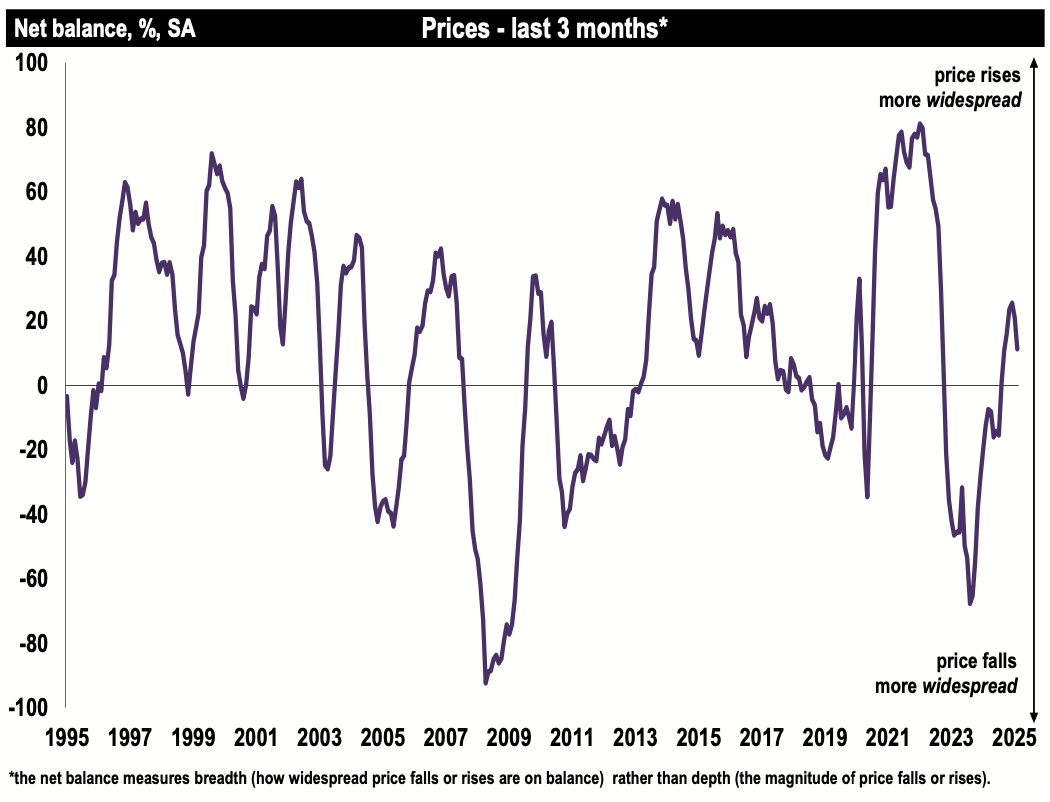

“Some concerns are also being expressed by respondents about the re-emergence of inflationary pressures and the more uncertain geopolitical environment.

“That said, looking beyond the next few months, sales activity is seen as likely to resume an upward trend with prices also moving higher.

“A key support for the market continues to be the increased flow of existing stock becoming available, giving buyers a greater choice of options.”

CHALLENGES AHEAD

However, Rubinson added: “Leading indicators around new build remain subdued for now, highlighting the significance of the Planning and Infrastructure Bill introduced to Parliament this week.

“Meanwhile, despite a flatter trend in demand for private rental properties, the key RICS metric capturing rental expectations is still pointing to further increases, demonstrating that the challenge around supply spans all tenures.”

CRAZY TIMES

Andrew Peter Gregory at The Letting Station, Cardiff, says: “The lack of confidence in the political stability of the country and financial uncertainty continues to fuel the lack of property entering the market.

“Add to that the additional constraints levied on the private rental sector and for this government to levy additional taxation burdens.

‘Crazy’.”

UNCERTAINTY IS THE ENEMY

Jeremy Leaf, north London estate agent and a former RICS Residential Chairman, says: “There’s no doubt that many brought forward buying decisions in view of the imminent withdrawal of the stamp duty concession.

“As a result, we have noticed in our offices demand – for flats not houses – has softened a little over the past few weeks as the deadline approached. No price correction is expected as underlying market strength remains sound.

“However, we know uncertainty is the enemy of investment so worries about the economy here and abroad as well as possible knock-on effects to inflation and interest rates will not help confidence.”

CUATIOUSLY OPTIMISTIC

James Abbott, Head of Residential Sales at Savills, Stamford, Lincolnshire, says: “It’s been a very good month, with sales building as you would expect.

“I would prefer domestic and world politics to be a little less newsworthy.

“However, there’s a dynamic core to the house hunting public, if properties are at 2025 values.

“We are cautiously optimistic about the coming months.

SENSIBLE OFFERS NEEDED

David Robinson, Principal Owner at David J Robinson Estate Agents & Auctioneers in Cornwall, says: “As the sugar rush of the stamp duty holiday wanes the need for positive news in form of interest rate reductions will be needed to underpin positive market activity.

“The supply and demand balance is still somewhat in favour of buyers.

“Vendors need to be willing to take sensible offers in order to move forward.”

MARKET INTERVENTION

Tomer Aboody, director of specialist lender MT Finance, says: “Both buyers and sellers have been used to much lower rates and are hoping for further cuts in coming months.

“While sales volumes are up, they are still well below historical figures and some intervention will be needed in order to inject more life into the market.

“Unfortunately, particularly given further difficulties ahead as the fallout from the recent Budget continues, any positive intervention doesn’t seem to be on the immediate horizon.

“In the rental market, as landlords are continually hit, there is reducing availability of rental property for tenants, which is driving up rents.”