UK house prices jumped 3.2% year-on-year in September with prices in Northern Ireland climbing 8.6% in Q3, latest figures from Nationwide reveal today.

House prices rose at their fastest pace since November 2022 with average prices now around 2% below the all-time highs recorded in summer 2022.

Robert Gardner, NationwideRobert Gardner, Nationwide’s Chief Economist, says: “Income growth has continued to outstrip house price growth in recent months while borrowing costs have edged lower amid expectations that the Bank of England will continue to lower interest rates in the coming quarters.

Robert Gardner, NationwideRobert Gardner, Nationwide’s Chief Economist, says: “Income growth has continued to outstrip house price growth in recent months while borrowing costs have edged lower amid expectations that the Bank of England will continue to lower interest rates in the coming quarters.

“These trends have helped to improve affordability for prospective buyers and underpinned a modest increase in activity and house prices, though both remain subdued by historic standards.”

ACCELERATION

While Northern Ireland remained the best performer Scotland also saw a noticeable acceleration in annual growth to 4.3% (from 1.4% in Q2), while Wales saw a more modest 2.5% year-on-year rise (from 1.4% the previous quarter).

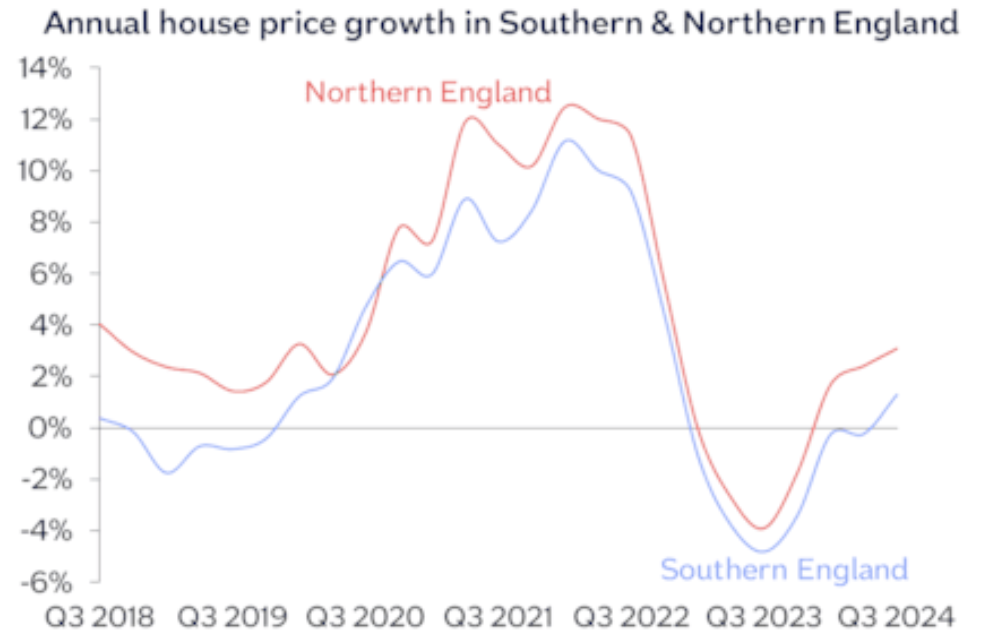

Gardner adds: “Across England overall, prices were up 1.9% compared with Q3 2023. Northern England (comprising North, North West, Yorkshire & The Humber, East Midlands and West Midlands), continued to outperform southern England, with prices up 3.1% year-on-year. The North West was the best performing English region, with prices up 5.0% year-on-year.

“Southern England (South West, Outer South East, Outer Metropolitan, London and East Anglia) saw a 1.3% year-on-year rise. London remained the best performing southern region with annual price growth of 2.0%. East Anglia was the only UK region to record an annual price fall, with prices down 0.8% year-on-year.”

INDUSTRY REACTION

Iain McKenzie, The Guild of Property ProfessionalsIain McKenzie, Chief Executive of The Guild of Property Professionals, says: “The biggest surge in house price growth in two years will be met with open arms by homeowners looking to sell.

Iain McKenzie, The Guild of Property ProfessionalsIain McKenzie, Chief Executive of The Guild of Property Professionals, says: “The biggest surge in house price growth in two years will be met with open arms by homeowners looking to sell.

“House prices usually remain robust at this time of the year, as there is still time to buy, complete and move in before Christmas.

“The final quarter of 2024 will hopefully be more of the same, if current market conditions remain in place. While continued positive growth mostly benefits sellers, it brings a sense of stability that buyers will appreciate once they have signed on the dotted line and do not want their property to devalue.

“Affordability concerns still loom for first-time buyers, but as earnings are currently outpacing house price growth, this should go some way towards bridging the gap for those who are close to getting their foot on the ladder.”

BUDGET 2024

“In a month’s time, the new Chancellor will take to the despatch box to unveil her first budget and give the property industry a good indication of how this government will engage with it.

