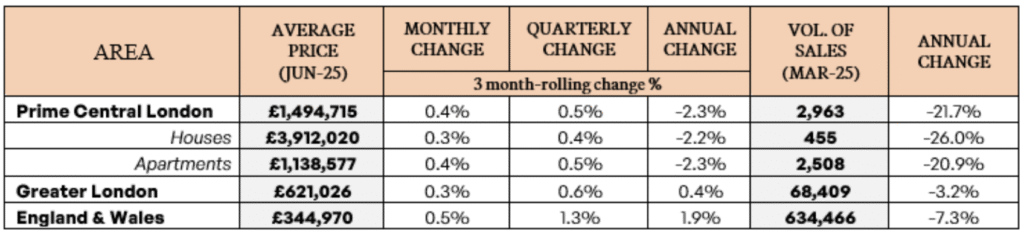

Values in Prime Central London (PCL) fell by 2.3% in the year to June – the steepest annual drop since 2019 – as transaction volumes continued to decline and high-end buyers adopted a wait-and-see approach, according to the latest Summer Market Review from LCP Private Office.

While June saw a modest 0.4% rise in quarterly prices across PCL – broadly in line with Greater London (0.3%) and England & Wales (0.5%) – the wider picture shows the capital’s prime postcodes under mounting pressure.

Market activity has been hit by a combination of factors including the end of the non-dom tax regime in April, broader economic uncertainty and persistent buyer caution, LCP said.

The result is a build-up of stock, particularly in the £5 million-plus segment.

TRANSACTIONS DOWN

Liam Monaghan, Managing Director of LCP Private Office, says: “The PCL sales market has remained significantly subdued.

“Transaction volumes in the year to March were down -21.7% compared to the previous year, averaging just 57 sales a week.

“Central London portal LonRes reported an even more dramatic fall in prime London sales during May, with 35.8% fewer transactions than the same point a year ago, and 33.5% fewer than the 2017–2019 average for May.”

Despite this backdrop, Monaghan sees opportunity for cash-rich or strategic buyers in the current market.

“There is a compelling opportunity for savvy buyers to secure prime London real estate in a less competitive market at the best value in a decade. Similarly, for vendors willing to price appropriately or remain open to accepting offers, there are real opportunities to transact.”

DIVERGING FORTUNES

Price falls were widespread across Central London’s prime neighbourhoods in the year to June, with the most pronounced declines in South Kensington.

Here, average flat prices were down -4.2%, while house prices dropped -4%. Compared with the 2015 market peak, South Kensington now offers the deepest value in PCL – with flats trading 20.5% below peak levels and houses down 13%.

Conversely, a handful of submarkets bucked the downward trend.

Marylebone, long favoured by international investors and domestic end-users alike, recorded the highest annual growth, with flat values up 0.6% and houses up 1.1%. Fitzrovia and Mayfair also saw marginal gains, with Fitzrovia flats rising 0.2% and houses 1.1%, while Mayfair saw 0.5% growth in the flat market only.

Marylebone has proved particularly resilient, says LCP, although even here, values for flats remain 11.2% below their 2015 peak.

SUMMER CAUTION, AUTUMN POTENTIAL

With the Autumn Budget on the horizon and no major relief expected for prime buyers, Monaghan believes the market is likely to remain subdued over the coming months.

But he adds that this phase of reduced competition could suit certain buyer profiles.

“We expect buyers to proceed with caution over the summer months in the run-up to the Autumn Budget,” he says. “But for those looking for best-in-class property in a globally important city, there may be no better time than now to negotiate favourable terms and lock in long-term value.”

The report underlines that while Prime Central London continues to feel the chill of global uncertainty and domestic tax reform, the fundamentals of demand remain intact – particularly for those playing the long game.