The UK’s multi-year rental boom is showing clear signs of cooling, with new figures from property portal Zoopla revealing the slowest rate of rental growth in almost four years.

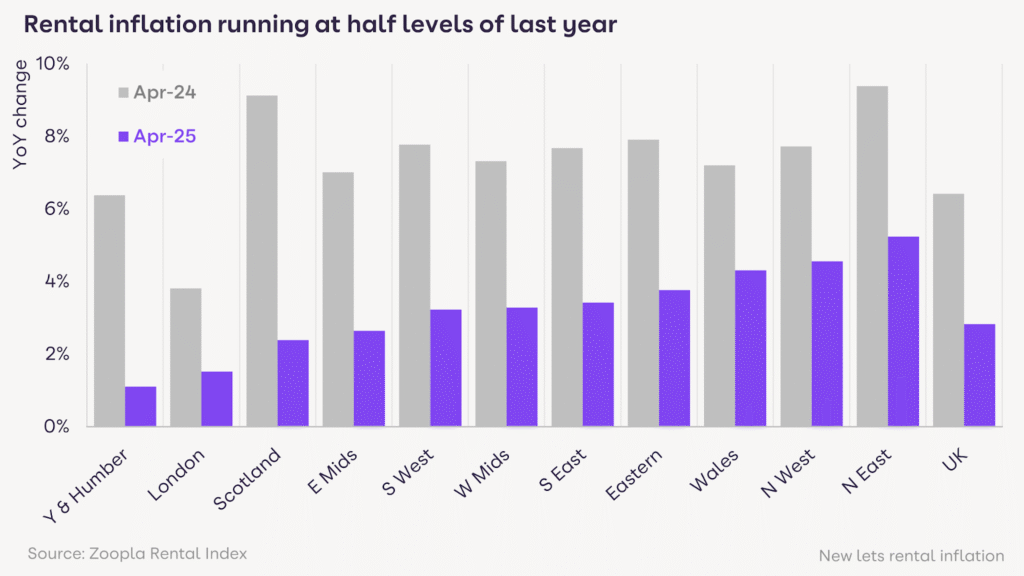

According to the firm’s latest Rental Market Report, average rents for new tenancies rose by just 2.8% in the year to April 2025 – less than half the pace recorded a year earlier (6.4%) and the weakest annual growth since July 2021.

The average monthly rent now stands at £1,287, up £35 over the past 12 months.

While the moderation in growth may bring some relief to stretched tenants, the broader market remains characterised by entrenched supply shortages and deepening affordability concerns, particularly for low- and middle-income renters.

REGIONAL COOLING

The slowdown is being felt across the UK, with all regions posting weaker annual growth. Yorkshire and the Humber saw rental inflation fall sharply to 1.1%, down from 6.4% in 2024, dragged down by stagnant rents in key university cities such as Leeds (-1.5%), Sheffield (1.9%) and Bradford (1.4%).

In Scotland, the impact of affordability constraints and the phased removal of rent controls has seen growth slow from 9.1% to 2.4%. Rents in Dundee have fallen by 2.1%, a reversal from 5.8% growth a year earlier.

Even London is not immune: while average rents in the capital remain high at £2,175 per month, annual growth has slowed to just 1.5%. Several inner London postcodes, including parts of North West and West Central London, are now seeing marginal year-on-year declines.

By contrast, some more affordable commuter locations and secondary cities continue to post above-average growth. Wigan and Carlisle both recorded increases of 8.8%, while Chester saw rents rise by 8.2%. However, these hotspots are increasingly rare – only five UK postal areas are now seeing rental growth above 8% annually, compared with 52 a year ago.

RENTS OUTPACE HOUSE PRICES

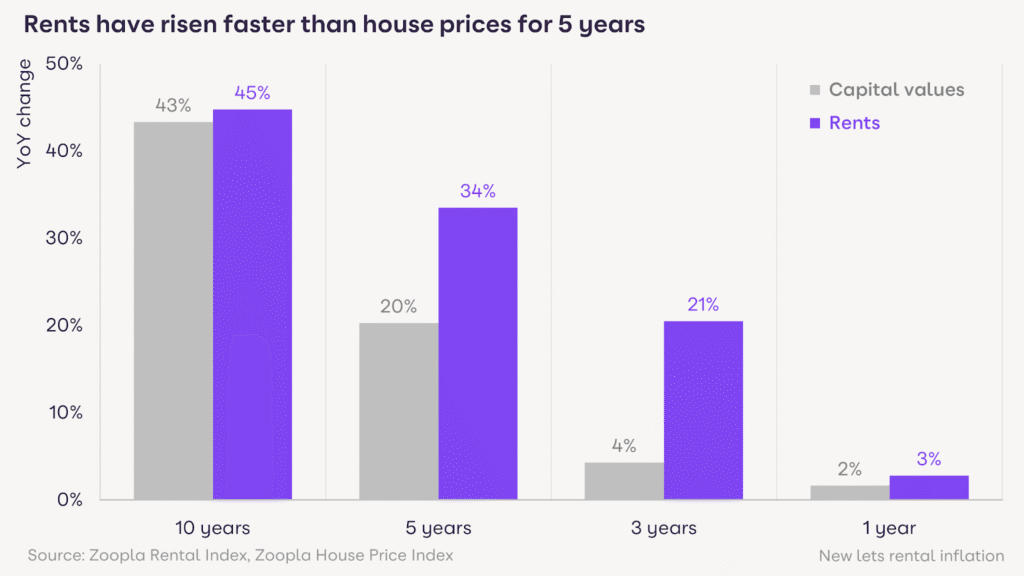

While rental growth is slowing, it continues to outpace house price inflation by a wide margin. Since 2022, average rents for new tenancies have risen 21%, compared to just 4% for house prices, according to Zoopla’s analysis.

