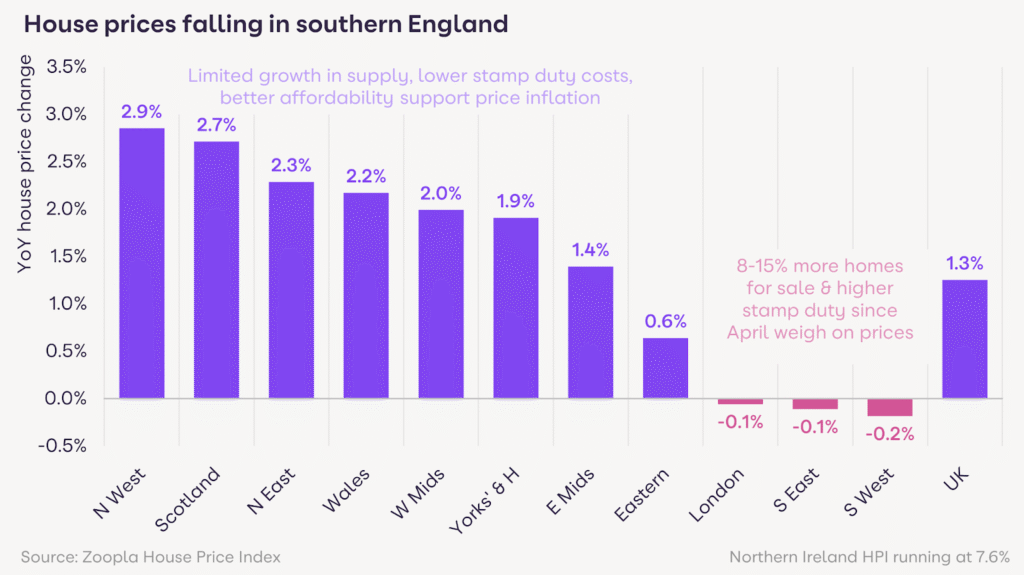

House prices across southern England have fallen year-on-year for the first time in 18 months as weeks of Budget speculation weakened demand and pushed sales volumes lower, according to Zoopla’s latest House Price Index.

Hints of a new annual property tax on homes over £500,000 had a clear and immediate impact.

Buyer demand fell 12% in the four weeks to 23 November, with fewer sales agreed and growing caution across the market. London, the South East and the South West all recorded marginal annual price declines of between 0.1% and 0.2%.

By contrast, markets with lower-value housing continued to show momentum. Average UK prices rose 1.3% over the year to £270,200, with the North West leading regional growth at 2.9%.

Affordable markets have been far less exposed to pre-Budget tax concerns, and continue to benefit from better relative affordability.

BUDGET REMOVES MAJOR THREAT

Much of the recent uncertainty has now been removed. The Autumn Budget did not include the feared annual levy on homes valued above £500,000 – a relief for owners of the 210,000 properties currently for sale at this level.

Zoopla expects the reversal to inject renewed confidence into early-2026 activity, particularly in southern regions where a higher share of stock sits above the £500,000 mark.

With supply rising and prices under pressure in the South, the removal of the tax threat could help stabilise conditions as buyers return to the market.

STAMP DUTY STILL WEIGHING ON MOVES

However, stamp duty continues to act as a brake on transactions. Thresholds for existing homeowners have been frozen since 2014, while prices have climbed 47% over that period.

The result is rising ‘fiscal drag’: more buyers pushed into higher tax bands and a growing tax burden on mainstream moves.

In 2019, 21% of home purchases by existing owners involved stamp duty costs above 2.5% of the price.

That figure has since risen to 33%, placing added strain on buyers in southern markets where average prices are already high.

With affordability tight and transaction taxes rising in real terms, calls for meaningful stamp duty reform – or abolition – continue to gather momentum across the industry.

BUDGET BARK WORSE THAN BITE

Richard Donnell, Executive Director at Zoopla, says: “The Budget bark was worse than the Budget bite for the housing market.

“Home buyers and sellers will welcome the end of the uncertainty that has stalled housing market activity since the late summer.

“Our data shows the underlying demand to move home remains strong. With greater certainty we expect a rebound in housing market activity that builds into the new year with households who paused home moving decisions over recent months return with greater confidence.”

And he adds: “The removal of the threat of a new annual property tax from 210,000 homes is particularly positive for the market and will help revive activity in higher-value areas across southern England where house prices are under pressure.”

