Britain’s property auction market showed resilience over the summer with residential sales underpinning growth even as commercial activity weakened.

Data from Essential Information Group (EIG) shows that more than 4,500 lots were offered at auction in July, a 3.6% increase on the same month last year. Total receipts rose 8.3% to £662.4 million.

David Sandeman, managing director of EIG, says: “Auction activity remained resilient over the summer, with national figures showing year-on-year growth in both volumes and values.

“Residential property was the standout sector, with lots offered up 4.2% and receipts up 13.5%, reflecting sustained buyer demand.”

MIXED PICTURE

But he adds: “Commercial, however, showed a more mixed picture: lots sold were down 9.2% year-on-year in July and receipts fell nearly 10%, underlining a more cautious mood among investors in that sector.

“Even so, several regions including the East Midlands, North-West, North-West Home Counties, and Yorkshire & The Humber reported double-digit gains in total raised, highlighting a robust appetite in key markets despite varying local trends.”

SPEED AND CERTAINTY

Stuart Collar-Brown, president of NAVA Propertymark, says that the buoyant residential market reflects sellers’ growing appetite for the speed and certainty offered by auction sales.

“The outstanding growth in the residential sector year-on-year further demonstrates what we are seeing in the market as more people are considering selling by auction for the higher level of security and certainty during these uncertain times.”

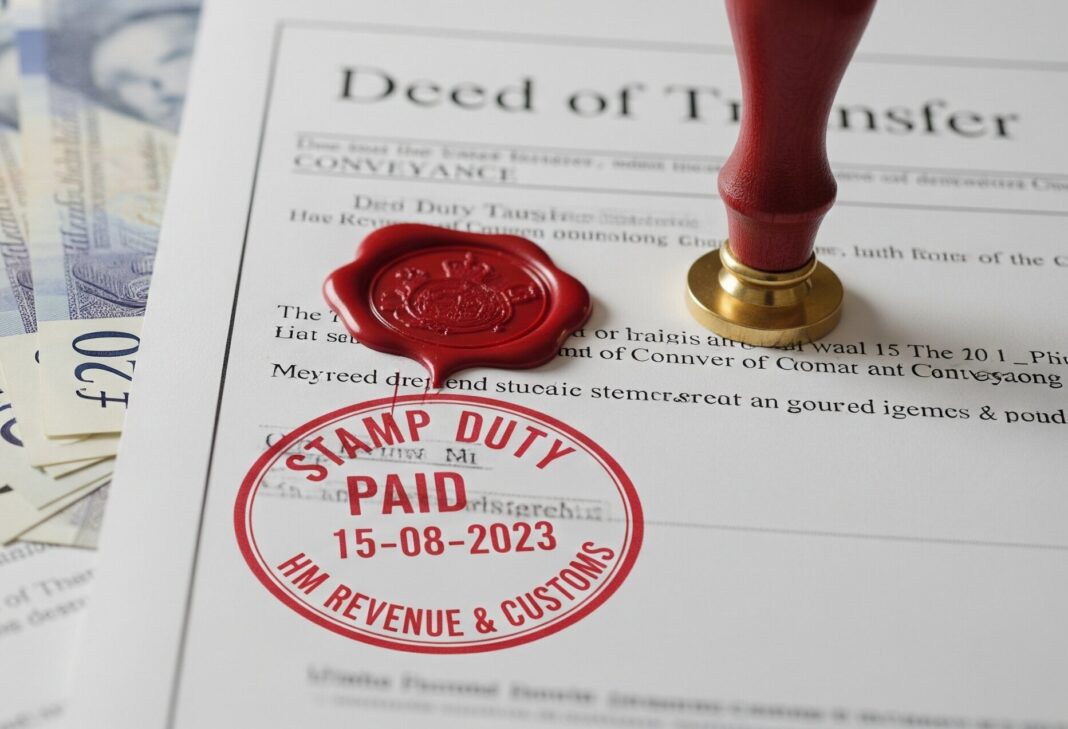

Collar-Brown adds that one challenge for buyers was the higher stamp duty threshold, with many bidders not purchasing properties as primary residences.

INVESTOR CAUTION

On the commercial side, he reckons investor caution was being driven by weakness in retail.

He says: “The commercial market has some way to go but this is mainly down to a lack of confidence in the retail market where the unsettled inflation rate is hurting the High Street and thus making commercial buyers cautious, especially if leases have less than two years remaining.”

Even so, Collar-Brown points to a “generic shift” from residential to the commercial and industrial sectors among investors, suggesting confidence could return as economic conditions stabilise.