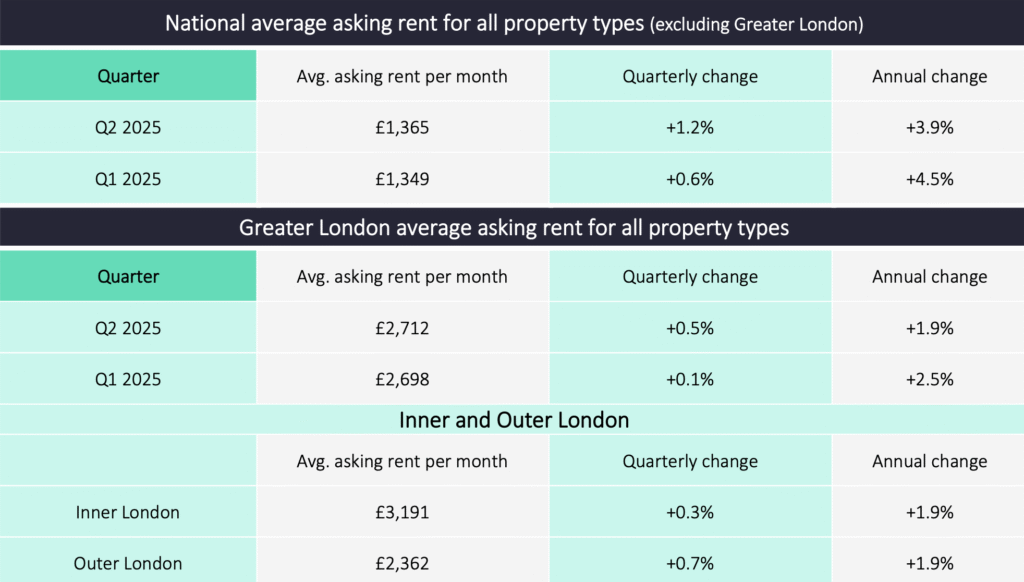

The average advertised rent of new properties coming onto the market outside of London has risen by 1.2% this quarter to a new record of £1,365 per calendar month (pcm), latest data from Rightmove reveals.

Despite another new record, the average asking rent for a home outside of London is now 3.9% higher than this time last year, the lowest this annual growth figure has been since 2020.

Average advertised rents for new properties in London also rose by 0.5% this quarter to £2,712 pcm, a 15th consecutive record for rents in the capital.

Now five years on from the pandemic starting, the average monthly rent that a new tenant will pay is over £400 (+£417) more than 2020. This is an uplift of 44%, outpacing the increase in average earnings over the same period, which have risen by 36%.

RENT RISES SLOWING

However, much of this growth in rents occurred during the frenetic pandemic years of 2021 and 2022. Since 2023, yearly rent rises have been gradually slowing.

The slowing in the pace of rent growth has been largely due to the balance between supply and demand improving. We’re currently seeing the best balance between supply and demand in the rental market since 2020, as the market continues to cool and recalibrate after the pandemic years.

The number of available properties to rent is now 15% higher than at this time last year, with the North East (+33%) leading the way. However, it is still 29% below 2019’s level.

TENANT DEMAND EASING

Tenant demand has also eased by 10% versus last year. The combination of these two metrics together means that the average number of enquiries a typical rental property receives is now 11. This is down from 16 last year, but up from seven at this time in 2019.

In further positive signs for supply in the market, the latest snapshot of buy-to-let lending from UK Finance shows that there has been an uplift in rental property investment compared with last year.

The total number of loans for buy-to-let properties is up by 17% so far this year versus the same period last year. This includes both new home purchases and remortgages, and encouragingly, the number of new rental home purchases is up by 28%.

BUY-TO-LET INVESTMENT

More investment into the buy-to-let sector from landlords is good for tenants, as it brings much needed rental homes into the sector, and a better balance of supply and demand helps to keep rental price increases at more moderate levels.

A knock-on effect of a less frenzied market is that homes are taking longer to find the right tenant, and the advertised rent is more likely to be reduced.

It’s taking an average of 25 days for a home to be marked let agreed on Rightmove, up from 21 days last year and 18 days during the pandemic frenzy at this time in 2022.

Nearly a quarter (24%) of rental homes see reduction in price during marketing, the highest this figure has been since 2017.

THE BIG PICTURE

Rightmove’s property expert Colleen Babcock says: “Despite another new record in average asking rents for tenants, the big picture is that yearly rent increases continue to slow, which is good news for tenants.

“Supply and demand is slowly rebalancing towards more normal levels, though we still have a way to go before we reach pre-2020 levels of available homes for tenants.

“The good news is that the latest industry snapshot suggests more investors are taking out buy-to-let loans compared with last year, which should help to bring even more homes to the rental market.”

INDUSTRY REACTION

Alex Caddy, Manager at Clarkes Estate and Letting Agency, says: “The rental market has undergone a marked shift in 2025. After several years of sharp rent inflation post-pandemic, tenants hit a ceiling by late 2024, leading to widespread price slowdowns.

“Competitively priced, well-presented properties continue to attract strong interest, echoing trends seen in the sales market. However, the market is now dealing with a much higher supply of rental homes, a complex reversal of previous trends.

“Some landlords have exited the sector over the past two years due to rising regulatory and financial pressures, but with the sales market slowing in some areas, a growing number of those properties have re-entered the rental market.”

ADAPTING MARKET

Andrew Ralph, Managing Director, Lettings at LRG (Leaders Romans Group) says: “We’re seeing a shift in the rental market this quarter.

“Stock levels are up, and demand remains strong but more measured, bringing us closer to a sustainable balance.

“Average rents are still rising year-on-year, but at a slower pace.

“Pricing correctly from the outset is key, and being quick to adjust price in line with market response helps avoid unnecessary void periods.

“Tenant affordability is a key focus. Matching the right tenants to the right homes is becoming more important than ever. The best outcomes, for landlords and tenants alike, are coming where there’s transparency, realistic pricing, and a shared understanding of future expectations.

“While some landlords are choosing to exit, the volume remains broadly in line with recent years.

“What’s more notable is the rise of a new generation of professional, tech-savvy investors entering the market, often with a long-term focus on capital growth. Many portfolio landlords remain active, particularly in areas with strong yields.

“The market is adapting, and while the challenges are real, the opportunities are still there for those taking a strategic view.”

SUPPLY AND DEMAND DISPARITY

Megan Eighteen, President of ARLA Propertymark, says: “Many landlords within the private rental market are grappling with substantial hikes in their overall costs, including increased taxes, unfavourable mortgage rates, and ongoing regulatory challenges.

“These factors are making property investment less appealing and potentially riskier.

“Consequently, this is exacerbating the disparity between supply and demand for housing, and we’ve seen a significant impact on rental prices, which vary regionally.

“It is clear to see that many landlords may now be struggling to justify their current or future property investments, especially if costs and the number of regulations continue to rise.

“It is crucial for all governments across the UK to recognise the vital role the private rented sector plays in accommodating the nation’s housing needs and provide urgent support to enhance the supply of homes while effectively lowering rent levels in the long term.”