Self-employed agents continued to gain market share of newly instructed sales properties in 2024 by nearly one third, most notably increasing their portfolios for terraced houses and properties within the price bracket of £200k – £350k, latest data from TwentyEA reveals.

A breakdown of the figures showed self-employed agents’ market share rose by 0.4 percentage points to secure 1.8% of the overall market – a YoY rise of 31%.

In contrast, online agents’ market share dropped by 0.4 percentage points to 5.2% of the overall market for new instructions – which equates to a YoY drop of over 7%.

Online agents are defined as estate agents who do not have a high street branch network, while self-employed agents are those identified as brands who contract with self-employed personnel and in this relationship, the brand does not determine the territory or the conditions of employment.

IMPRESSIVE GROWTH

TwentyEA, part of the TwentyCi group, carried out their research as part of their latest Property and Homemover Report.

They found online agents were losing share from all types of property instruction but the largest declines were for terraced housing. Meanwhile, self-employed agents saw impressive growth in share, with gains across all property types.

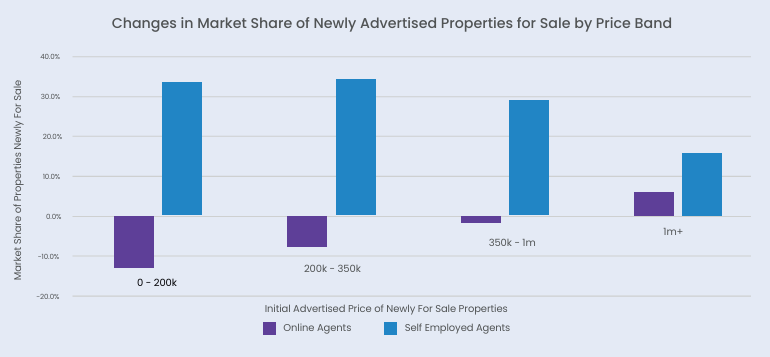

Further analysis shows that self-employed agents gained across every single price category – most successfully in the £200k – £350k bracket – as shown in the chart below.

For online agents’, their market share of new instructions fell in all price bands except £1m+ properties. Their most significant decline in market share was seen in the least expensive properties between £0-200k.

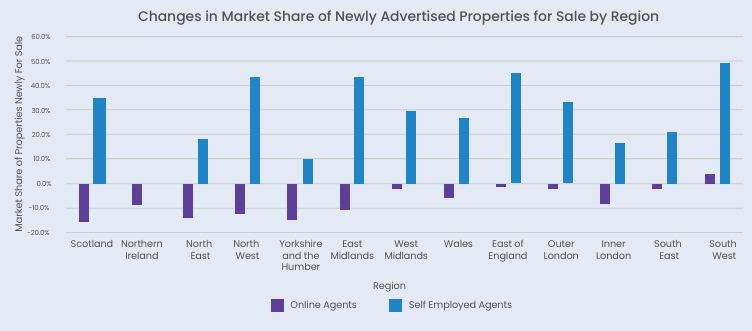

Regional analysis showed online agents lost ground across the UK, except for the South West. Notably, they experienced a more substantial loss of market share in the North, whereas self-employed agents gained market share everywhere, with the exception of Northern Ireland, where the model has yet to be properly established.

Their instructions increased the most in the South West, the East, the North West and in Scotland as seen in the chart below.

Katy Billany, Executive Director of TwentyEA, says: “We have been tracking the market share for both the online and self-employed business models for some time and have noted how the growth trajectory of self-employed agents is continuing to travel in one direction only.

“We’ve looked at many different metrics within our research and seen how they have continued to grow their market share while online agents are generally losing ground.”

AVAILABLE STOCK

Across the UK there has been an increase in the volume of available properties for sale, except in Northern Ireland, which experienced a 17% reduction.

This growth in available properties was highest in the South West (at 15.5%) which may reflect efforts to sell second homes before changes in stamp duty or local taxation measures.

Cornwall, for example, will charge an additional 100% council tax premium on second homes from 1st April 2025 and in Wales (where available stock grew 9.6%) the council tax premium can be up to 300%.

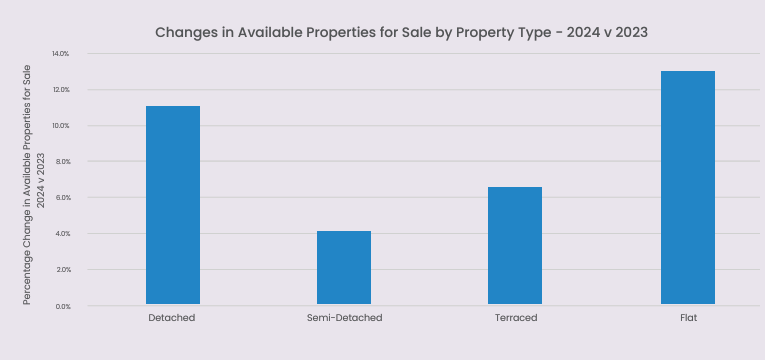

Within the growing stock, there has been a significant increase in the volume of flats available for sale (13%), with detached homes (11%) following closely behind. The increases in the availability of semi-detached homes have been more subdued, standing at just over 4%, as seen in the chart below.

MARKET INDICATORS

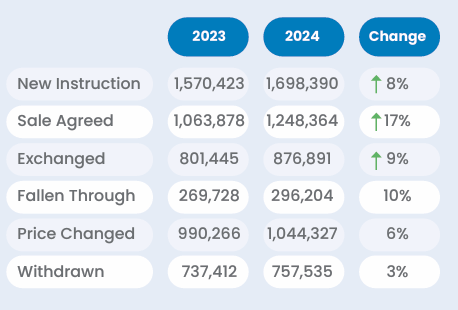

In 2024, there were 1,250k Sales Agreed, an increase of 17% compared to 2023. While many challenges persist, the desire to be an owner-occupier and the recalibration of affordability expectations have delivered a market that demonstrates both resilience and renewed momentum.

Billany adds: “In 2024 the market picked up considerably compared with the previous year following a large jump in both supply and demand and is looking robust.

“With a new Government in place which aims to increase housing supply, it will be interesting to see how quickly this can be achieved given the known supply chain issue and workforce considerations.

“Alongside significant calls for buying and selling reform, both factors will impact prices if stock numbers increase and transactions become easier.”