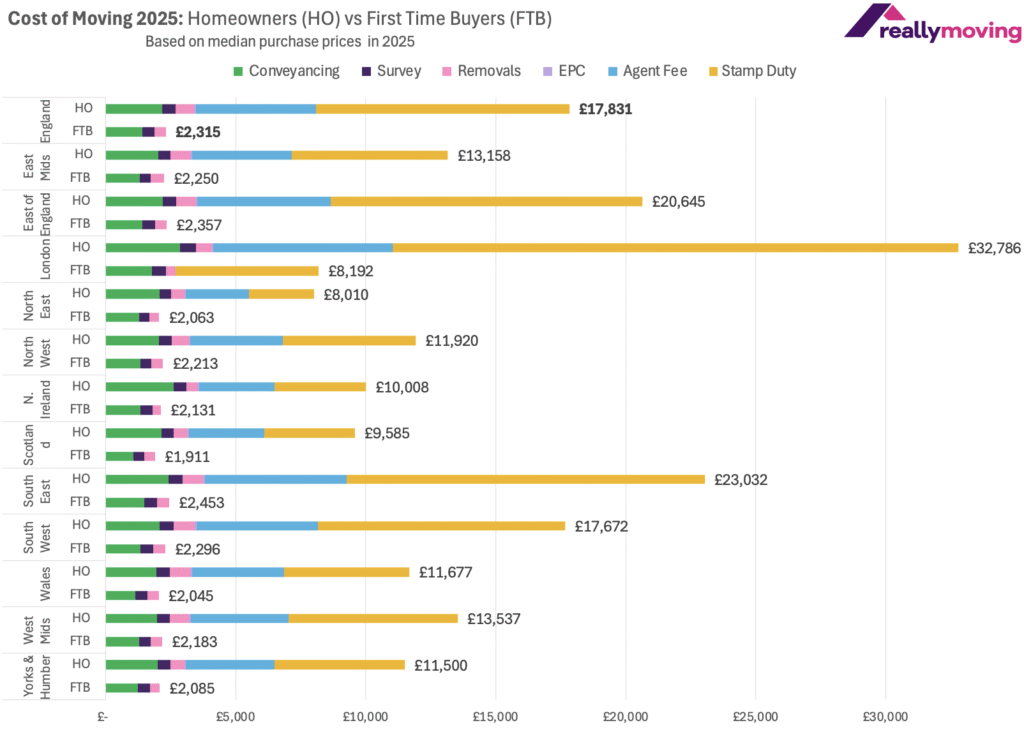

The cost of moving home in England has surged to a record £17,831, placing the highest financial burden on buyers and sellers since records began, according to reallymoving’s annual Cost of Moving Report.

The comparison site analysed 181,000 quotes to calculate typical 2025 moving costs, factoring in stamp duty, conveyancing, estate agency fees, a Level 2 RICS survey, EPC and removals. The total is now 27% – or £3,786 – higher than in 2024, when the average bill stood at £14,045.

The sharp rise is largely driven by stamp duty following the reintroduction of lower thresholds in March, but almost every other cost has also crept up.

Conveyancing fees have climbed 8.7%, survey charges are up 6.5%, and removals now average £709 for a sub-30-mile move. Only the £65 EPC has remained unchanged.

MOBILITY BARRIER

Rob Houghton, Chief Executive of reallymoving, says that the figures highlight “a stark reminder of how transaction costs are acting as a significant barrier to mobility, market fluidity and broader economic growth”.

He adds: “The overwhelming cost of moving home now swallows up 46% of the median annual salary in England.”

CAPITAL BURDEN

Costs in London far exceed the national picture. A typical mover in the capital will pay £32,786 to buy and sell a home – equivalent to 69% of the median London salary. Much of the burden comes from higher house prices.

Based on a median purchase price of £635,000, Londoners face £21,750 in stamp duty, £6,887 in estate agency fees and £2,859 in conveyancing charges.

London is also now the only part of the UK where first-time buyers (FTBs) are liable for Stamp Duty on a median-priced property. With a £5,500 tax bill added to other costs, total upfront expenses for FTBs in the capital have reached £8,192.

Despite a slight fall in London’s median FTB purchase price, down to £410,000 from £425,000 last year, moving costs have soared as a result of the threshold change.

By contrast, homeowners in the North East face an average moving bill of £8,010 – just a quarter of the London figure. Costs remain far lower across Yorkshire & Humber (£11,500) and the North West (£11,920), reflecting reduced exposure to Stamp Duty.

HALVE MOVING COSTS

Speculation that the Chancellor may replace stamp duty with an annual property tax of 0.54% on homes valued above £500,000 could dramatically reduce upfront costs.

Reallymoving estimates the average cost of moving in England would fall to £8,081 if stamp duty were scrapped, based on the national median purchase price of £325,000.

Houghton says such a reform “would immediately lower the financial barriers to moving and inject fresh momentum into the lower to mid-market”, though the true impact would depend on valuation thresholds and the rate set.