The drive to bring much needed reform into the property sector has led to property professionals being under more pressure than ever before.

Chaotic piecemeal legislation has caused much confusion and a general sense of uncertainty.

There is no doubt we live in a society where there is an ever-increasing claims culture.

Social media, chat rooms, blogs, podcasts, webinars, newspapers, television documentaries are just a few of the powerful mediums which serve to educate and facilitate the consumer to bring claims against property professionals.

COMPLAINTS INCREASE

When you add artificial intelligence (AI) NO WIN NO FEE law firms to the above list, it is hardly surprising the property sector is seeing an increase in complaints and claims frequency.

For many years there has been much talk around Regulation of Property Agents (RoPA) and the Renters Right Act. The latter received Royal Assent on 27th October 2025 and has been the subject of much speculation. Irrespective of what people may think, it is almost certain that the Renters Rights Act will bring about more consumer claims against Property Professionals.

And according to one poll, 25% of agents are not aware of the changes and only 4% are fully prepared.

The Property Ombudsman saw a 27% rise in consumers contact them in 2024. The Renters Rights Act will come with more responsibilities for agents and therefore more room for error. The consumer will enjoy added protection affording them more rights to pursue Property Professionals.

COMMON CAUSE OF PI CLAIMS

- Anti Money Laundering

- HMO Licensing

- Lodging Deposits Late

- Incorrect Prescribed Information

- Energy Performance Certificates

- Personal Injury

- Breach of Confidentiality

- Financial Sanction Regulation

- Gas Safety Certificates

- Referencing

- Material Information

- Data Protection

- Copyright Breach

- Discrimination

INCREASED RISK

Charlie Bending, Partner at DAC Beachcroft LLP, who specialises in defending claims against property professionals and their insurers, says: “We have seen a considerable uptick in claims against property managers and anticipate, with the increase in legislation in this sector, this is only the beginning.

“The Renters Rights Act will make widespread changes to the landlord and tenant landscape, but most notably introduce greater rights of security for tenants as well as remove no fault evictions, and we will see a new Ombudsman – the Private Sector Landlord Ombudsman.

“Change brings uncertainty and, therefore, increased risk, in addition to the increase in possession claims that will be brought about by the removal of the section 21 eviction process. Property managers need to familiarise themselves with these changes to ensure they are advising their clients appropriately.”

