Caution dominated the capital’s prime housing market in October as speculation over potential property tax changes in the forthcoming Autumn Budget weighed on both buyers and sellers, according to the latest analysis from LonRes.

Average achieved prices across prime London fell by 5.8% on the year and are now 4.9% below their pre-pandemic average.

New sales instructions were 2.1% lower than a year ago, while total stock on the market was up 17.1%, suggesting longer selling times and growing hesitancy among vendors.

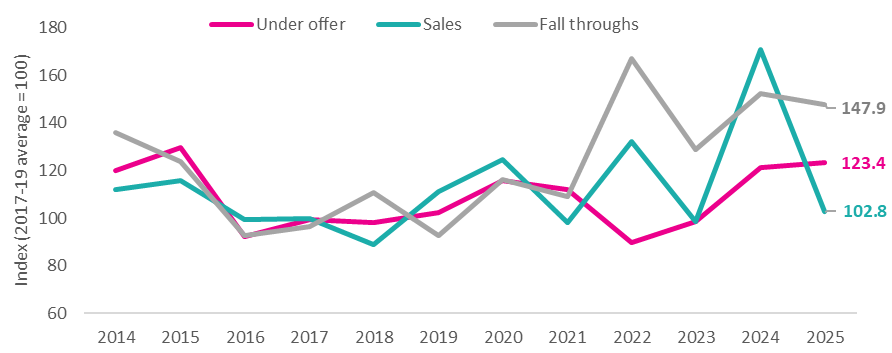

Transactions dropped sharply, down 39.8% compared with October 2024, when activity had surged as deals were rushed through ahead of expected fiscal changes. Compared with the 2017–2019 October average, sales were marginally higher at +2.8%.

TOP END HARDEST HIT

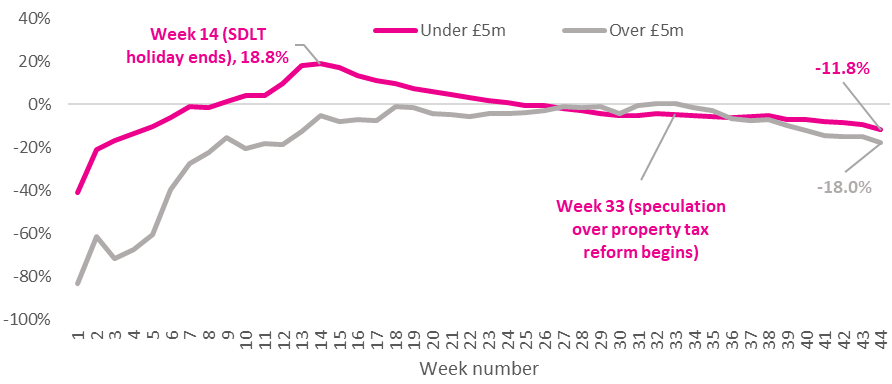

The top end of the market has been hardest hit. Sales of homes priced above £5 million plunged 64.7% year-on-year, while new instructions in the same bracket fell 18.9%.

Source: LonRes

Despite this, available stock in the super-prime segment rose by 15.6%, reflecting increased price reductions and a widening gap between vendor and buyer expectations.

Price cuts across the £5 million-plus market are up 27% on last year and now more than double pre-pandemic levels.

Source: LonRes

LonRes said that from August to October, transactions in this bracket were down 50% year-on-year, underlining the depth of the slowdown at the top of the capital’s housing market.

RENTAL SUPPLY UP

While the sales market cools, the lettings sector is moving in the opposite direction. Rental supply rose sharply, with new instructions up 61.5% year-on-year – the highest single-month increase since 2021. The number of properties available to rent was 42.4% higher than a year earlier, and lets agreed rose 8%.

Despite the uptick in supply, average rents continued to edge higher, up 2.2% on an annual basis and now 38.5% above their 2017–2019 average.

However, LonRes noted that growth has flattened after two years of rapid increases, with prime central London rents down 1% in October.

The report said pre-Budget uncertainty had created “caution all around”, with activity expected to remain subdued until the government clarifies its stance on property taxation later this month.

FRAGILE SALES MARKET

Nick Gregori (main picture, inset), Head of Research, LonRes, says: “The prime London sales market remained fragile in October.

“Under offer levels continue to look robust but stubbornly refuse to translate into actual sales, with the existing lack of confidence in the market exacerbated by fears of significant tax changes in the upcoming Budget.

“This has started to impact prospective sellers too, with new instructions decreasing, though the volume of stock on the market remains high. Unsurprisingly these dynamics are having a negative impact on values, with average achieved prices falling at their fastest rate since February 2024.

LONG-TERM VIEW

But he adds: “However, with many metrics based on annual comparisons, the downbeat picture painted by the latest figures may be overstating things.

“Last October saw record activity as deals were rushed through ahead of anticipated tax changes, while this year we are seeing something approaching the polar opposite.

“As is often the case, the longer-term context is important and here it shows a market that is below average for the time of year, but not chronically so.

“The tax uncertainty continues to have a larger impact on the top end of the market. Transaction levels over the past three months – the period since the mooted changes started appearing in the press – are significantly down.

“Despite sentiment being so poor, multiple £10m+ sales have exchanged in the past couple of weeks, suggesting that there are buyers out there if they see value in a deal.”