The prime London property market has demonstrated remarkable resilience in the face of economic uncertainty, as new data from LonRes reveals a steady start to 2025.

While transactional activity remains slightly below last year’s levels, a surge in properties under offer and a tightening rental market indicate a market adjusting to prevailing conditions rather than succumbing to them.

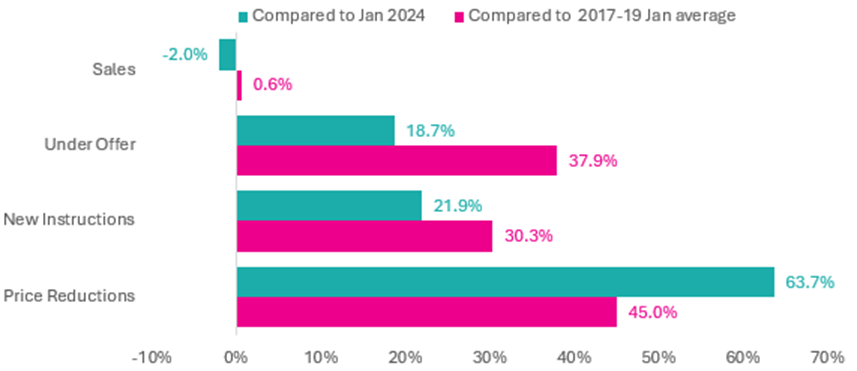

Despite prevailing economic headwinds, prime London property sales are holding firm. January saw a 2.0% year-on-year drop in completed sales transactions.

However, the number of properties going under offer surged by 18.7% compared to the same period last year, and a staggering 37.9% above the pre-pandemic average from 2017-2019. These figures suggest that demand remains robust, even if completion rates lag behind.

FALL-THROUGHS CONCERN

However, a growing trend of fall-throughs raises questions about how many of these deals will ultimately close. January recorded a 45% increase in collapsed transactions compared to last year, underscoring a degree of uncertainty that could weigh on market confidence in the coming months.

Source: LonRes

The urgency among sellers is becoming more pronounced, with new instructions in January rising by 21.9% compared to the previous year and exceeding the 2017-2019 average by 30.3%. This influx of new listings has triggered a wave of price reductions, up 63.7% year-on-year, as vendors respond to increased competition.

Although price reductions are prevalent, prime London’s pricing performance remains relatively stable. Average achieved prices saw only a modest annual decline of 0.3%—the slowest rate of depreciation since mid-2023. Compared to pre-pandemic levels, values are now only 1.6% lower, reinforcing the notion of a market in transition rather than in decline.

Source: LonRes

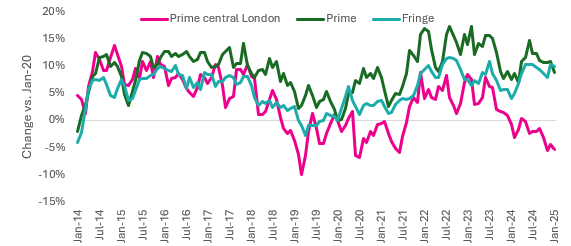

Central London’s ultra-prime sector, encompassing areas such as Mayfair and Chelsea, continues to underperform relative to the wider market. Achieved sold prices per square foot remain approximately 5% below January 2020 levels, whereas prime fringe locations like Notting Hill and Fulham have seen values rise by 10% over the same period. Central London’s prime properties have suffered an 11% price drop in the last 18 months alone, a trend that may take time to reverse.

TOP END FALTERS

The ultra-prime segment (£5m+) had a sluggish start to the year, with transactions plummeting by a staggering 68% year-on-year – marking the worst January since December 2008. While a single month’s data may exaggerate the situation, the downward trend in this market has been apparent for months.

Encouragingly, the number of £5m+ properties under offer rose by 13.3% in January, suggesting that this slowdown may be temporary. Supply continues to grow, with total available stock up 22.8% compared to a year ago, ensuring continued choice for high-net-worth buyers. Despite subdued demand, pricing metrics in this market remain resilient, with properties achieving just over 90% of their original asking price – an improvement from last year’s sub-89% figures.

TIGHTENING RENTAL SUPPLY

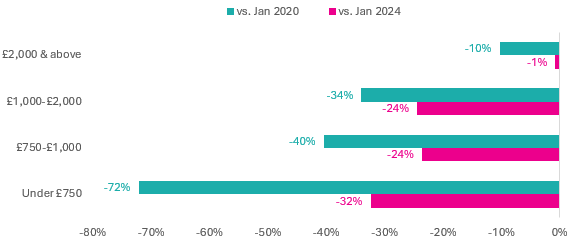

London’s prime lettings market continues to see strong rental growth as dwindling supply exerts upward pressure on prices. Annual rental growth across prime London accelerated to 5.0% in January, marking the fastest pace of increase in over a year. Average rents now stand 32.2% above their 2017-2019 pre-pandemic levels.

The supply crunch is particularly acute in the lower rental bands, where availability has dropped dramatically. Properties below £750 per week saw stock levels fall by 32% year-on-year and remain more than 70% below their levels five years ago. In contrast, availability in the £2,000+ per week bracket has been more stable, down only 10% compared to pre-pandemic levels.

Source: LonRes

With limited new instructions coming to market, tenants are facing increased competition, leading to fewer rental discounts. Average discounts fell to 4.0% in January, down from 4.4% a year ago, signaling a landlords’ market where tenants have little room for negotiation.

Nick Gregori, Head of Research, LonRes, says:“We noted last month that a subdued housing market is not surprising considering the performance of the wider economy. But January saw the economic data get worse while the housing market showed signs of improvement. Sales volumes were 2% lower than a year ago but under offer numbers were up almost 20%, indicating a potential rise in the near future.

“House price falls continued to bottom out, with an annual change of -0.3% the slowest rate of decline in more than 18 months.

“The Bank of England cut their base interest rate to 4.5% on 6 February. This is positive for those already committed to buying, potentially reducing their cost of borrowing or increasing their purchasing power. But the reasons for the cut paint a picture of a sluggish economy narrowly avoiding recession. The Bank summed up the challenges by halving their expectations for GDP growth this year and forecasting inflation to rise again, to 3.7% by autumn.”

STAGFLATION FEARS

He adds: “Elsewhere in the world, President Trump started to follow through on his promise of tariffs, with economists warning that escalating trade wars could negatively impact on global growth. The big fear is stagflation, where prices rise due to external factors but domestic growth is weak.

“The top end of the market took an extended Christmas break, with extremely low levels of £5m+ transactions in January. This market is unlikely to return to the highs of 2021 and 2022 any time soon, with activity already trending downwards for a number of months.

“However, the January low appears to be a temporary blip, with the under offer data and transaction levels in the early part of February looking much healthier. Available £5m+ stock continued to grow, as the low sales figures more than offset a small fall in new instructions in January.

“Rental growth across prime London increased in January, with the annual rate reaching 5% for the first time in 15 months. Activity continues to be limited by low levels of available homes, with stock on the market falling across all price points but particularly sharply for more affordable properties.”