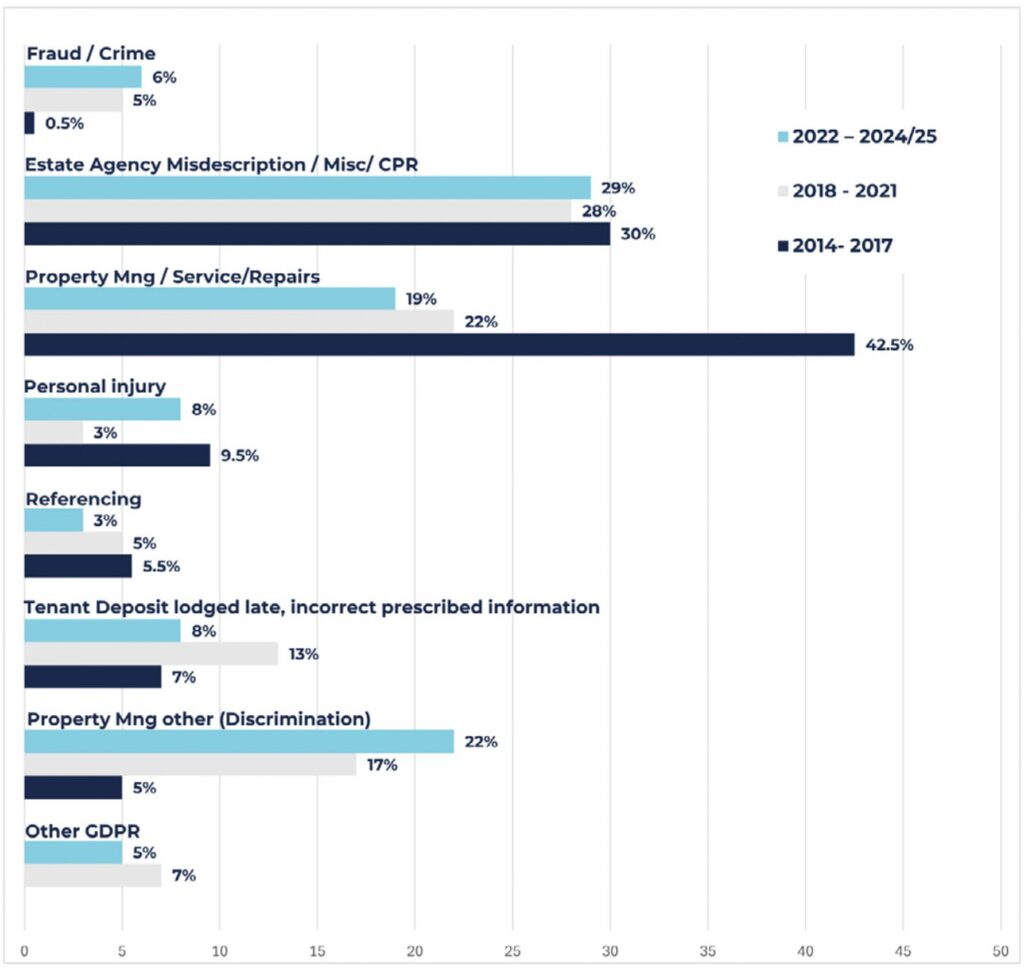

CHANGES IN CLAIMS FREQUENCY SINCE 2010

NO WIN, NO FEE

Property management claims continue to show consistent frequency and especially in connection with personal injury claims and failure to lodge deposits on time.

Both claim examples are often driven by No Win No Fee law firms. It has been well documented that the courts can award up to three times the value of the deposit where a deposit has not been lodged on time, therefore tenants are being much more attentive and especially if prompted by a No Win No Fee law firm.

The use of AI is influencing more claims and particularly where material information, referencing and copyright claims are concerned.

Tenants are easily able to use fake documents to pass the referencing process and search engines are now effortlessly able to identify intellectual property being used without permission.

We have also seen fake listings being posted by fraudsters purporting to be genuine agents.

CYBER RISKS

Nobody is immune to the threat of cyber-attacks and especially property professionals. Years of underinvestment in cyber protection and general complacency, coupled with increased amounts of data held and processed has created a vast playground for cyber criminals.

Most cyber events are down to human error. You can have the best cyber security, yet all it takes is a staff member clicking on a malicious link.

Property professionals hold sensitive and valuable data such as passports, account details, referencing information, security details for property, floorplans, evidence of proof of funds.

The consequences of this sort of data falling into the hands of cyber criminals can be costly and comes in the form of potential, investigation costs, ICO fines, third party claims, legal costs and expenses in defending claims, legal costs associates with writing to data subjects to alert them that their confidential data has not been kept secure.

In addition to the above costs, you need to also consider the cost from business interruption and brand reputational damage.

Gone are the days of the lone wolf cyber hacker, most criminal groups now run highly sophisticated operations exploiting ransomware, phishing campaigns and advanced social engineering techniques with ruthless efficiency.

“AI is going to play a big part in the next wave of cyber-crime.”

AI is going to play a big part in the next wave of cyber-crime. Attackers are now using generative AI tools to craft even more convincing phishing emails, mimic employee communications and automate intrusion attempts.

Cyber security has become a fundamental business priority. Business continuity plans with rehearsed incident response and recovery plans are no longer optional and can make all the difference when it comes to being on the receiving end of a targeted cyber event.

One small business in the UK is successfully hacked every 19 seconds

Over 50% of claims notified are capable of being successfully defended, and it is therefore extremely important to maintain and retain good record keeping.

BASIC CONTROLS NEED TO BE IN PLACE

- Regular password updates on all devices.

- Password complexity – Strict password rules should be implemented.

- Keep variety eg different passwords for different accounts.

- Do not share your password.

- Multi Factor Authentication.

- Staff training to be aware of phishing emails and the damage they represent.

- Software updates.

- Regular Patching.

- Ensure files are encrypted.

- Monitoring of mobile and home working procedures.

- Never, under any circumstances, should a payment be made to a new bank account without verbal confirmation that the account details are genuine.

- Dual sign off on payments.

- Cyber Insurance.

CYBER RESILIENCE STRATEGY

Cyber resilience means three things:

- Reducing risk – through prevention and security controls

- Mitigating harm – through backups, segmentation, and planning

- Insuring the residual risk – through cyber insurance that delivers when it counts

RISK MANAGEMENT GUIDENCE

Consumer protection is important and should be encouraged, however we are seeing an increasingly worrying trend where claimants are pursuing agents regardless of whether there is any substance to the claim, in the hope insurers shall settle.

Typically, the claim values are low eg £2,500 – £5,000 where going to court would cost the insurers more in defence costs therefore they settle out of court. Having a strict record keeping policy is crucial to protecting your position.

Below are some examples of some controls and procedures insurers encourage.

RECORD KEEPING

The importance of keeping up to date and accurate records is imperative when running any business, however when faced with a claim and especially a spurious claim, it can be very difficult not to take it personally.