That disparity equates to a £219 increase in average monthly rents – roughly mirroring the increase in average monthly mortgage repayments over the same period. Over three years, annual rental bills have risen by £2,650, from £12,800 to £15,450.

This divergence reflects a structural imbalance between rental supply and demand that is only partially being corrected.

DEMAND EASES

Despite the slowdown in rental inflation, the fundamentals of the market remain tight. Zoopla reports that rental demand is down 16% year-on-year but remains 60% above pre-pandemic levels.

A 50% drop in long-term net migration in 2024 – driven in part by a decline in overseas students and skilled workers – has eased some pressure on the rental market. Meanwhile, improved access to mortgage finance and recent changes to bank affordability assessments are enabling more higher-income renters to transition into home ownership, particularly first-time buyers.

But the supply of homes to rent remains significantly constrained. While the number of rental listings is up 17% over the past year, total availability remains 20% below 2019 levels. A slowdown in new investment from private and institutional landlords – deterred by tax changes and regulatory uncertainty – continues to hamper growth in rental stock.

2025 OUTLOOK

Looking ahead, Zoopla expects rents to continue rising in 2025, albeit at a more moderate pace. Annual rental inflation is forecast to settle between 3% and 4% by year-end, barring any sharp changes in migration or interest rate policy.

However, affordability pressures are likely to persist – particularly for lower-income tenants, who face limited options amid constrained supply and shrinking local housing allowances.

LOWEST LEVEL FOR FOUR YEARS

Richard Donnell, Executive Director of Research at Zoopla, says: “Rents rising at their lowest level for four years will be welcome news for renters across the country.

“The average annual cost of renting is over £2,500 a year higher than three years ago, the same as the increase in average mortgage repayments for homeowners.

“While demand for rented homes has been cooling, it remains well above pre-pandemic levels sustaining continued competition for rented homes and a steady upward pressure on rents. The pressures are particularly acute for lower to middle incomes with little hope of buying a home and where moving home can trigger much higher rental costs.

“The rental market desperately needs increased investment in rental supply across both the private and social housing sectors to boost choice and ease the cost of living pressures on the UK’s renters.”

INUDTRY REACTION

Adam Jennings, head of lettings at Chestertons, says: “Overall, the UK’s rental market remains highly competitive as a growing population results in a continuous requirement for suitable housing.

“Whilst some areas of the UK may have witnessed an adjustment in supply or demand levels as well as rental inflation, the majority of cities and particularly London, still see a single property attract several tenant enquiries.

“Despite occasional market fluctuations, demand will likely always outweigh supply which can result in a challenging property search for tenants.

“In fact, based on 2025 market trends this summer may be the most competitive we have seen for many years.

“To stay ahead of the competition, tenants are advised to start their property search as early as possible but also establish what they might be prepared to compromise on whether that’s price, location or the size of the property.”

UPWARDS PRESSURE REMAINS

Tom Bill, head of UK residential research at Knight Frank, says: “Rental value growth has cooled over the last year but upwards pressure remains thanks to tight supply.

“While some demand has transferred to the sales market as mortgage rates edge lower, a number of landlords have sold due to the tougher regulatory and tax landscape.

“As the Renters’ Rights Bill comes into force over the next 12 months, the upwards pressure on rents could intensify if landlords see added risks around the repossession of their property and void periods.”

INCREASED LANDLORD COSTS

Angharad Trueman, President of ARLA Propertymark (Association of Residential Letting Agents), says: “It’s interesting to see that rent growth has slowed year on year. This is more than likely down to rent levels reaching their peak in many places across the UK, as they have been rising to unrealistic levels for years.

“From the outside looking in, it may look as though landlords and their greed are at the heart of this problem, however, this is not the case.

“A significant number of landlords face increased costs across the board, from continuous legislative hurdles, tax hikes, and mortgage increases, many are struggling to break even on their costs.

“Crucially, the fundamental pressures and reasons for these rises remain. The bombardment and penalisation of landlords is pushing many to leave the market altogether or prohibit new investors from entering, which is creating an ever-growing undersupply of private rented homes against a backdrop of increasing demand from renters.

“It’s crucial that support is available and incentives are introduced for investment moving forward in order to make private rented housing more affordable in the long term.”

MORE RENTAL HOMES NEEDED

Louisa Sedgwick, Managing Director of Mortgages at Paragon Bank, says: “It’s positive that supply pressures in the rental market ease over the period and rent inflation has tempered, although demand is still significantly higher than pre-pandemic levels, with stock remaining depressed compared to that period.

“This long-term structural rental market supply demand imbalance will only deteriorate unless action is taken to boost the number of rental homes available, particularly as population growth and household formation is forecast to accelerate over the next few years.

“It is important that the economic and regulatory environment is one that provides landlords with the confidence to not only remain in the sector, but to grow their portfolios and provide much-needed new rental stock.”