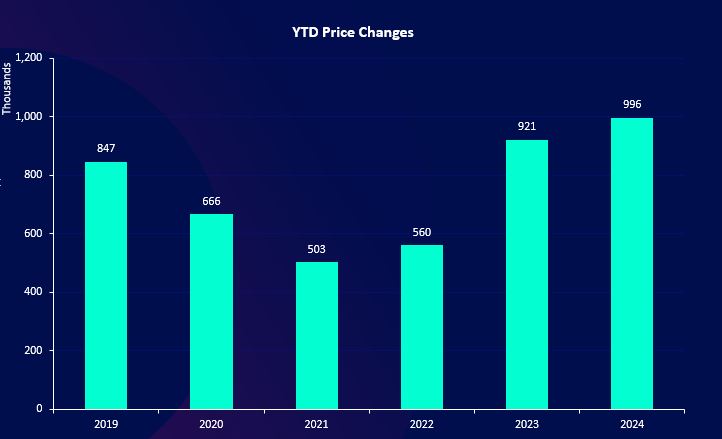

Nearly one million price reductions have been recorded throughout 2024 – the largest number on record, data from analytics company TwentyEA reveals.

This number is 8.1% higher than 2023 and 17.6% higher than 2019 and at a broader level means 38% of all concluded listings in 2024 had at least one price reduction.

Compared with last year, the price reduction rate in 2024 has increased most in the lower price bands below £350k and rose everywhere in the UK in 2024 except for Northern Ireland.

At the other end of the spectrum, Wales’ price reduction rate had the largest growth, moving from 36% in 2023 to 40% in 2024.

TwentyEA examined the price reductions regionally and by price band and found there were two specific trends which suggested the reductions were not caused by agents overvaluing but instead were more likely driven by sellers with unrealistic price ambitions.

SELLERS DEMAND

Katy Billany, Executive Director of TwentyEA says: “Firstly, price reductions are more prevalent within the lower price brackets and secondly there is an increase of price reductions concentrated within specific regions such as Wales.

“If agents were overvaluing, we would expect to see a starker growth in price reductions across all price brackets and a more even spread of reductions occurring across the regions but that’s not the case, so we suggest sellers are demanding unrealistic asking prices.

“Given the prevalence of price reductions happening right now, we’re expecting to see this continue for the foreseeable future.”

ONLINE AND SELF-EMPLOYED AGENTS

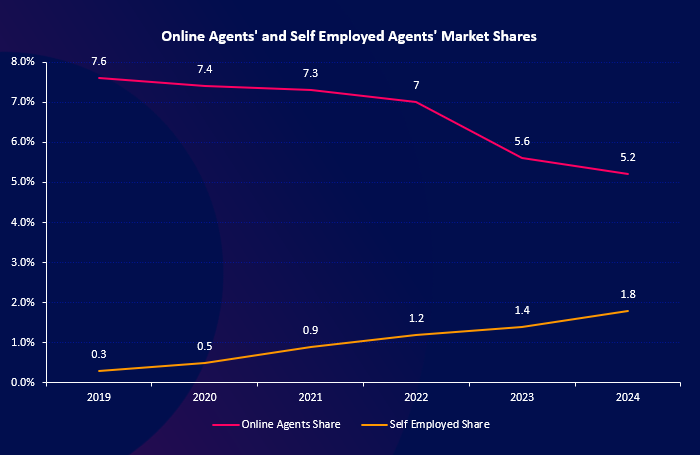

Online agents’ market share fell in 2024 to 5.2% which is 7% lower than 2023 and 32% lower than 2019.

This group also lost share in all price brackets below £1million, with the largest decline seen in the lower priced band of £0-£200k (-13% in the last year).

They also saw a decline across all regions of the UK with the exception of the Southwest, with the North and Midlands experiencing the largest reductions.

RISING MARKET SHARE

Meanwhile, self-employed agents continued to rapidly grow with their market share rising to 1.8%.

This is 31% higher than 2023 and 592% higher than 2019. As a collective, they now have a larger market share than Purplebricks (1.6%), and William H Brown (1.4%)

Billany adds: “As the market continues to evolve with the numbers of self-employed agencies now higher than ever, there’s no better time to understand the competitive landscape through the power of data.

“Tracking market activity in real-time gives agents the chance to discover how they, their competitors and the national market are performing. These are necessary foundation blocks for agents to launch an effective business strategy which can identify opportunities while helping them to laser-focus their marketing on the right audience.”