To help defend your position, it is absolutely essential to always have accurate records in place including dated and timed phone notes. If insurers cannot mount a robust defence with good written evidence due to poor record keeping, this may result in a settlement regardless of whether the insured is at fault.

Robert Gibson of Tokio Marine HCC Claims, says: “Over 50% of claims notified are capable of being successfully defended, and it is therefore extremely important to maintain and retain good record keeping.

“Lack of documentation/evidence very often means that claims with a potential for being defended end up being paid.”

TERMS OF BUSINESS

Review your terms of business (with a solicitor) to ensure they are as thorough as possible. Recently we have seen claims brought under PI policies that could have been avoided, had the terms of business been more robust.

EXAMPLE ONE

Agents should protect their position as much as possible where market appraisals are provided. A market appraisal is an estimate only and not to be relied upon as an accurate assessment of value in place of a professional valuation. It should not be relied upon by a third party nor should it be used for loan purposes.

EXAMPLE TWO

Property owners insurance is taken out by a landlord to protect their rental property and the tenant that occupies it. A property manager has a duty of care to ensure the property they manage is suitably insured, however they cannot always rely upon the landlord to take out the correct policy, therefore it is sensible to clarify in the terms of business that the onus is on the landlord to ensure the correct insurance is in place for a rental property and that the property manager cannot be held responsible.

LODGING DEPOSITS

We continue to see a high frequency of claims being brought against agents for failure to lodge deposits on time.

Letting agents should have written and documented controls and procedures in place which are followed by all staff responsible for collecting deposits to ensure deposits are lodged and prescribed information issued within the required thirty day timeframe.

“Lack of documentation/evidence very often means that claims with a potential for being defended end up being paid.”

Even a simple periodic audit can offer an invaluable line of defence.

Check what system you have in place for lodging deposits. Can you improve your system through better diary systems, introducing internal audits, client account reconciliation?

Removing the risk entirely by outsourcing the client accounting functions to third party client account service providers is an option to consider.

NEW LEGISLATION

To ensure you are operating in accordance with the law, there are Government updates available online, via trade associations and there is plenty of guidance in the trade press.

FRAUD AND DISHONESTY

Introducing simple measures to ensure the security of your business could save you from costly litigation and brand reputational damage.

- Verifying account details and having dual sign off on payments.

- Weekly or monthly account/statement audits by a principal or by an independent third party.

- Monitor holiday: Often the inconsistencies/irregularities are brought to light during a period of absence. If employees are not taking holiday for prolonged periods of time, it should be an alarm bell. A 2 week continuous period of annual leave, should be encouraged.

BURDEN OF RESPONSIBILITY

Chris Mason, Chief Operating Officer at The Letting Partnership, says: “Property professionals, particularly those handling client money, carry a significant burden of responsibility.

“In our work supporting lettings and estate agents across the UK, we regularly encounter instances where funds have been misallocated or, in the worst cases, misappropriated.

“Despite the unfair perception that sometimes surrounds the industry, the vast majority of agents act with diligence and integrity.

“But the complexity of client accounting systems, combined with the fast pace of operations and the tens of billions of pounds flowing through the sector, creates plenty of opportunity for genuine error or oversight.

“Even a simple periodic audit can offer an invaluable line of defence. Detecting issues early, before they escalate into costly or reputationally damaging events, audits not only protect the business, but also preserve the trust of clients and regulators.

“More importantly, they can save property professionals from the unimaginable emotional toll that follows when something goes wrong. In that sense, audits shouldn’t be viewed as a burden or tick-box exercise, but as a practical tool for protecting both the business and the people it serves.”

MUST DO’S

- Notify a circumstance as soon as you are made aware of it.

- Disclose your full business activities at renewal and if there is any change mid-term.

- Pay the premium before the settlement due date.

- Check with staff ahead of renewal to make sure there are no notifiable circumstances.

- Check your policy is accurate and reflects the instructions given to the broker.

- Review data processing and security procedures to ensure GDPR compliant.

DON’TS

- Leave the renewal exercise until the last minute.

- Admit liability or agree to a claim settlement without insurers authority.

- Disclose insurers involvement when dealing with a claimant unless authorised to do so

- Hide information regarding historical claims.

- Leave viewers unattended and be especially vigilant on open days.

BETTER PROTECTED

The consumer is better protected than ever before. With the increasingly litigious society we operate in and legislation constantly evolving, property professionals are finding themselves more and more exposed to negligence claims.

It is critical that property professionals become more conscious of their duty of care to the consumer and the negative impact poor risk management can have on their business.

Whilst it is impossible to entirely remove the risk of a claim being brought, there are measures and controls that can be implemented to help mitigate potential threats.