The UK rental market is cooling after five years of rapid increases with new data from Zoopla showing the slowest annual rise in rents since 2020.

Average rents rose 2.4% in the year to August, less than half the rate seen a year earlier and the weakest pace of growth in four years. The typical monthly rent now stands at £1,300, £30 higher than a year ago.

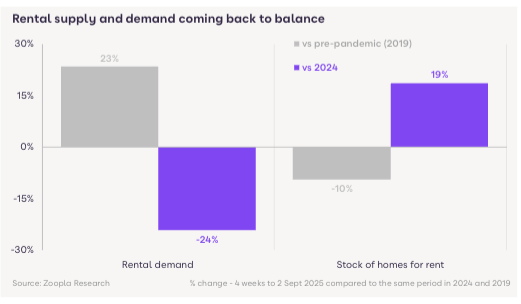

The slowdown comes as demand eases and supply improves. Letting agents are receiving 24% fewer enquiries from prospective tenants compared with a year ago, while the number of homes available to rent has risen 19%. On average, each branch now has 19 properties to let, up from a low of 14 in 2022.

Several factors are reshaping the market. Tighter visa rules have contributed to migration levels almost halving in 2024, reducing rental demand.

STABLE MORTGAGE RATES

At the same time, more stable mortgage rates and rising incomes are encouraging renters to move into home ownership.

A change in mortgage affordability rules at the start of 2025 boosted first-time buyer borrowing capacity by 20%, helping drive a 30% rise in first-time buyer mortgages over the past year. As these buyers vacate rental homes, more stock is returning to the market.

Landlords are also re-entering. Rents have climbed 36% since 2020, supporting higher returns and prompting a 60% rise in new buy-to-let loans. This is adding to supply, particularly outside London.

The South West and East Midlands have seen rental stock rise 36% and 31% respectively, with many homeowners opting to let properties rather than sell in slower markets.

CAPITAL CONSTRAINT

Conditions remain tighter in the capital, where supply has increased only marginally. High deposit requirements for landlords – averaging £187,000 compared with £29,000 in the North East – and a higher proportion of investors seeking to sell are constraining growth in available homes.

Affordability remains a challenge despite slowing growth. Rents are almost £80 a week higher than five years ago, an increase of £4,100 a year. At a regional level, annual growth now ranges from below 2% in London, Scotland and Yorkshire and the Humber to 4.6% in the North East, while cities such as Bristol and Leeds have recorded modest annual declines.

Zoopla expects rental growth to average 3% in 2025 as the market continues to rebalance, though demand is likely to remain above pre-pandemic levels given the ongoing cost of home ownership.

CONDITIONS NORMALISING

Richard Donnell, Executive Director at Zoopla, says: “Rental market conditions are starting to normalise which will be very welcome news to renters.

“Lower migration and better mortgage availability for first time buyers are easing the scale of the competition for rented homes.

“There is also more choice for renters with more homes for rent as landlords start to buy homes once again and some owners who can’t find a buyer listing their homes for rent.

“The affordability of renting remains a key constraint on the pace of future rental inflation and we expect rents to be three per cent higher by the end of the year at an average of £1,320 a month.”

INDUSTRY REACTION

Peter Maskell, Managing Director of Brock Taylor located in Sussex, adds: “The South East rental market is rebalancing, with more homes available and rent growth easing, giving tenants more choice than we’ve seen in recent years.

“For landlords, success now hinges on being realistic with pricing and ensuring properties are both well-presented and well-located, as these are the homes that continue to attract strong demand even as the market steadies.”

WELCOME NEWS FOR TENANTS

Nathan Emerson, Chief Executive of Propertymark, says: “A cooling in rental prices isn’t necessarily as detrimental for landlords, given that mortgage products have improved, providing those with buy-to-let tracker mortgages an easing in financial pressure, which can mitigate the impact or reduce rent rises.

“The stabilisation of rental levels will equally be welcomed by many tenants who have been struggling against the rise in inflation over the past few years, which exceeded what people have been historically used to.

“Not only have the increases in the cost of living pushed rent prices up, but they have also, in part, been caused by an imbalance of supply and demand.”

COMPETITIVE EDGE

Adam Jennings, head of lettings at Chestertons, says: “London has always had a competitive rental market due to an ongoing supply and demand imbalance.

“This has only intensified over the past months as some landlords have decided to sell up, which has led to a decrease in the number of available rental homes in the capital.

“As the volume of tenant enquiries remains high, however, we are seeing multiple enquiries for a single property.

“This is resulting in London rents not seeing the price adjustment the market is witnessing on a national level.”