“The theme of the Autumn Budget will likely focus on decisions that aim to grow the economy, while spending carefully, which will in turn keep the markets stable and avoid any shock waves to ripple down to the housing market.

“We need to see a renewed push to help people own their own home and any incentives from the Government to help further that goal would be welcome by buyers and sellers alike.”

MARKET HAS CHANGED

Jeremy LeafJeremy Leaf, north London estate agent and a former RICS residential chairman, says: “The market has changed and demand is improving which has coincided with lower mortgage rates and a more settled picture for inflation and politics.

Jeremy LeafJeremy Leaf, north London estate agent and a former RICS residential chairman, says: “The market has changed and demand is improving which has coincided with lower mortgage rates and a more settled picture for inflation and politics.

“This shift has resulted in more appraisals, listings, offers and firming pricing. But with choice of properties and mortgages rising, a fear of missing out is also prevailing. Uncertainty remains an obstacle, particularly at the higher end, probably at least until after the Budget at the end of October.”

STRENGTH TO STRENGTH

Guy Gittens, FoxtonsGuy Gittins, Foxtons Chief Executive, says: “Further positive house price growth in September suggests that market momentum has continued to build and there’s no doubt that buyer activity has strengthened following the cut to interest rates seen in August.

Guy Gittens, FoxtonsGuy Gittins, Foxtons Chief Executive, says: “Further positive house price growth in September suggests that market momentum has continued to build and there’s no doubt that buyer activity has strengthened following the cut to interest rates seen in August.

“We anticipate that the market will now go from strength to strength as we head into the Autumn season and what is traditionally a very active period for the UK property market and we’re already seeing more enquiries made, more offers submitted and more sales agreed, all of which bodes very well for the remainder of the year and beyond.”

DRIVE POSITIVITY

Ed Phillips, LomandEd Phillips, Lomand Chief Executive, says: “Stability has been key to the returning health of the UK property market and this stability has been gradually building since interest rates were held this time last year.

Ed Phillips, LomandEd Phillips, Lomand Chief Executive, says: “Stability has been key to the returning health of the UK property market and this stability has been gradually building since interest rates were held this time last year.

“However, it’s clear that the first base rate reduction in four years has helped to revitalise buyer activity, with house prices rising at their fastest rate in two years. With market confidence now at a high, this will only help to drive further positivity as we enter into the Autumn selling season.”

CONSIDERABLE IMPROVEMENTS

Verona Frankish, YopaVerona Frankish, Chief Executive of Yopa, says: “The current outlook is an extremely positive one when compared to just a year ago and we’ve seen considerable improvements on all fronts, with buyer demand climbing, more homes going under offer and sellers achieving stronger prices in the process.

Verona Frankish, YopaVerona Frankish, Chief Executive of Yopa, says: “The current outlook is an extremely positive one when compared to just a year ago and we’ve seen considerable improvements on all fronts, with buyer demand climbing, more homes going under offer and sellers achieving stronger prices in the process.

“As a result, house prices are now just 2% off the record highs seen during the summer of 2022 and we could well see a new record set before the year is out.

“Of course, it’s important to remember that the base rate still remains significantly higher than we’ve seen in recent years and whilst buyers are returning with confidence, we’re not quite out of the woods yet with respect to transactional volumes, which still remain someway off the previous pace.”

ECONOMY IS STABILISING

Nicky Stevenson, Fine & CountryNicky Stevenson, Managing Director at national estate agent group Fine & Country, says: “UK house prices saw their strongest annual growth in two years this September — up 3.2% — a positive sign that the economy is stabilising.

Nicky Stevenson, Fine & CountryNicky Stevenson, Managing Director at national estate agent group Fine & Country, says: “UK house prices saw their strongest annual growth in two years this September — up 3.2% — a positive sign that the economy is stabilising.

“As we head into autumn, we expect the market to gain even more momentum, driven by lower interest rates, steady inflation, and an uptick in buyer demand.

“Two years after the upheaval of Liz Truss’s mini-budget, mortgage rates have been steadily declining, drawing some hesitant buyers back into the market. But ongoing affordability challenges mean many are focusing on areas where they can maximise value for money.

“The Bank of England’s upcoming interest rate decision in November could further impact the market. Another anticipated rate cut could sustain buyer activity, maintaining the market’s upward trajectory.

“However, the upcoming October budget introduces new uncertainties, particularly with rumours of a potential increase to capital gains tax. This may prompt some investors and people with a second home to act quickly to finalise purchases before any tax hikes take effect.

“While the recent rise in house prices suggests a resilient market, recovery remains fragile. On the positive side, the combination of stabilising inflation and easing mortgage rates offers a more favourable environment for first-time buyers and those looking to move.”

RESILIENT MARKET

Marc von Grundherr, Benahm and ReevesMarc von Grundherr, Director of Benham and Reeves, says: “Although the new Labour government has been quick to wage war on the nation’s landlords, it certainly seems as though the nation’s homebuyers have been left out in the cold with respect to the upcoming Autumn Statement and any positive property market initiatives.

