For the first time in more than six months, there is a sense of stability in the prime London property market.

Months of pre-Budget speculation are over and the high-value council tax bands announced in November were lower than feared. The sense of clarity drove activity levels higher at the end of 2025

The number of offers accepted in London in December was 34% higher than in 2024 and the increase in January was 12%. It should signal higher transaction levels this spring, but supply is still stronger than demand.

The number of sales instructions increased by 15% compared to the five-year average in January but new prospective buyer numbers fell by 4%, indicating continued downwards pressure on prices.

FADED HOPES

There were signs in the first fortnight of the year that demand would improve more notably but they faded. The early optimism was partly driven by buyers activating plans delayed by the Budget.

Average prices in prime central London fell 5% in the year to January, a decline that widened from a revised figure of -4.7% in December.

Meanwhile, in the more needs-driven market of prime outer London, prices declined 0.2% in the year to January, meaning they have essentially been flat for three years.

GEOPOLITICAL VOLATILITY

Even last month’s global geopolitical volatility was unlikely to have meaningfully undermined sentiment, as discussed on the latest episode of Housing Unpacked.

Admittedly, one bit of bad news was the mid-January jump in borrowing costs, which will have kept a lid on spending power, for reasons we explored here.

However, the rate outlook is unclear. You can find economists in different camps who believe there will be one, two and three cuts in 2026, as noted by The Times economics editor David Smith last week.

The Bank of England held Bank Rate at 3.75% last week. But, provided there are no data shocks, stronger language signalling an imminent cut, the fact it was a split decision and the prospect of inflation hitting 2% this spring mean a March cut is the most plausible outcome, according to Michael Brown, a research analyst at broker Pepperstone.

STORM CLOUDS GATHER

That’s the good news. The Budget is over, geopolitical volatility hasn’t cut through to buyers and sellers and rates are broadly on a downwards trajectory.

However, there are political storm clouds gathering on the horizon. Sentiment has been on a knife-edge early this year, as noted by Berkeley Group executive chairman Rob Perrins on the Housing Unpacked podcast last month.

The Peter Mandelson row that erupted last week is the latest in a series of threats to the position of the Prime Minister. A number of political journalists believe his premiership is now in its endgame.

The Gorton and Denton by-election on 26 February is another moment when the pressure on Keir Starmer could intensify and increase the chances of a challenger emerging after the local elections in May.

One risk for the property market is upwards pressure on borrowing costs if a new Prime Minister increases spending. This weekend’s election in Japan and fears on global bond markets about a debt-fuelled spending spree were a reminder of that. Renewed speculation around wealth taxes would also undermine sentiment.

By the summer, we may be looking back at this period of relative stability with a sense of fond nostalgia.

SUPPLY SQUEEZE CURBS ACTIVITY IN LONDON RENTAL MARKET

January failed to live up to its early promise in the London lettings market. Demand was strong in the first fortnight of the year but this was partly driven by tenants activating plans delayed by the Budget, which meant the early momentum faded.

It was a similar story in the sales market. As a result, the number of new prospective tenants registering last month was 4% below the five-year average. Meanwhile, the number of tenancies started fell by 12%.

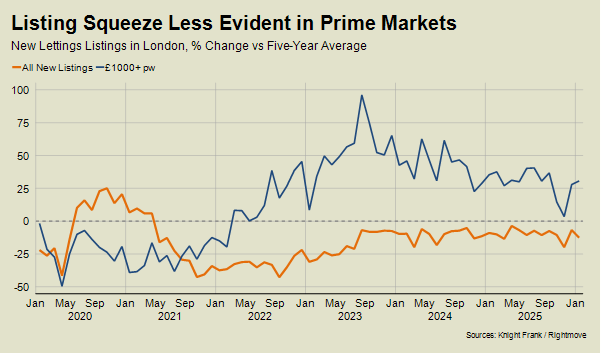

Falling levels of supply are also to blame for the declines. The number of new lettings listings in prime central and outer London in January was 13% below the five-year average, Rightmove data shows. Overall, the number of listings in January was down by a third compared to its pre-pandemic level in January 2019.

“It has become less attractive to be a landlord.”

The reason for the decline is that it has become less attractive to be a landlord in recent years. In addition to a succession of regulatory and tax changes, this May sees the introduction of the Renters Rights Act.

The new legislation means landlords face uncertainty around rent increases, repossession rules and what happens if they try to sell.

It means some have pre-empted the new rules by attempting to do precisely that. While there was a fall in the number of properties for rent in January, the number of sales listings in London was 14% higher than the five-year average.

TEMPERED DEMAND

The uncertainty has also tempered demand among would-be landlords in the sales market.

For example, some are holding off to see whether the court system becomes overwhelmed under new repossession rules, according to Berkeley Group executive chairman Rob Perrins on Knight Frank podcast Housing Unpacked last month.

Despite the supply squeeze, average rental growth in prime central London actually narrowed in January, with demand typically lower at the start of the year.

Rental values increased by 1.3% in the year to January, which was down from 1.7% in December but up from 0.6% in the first month of 2025.

It is also true that supply has held up better in higher-value markets, as the chart below shows.

Owners are typically more flexible, and some have rented out their property while prices are under pressure in the sales market.

The number of lettings properties above £1,000 per week in London was 31% above the five-year average in January, Rightmove data shows.

Meanwhile, average rents in prime outer London increased 2.7% in January, which was the largest increase since July 2024.

With uncertainty growing ahead of the Renters Rights Act, tight supply and upwards pressure on rents look set to define the market this year – again.