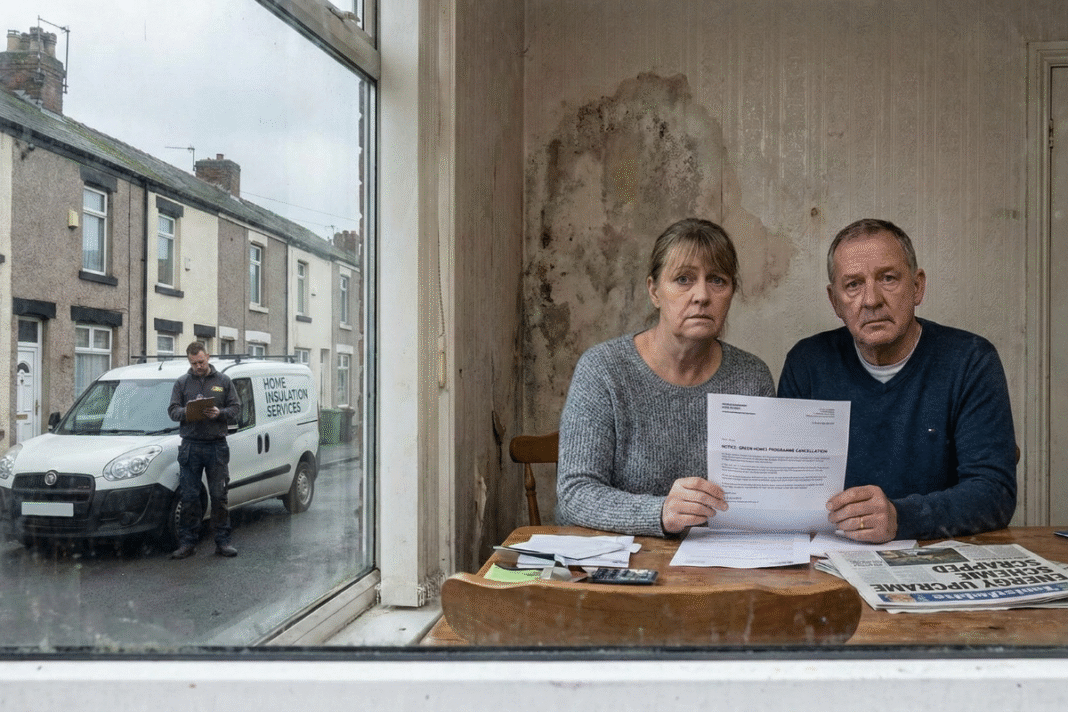

MANSION TAX WOES

Tom Bill, Head of UK Residential Research at Knight Frank, says: “There is more certainty after the Budget, which should allow demand to bounce back following months of speculation.

“However, there are still questions around the Mansion Tax. Until it is introduced in 2028, buyers and sellers face uncertainty around price thresholds and even once valuations are completed, they could be challenged, which would prolong the limbo.

“As the OBR has admitted, that could weigh on demand and transaction activity. The other risk is the precedent of a new tax.

“Over time, more properties will get dragged into the mansion tax net, which means the proportion of terraced houses, flats and semi-detached homes will grow, particularly in the capital. The term ‘mansion tax’ could increasingly feel like a misnomer.”

MISSED OPPORTUNITY

David Powell, CEO of Andrews estate agent, says: “After months of speculation, I am disappointed the Government has missed this opportunity to address the challenges around stamp duty and affordability.

“There will be much disappointment around the £2m+ mansion tax and it’s likely the South will get hit the hardest, we will eagerly await how this impacts the market and the unintended consequences that may follow.

“I suspect house price growth in the South may remain static in the short term whilst the market adjusts to the new normal.

“I expect the market to bounce back from any damage caused by leaked or shelved policies leading up to the Government’s Budget and we will see activity levels increase across the South throughout 2026.”

“The prospect of homeownership continues to prove extremely challenging for those taking their first steps onto the property ladder.”

Nathan Emerson, CEO of Propertymark, adds: “After much speculation, we have gained clarity on many future fiscal plans that will affect the housing sector following the Autumn Budget.

“A key takeaway was the proposal of a High Value Council Tax Surcharge, also referred to as a mansion tax, which will mean properties with a value over £2m will see a taxation upwards of £2,500 each year.

“This is of particular relevance in areas such as London and the South East, and when compounded with a deceleration of house price growth within these areas, has the potential to cause market uncertainty.

LACK OF SUPPORT

And he adds: “It has also been disappointing not to see targeted support for first-time buyers included within the Budget, with many deposits typically sitting at around £60,000.

“The prospect of homeownership continues to prove extremely challenging for those taking their first steps onto the property ladder.

“Overall, this may prove to be a missed opportunity by the UK Government to help promote long-term economic stability down the line.”