Marc von Grundherr, Benahm and ReevesMarc von Grundherr, Director of Benham and Reeves, says: “Although the new Labour government has been quick to wage war on the nation’s landlords, it certainly seems as though the nation’s homebuyers have been left out in the cold with respect to the upcoming Autumn Statement and any positive property market initiatives.

“However, as the latest figures show, it’s far from needed and the property market has continued to prove its resilience, with house prices now increasing at their fastest rate in two years and climbing close to historic record highs.

“With both mortgage approvals and house prices increasing consistently, and with the cost of borrowing starting to ease, the expectation is that the market will continue to improve under its own head of steam and without the need of government intervention.”

PENT-UP DEMAND

Matt Thompson, ChestertonsMatt Thompson, head of sales at Chestertons, says: “Pent-up demand, lower interest rates and sub-4% mortgage products resulted in more house hunters entering the market in September. In response to the uplift in buyer activity, and with looming changes to Capital Gains Tax in the upcoming Autumn Budget, we have also seen more sellers putting their property up for sale.

Matt Thompson, ChestertonsMatt Thompson, head of sales at Chestertons, says: “Pent-up demand, lower interest rates and sub-4% mortgage products resulted in more house hunters entering the market in September. In response to the uplift in buyer activity, and with looming changes to Capital Gains Tax in the upcoming Autumn Budget, we have also seen more sellers putting their property up for sale.

“We expect September’s level of market activity to continue in October but sellers will review their position following the Autumn Budget whilst some buyers await the next Bank of England announcement on interest rates in November.”

NEW STOCK

Amy Reynolds Antony RobertsAmy Reynolds, head of sales at Richmond estate agency Antony Roberts, says: “Plenty of new stock is coming to market, which is standard for this time of year, with well-priced properties attracting interest from buyers. We are agreeing a lot of sales at asking price, just under or even slightly over.

Amy Reynolds Antony RobertsAmy Reynolds, head of sales at Richmond estate agency Antony Roberts, says: “Plenty of new stock is coming to market, which is standard for this time of year, with well-priced properties attracting interest from buyers. We are agreeing a lot of sales at asking price, just under or even slightly over.

“While sellers may be encouraged by these price rises, we find if a property is too highly priced, applicants don’t waste their time and view. So if a property isn’t getting viewings, it is likely to be down to price, and the best advice we can give is to bring that price down to the market level.”

COMPETITIVE OFFERINGS

Nathan Emerson, Chief Executive of Propertymark, says: “As 2024 has progressed, it has been extremely positive to see a firm trend of growth emerge across the year within the housing market.

Nathan Emerson, Chief Executive of Propertymark, says: “As 2024 has progressed, it has been extremely positive to see a firm trend of growth emerge across the year within the housing market.

“We have seen the economy settle down to a position that provides far greater consumer confidence and although we are still at the very start of the journey regarding base rates, we are starting to see lenders introduce improved competitive offerings when it comes to mortgage deals, which is a firm foundation for confidence and growth over the coming months.”

FIRMER FOOTING

Mark Harris, SPF Private ClientsMark Harris, chief executive of mortgage broker SPF Private Clients, says: “Competition among lenders to offer cheaper mortgage rates is boosting housing market activity and property prices.

Mark Harris, SPF Private ClientsMark Harris, chief executive of mortgage broker SPF Private Clients, says: “Competition among lenders to offer cheaper mortgage rates is boosting housing market activity and property prices.

“Many buyers were waiting for rates to come down before taking action and now that the Bank of England has made that all-important first cut, with another expected in November, this will further encourage those who may be wavering.

“The housing market appears to be on a firmer footing with buyer and seller confidence noticeably stronger.”

WIDER RECOVERY

Tanya Elmaz, TogetherTanya Elmaz, Director of Intermediary Sales at Together, says: “The 3.2% annual rise in house prices is a further sign of the market’s wider recovery. Activity continues to tick over, despite there being some reservations around what’s to come from the Autumn Budget.

Tanya Elmaz, TogetherTanya Elmaz, Director of Intermediary Sales at Together, says: “The 3.2% annual rise in house prices is a further sign of the market’s wider recovery. Activity continues to tick over, despite there being some reservations around what’s to come from the Autumn Budget.

“Indeed, while most buyers and sellers are pressing on with their property plans, with Starmer’s warnings of the ‘tough’ announcements expected next month and the Bank of England deciding to hold rates this month, some may prefer to wait for further falls in mortgage rates before making their property move.”

STRONG END

Tomer Aboody, MT FinanceTomer Aboody, director of specialist lender MT Finance, says: “A strong September has seen prices increase to very close to the highest recorded levels from 2022.

Tomer Aboody, MT FinanceTomer Aboody, director of specialist lender MT Finance, says: “A strong September has seen prices increase to very close to the highest recorded levels from 2022.

“With mortgages at a more affordable levels and the Bank of England expected to reduce rates again, we are hoping for a strong final quarter, although the autumn Budget is yet to come and we have already been warned.”

Source: Nationwide

Source: Nationwide