The prime London property market posted a strong recovery in March after a subdued start to the year but underlying indicators suggest continued volatility, with falling prices and a rise in discounting pointing to ongoing sensitivity around valuations.

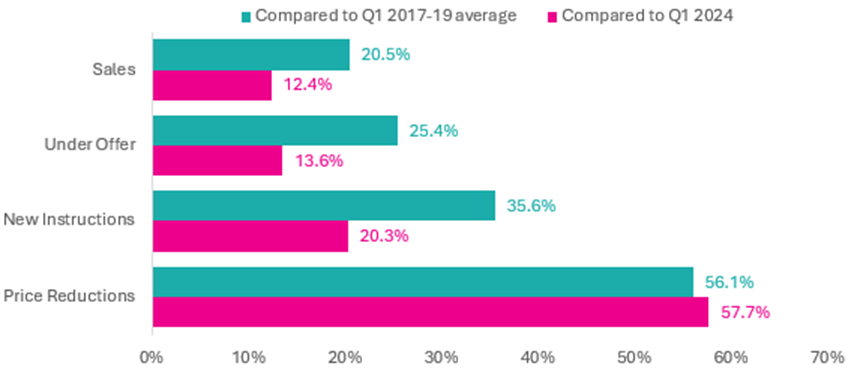

According to new data from LonRes transaction volumes surged by 29.9% in March compared to the same month last year, and by 32.4% compared to the pre-pandemic March average of 2017–2019.

Properties going under offer also saw a year-on-year rise of 6.9%, with activity up 17.3% on the longer-term seasonal average.

New instructions rose by 14.6% compared to March 2024 and stood 29.8% above the pre-pandemic norm.

PRICE REDUCTIONS

However, this supply-side growth has been accompanied by a sharp increase in price reductions, up 77.6% year-on-year. Total stock on the market was 9.1% higher than a year earlier.

Source: LonRes

Despite the increase in activity, average achieved prices across prime London fell by 2.7% in March. Compared to 2017–2019 levels, prices are now 3.6% lower, with the average discount from asking price sitting at 8.2%.

Homes that sell quickly continue to command higher prices. Properties sold within three months of listing secured an average discount of just 3.1%, while those on the market for six to twelve months required a 9.7% reduction to achieve a sale. These patterns suggest pricing strategy remains a key determinant of performance, regardless of wider market conditions.

TOP OF THE MARKET

The £5 million-plus market showed weaker momentum. Transactions in March were 17.1% lower than in the same month last year, despite being 4.8% above the 2017–2019 March average.

For the first quarter of 2025, transactions in this top-end segment were down 13.3% annually, though still 25.1% higher than the pre-pandemic baseline.

Supply in the ultra-prime segment has expanded sharply. New instructions for £5m+ properties in March were 61.8% higher than a year earlier. Quarterly data shows this level of supply is more than double the 2017–2019 average. Stock levels rose 22.2% in the 12 months to the end of March, while price reductions in Q1 increased by 69%, offering greater choice for buyers but underscoring continued sensitivity at the top of the market.

COOLING RENTAL MARKET

Meanwhile, the prime London rental market has cooled. Lettings activity in March fell sharply, with lets agreed down 34.2% year-on-year and new instructions falling 23.5%. Stock has also declined, with 16.0% fewer rental properties available than at the same point last year.

Source: LonRes

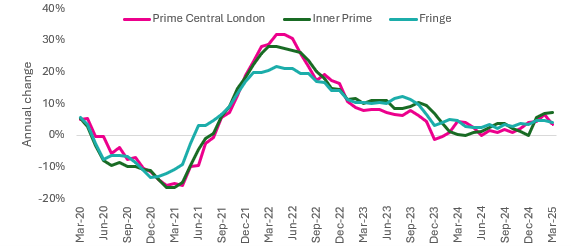

Annual rental growth eased to 4.9% in March, down from 6.2% in February. However, rents remain 33.3% above the 2017–2019 average. Inner prime areas, including Notting Hill and Marylebone, led growth with annual increases of 7.3% – the highest rate in this segment since November 2023.

UNCERTAIN OUTLOOK

Despite March’s uptick in sales activity, the broader outlook remains uncertain. The combination of rising supply, discounting, and falling achieved prices suggests a market still finely balanced amid economic and political headwinds.

Nick Gregori (main picture), Head of Research, LonRes, says: “Across prime London sales activity looked much more positive in March, with transactions growing strongly compared to the same month last year.

“After February’s surprise house price rise, average achieved values fell again on an annual basis, suggesting perhaps that increasingly realistic pricing may have been the key to unlocking more demand.

“After many months where the flow of under offers into exchanges has not been smooth, this pick up in deals going through is a welcome result for buyers, sellers and agents.”

TIME WILL TELL

He adds: “As always with a single good month or even quarter, it will take longer to know if this is a sustainable increase in activity or a temporary one. There is an argument in favour of the latter given that the ending of the stamp duty holiday on 31 March is likely to have created pressure to conclude deals and secure a tax saving, however small. From April we may see a return to less decisive buying activity without this incentive.

“The top end of the market did not see the same kind of improvement. At £5m+ the relative scale of the potential tax saving is much smaller so the change to SDLT is likely to have had a minimal impact. With so much political and economic uncertainty around, demand is likely to remain subdued as potential buyers revisit the now well-worn phrase ‘wait and see’.”

UNPREDICTABLE RISKS

And he says: “The outlook for mortgage rates is often a key consideration for buyers, but the extent of expected rate cuts this year are now subject to growing and unpredictable external risks.

“Economists are forecasting higher chances of recession in many countries as a consequence of the stop-start trade war initiated in the US. Struggling economies both at home and from countries which international buyers are drawn are unlikely to be a good thing for the prime London market.

“Unlike the volatility seen in the sales market, prime London lettings has been consistent so far in 2025. Low levels of new instructions are limiting activity, with the usual caveat that many deals are taking place without the properties being marketed. Annual rental growth was 4.9% in March, with our inner prime catchment recording the largest rise this year.”